Overview

Massachusetts adopts the federal deduction for moving expenses allowed under section 217 of the Internal Revenue Code (“Code”) in effect on January 1, 2022, which is available to qualified members of the armed forces for tax years 2022 through 2025, and to all qualifying taxpayers for tax years 2026 and after.

For Tax Years 2022 through 2025

For tax years 2022 through 2025, the moving expense deduction is only allowed for members of the armed forces. To qualify, an individual must:

- Be on active duty

- Have moved due to a military order and permanent change of station

- If the individual is a nonresident or part-year resident, have moved to or from Massachusetts due to a military order and permanent change of station

Qualifying members of the armed forces may not deduct moving expenses reimbursed by the government (or paid for directly by the government) that are excluded from Massachusetts gross income.

Go to TIR 23-5: Chapter 62 Conformity to Select Provisions of the 2022 Internal Revenue Code.

For Tax Year 2026 and After

For the 2026 tax year and after the moving expense deduction is available to all taxpayers who qualify.

Employees or self-employed individuals may deduct from Massachusetts gross income the expense of moving themselves and their families, provided the move relates to employment or business income that is subject to Massachusetts tax.

Taxpayers may not deduct moving expenses covered by reimbursements from their employers that are excluded from Massachusetts gross income.

To claim the deduction, the following must be met:

- The taxpayer's new main job location (commute) is at least 50 miles farther from his/her former home than his/her old main job location (commute) was from the former home. This requirement does not apply to qualifying members of the armed forces.

- The taxpayer must be employed full time for at least 39 weeks during the 12-month period immediately following the move. If self-employed, the taxpayer must be employed or performing services full time for at least 78 weeks during the 24-month period immediately following the move and at least 39 weeks during the first 12-months. This requirement does not apply to qualifying members of the armed forces.

- The amount spent on moving is reasonable

Qualified deductible moving expenses are limited to the cost of:

- Transportation of household goods and personal effects

- Travel (including lodging but not meals) to the new residence

Where an automobile is used in making the move, a taxpayer may deduct either:

- The actual out-of-pocket expenses incurred (gas and oil, but not repairs or depreciation, etc.); or

- A standard mileage allowance as determined by the IRS

Go to IRS Form 3903 (Moving Expenses).

Members of the Armed Forces

A members of the armed forces may claim a moving expense deduction. To qualify, the individual must:

- Be on active duty

- Have moved due to a military order and permanent change of station

- If the individual is a nonresident or part-year resident, have moved to or from Massachusetts due to a military order and permanent change of station

Qualifying members of the armed forces may not deduct moving expenses reimbursed by the government (or paid for directly by the government) that are excluded from Massachusetts gross income.

Go to TIR 23-5: Chapter 62 Conformity to Select Provisions of the 2022 Internal Revenue Code.

For Tax Years 2018 through 2021

For tax years 2018 through 2021, qualifying members of the armed forces may deduct moving expenses from both Massachusetts and federal gross income. A deduction is available to other taxpayers for Massachusetts, but not federal, tax purposes for these tax years.

Go to TIR 18-14: Impact of Selected Provisions of the Federal Tax Cuts and Jobs Act on Massachusetts Personal Income Tax under Chapter 62.

Additional Resources

Massachusetts References

- TIR 18-14: Impact of Selected Provisions of the Federal Tax Cuts and Jobs Act on Massachusetts Personal Income Tax under Chapter 62

- TIR 23-5: Chapter 62 Conformity to Select Provisions of the 2022 Internal Revenue Code

Federal References

- 26 U.S.C. § 217 - Moving expenses

- IRS Topic No. 455: Moving Expenses for Members of the Armed Forces

- IRS Form 3903 (Moving Expenses)

Questions

Tax Department: Contact Center hours are 9 a.m. – 4 p.m., Monday through Friday.

- (617) 887-6367 (Personal Income) or

- (800) 392-6089 (toll-free in Massachusetts).

For more ways to connect, go to Contact DOR.

Do you have a question about your tax account?

If you are registered, log in to your MassTaxConnect account and send DOR a secure e-message.

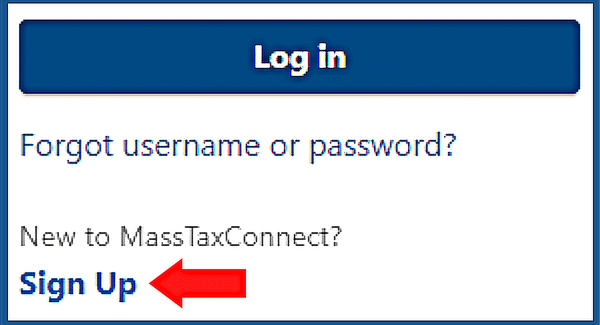

Do you need to register with MassTaxConnect?

On the upper right-hand side of MassTaxConnect's home screen:

- Select Sign Up

- Select Create My Logon.

You may also register by clicking on Register a new taxpayer under Quick Links.

Translation Help

Do you need to change this page's language?

Visit How to Translate a Website, Webpage, or Document into the Language You Want.