For applications filed on or after November 1, 2023, employees receiving PFML benefits may supplement (or “top off”) their PFML benefits with any available accrued paid leave (sick time, vacation, paid time off (PTO), personal time, etc.).For employees who choose to supplement their PFML benefits in this way, the combined weekly sum of PFML benefits and employer-provided paid leave benefits cannot exceed the employee’s IAWW. Both amounts can be found in the Approval Notices sent to employees and available for viewing in the Employer Application Website.

Employers should tell their employees that under the PFML law, they have the option to use their available accrued PTO to supplement their PFML benefits while on leave, up to the employee’s Individual Average Weekly Wage (IAWW). It is important to let employees know what is offered and when, so they do not report these benefits on their application for benefits.

Employers will be responsible for monitoring and ensuring that the combined weekly sum of employer-provided paid leave benefits and PFML benefits does not exceed an employee’s IAWW. DFML is not involved in the repayment process for top off overages. This process is solely the responsibility of the employer and the employee.

The image below shows where you would find the link to the Approval Notice on the Employer Application Website.

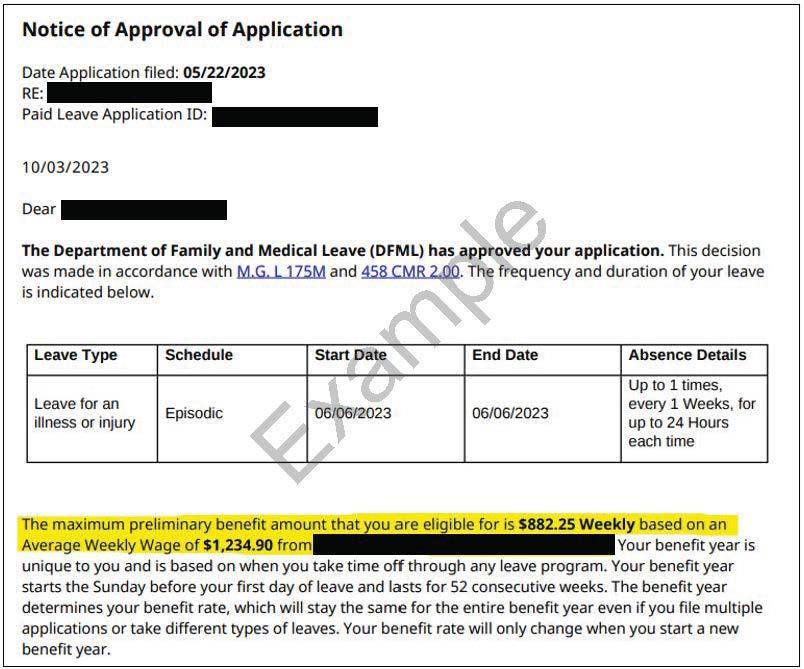

The image below shows where the employee’s weekly benefit amount and IAWW are located on the Approval Notice.