Send a Secure Message Through MassTaxConnect

MassTaxConnect is DOR's online portal to safely register, file, and pay taxes.

You can also send an electronic message (e-message) through your MassTaxConnect account to:

- Ask questions about your tax account

- Provide confidential information.

You have a MassTaxConnect account

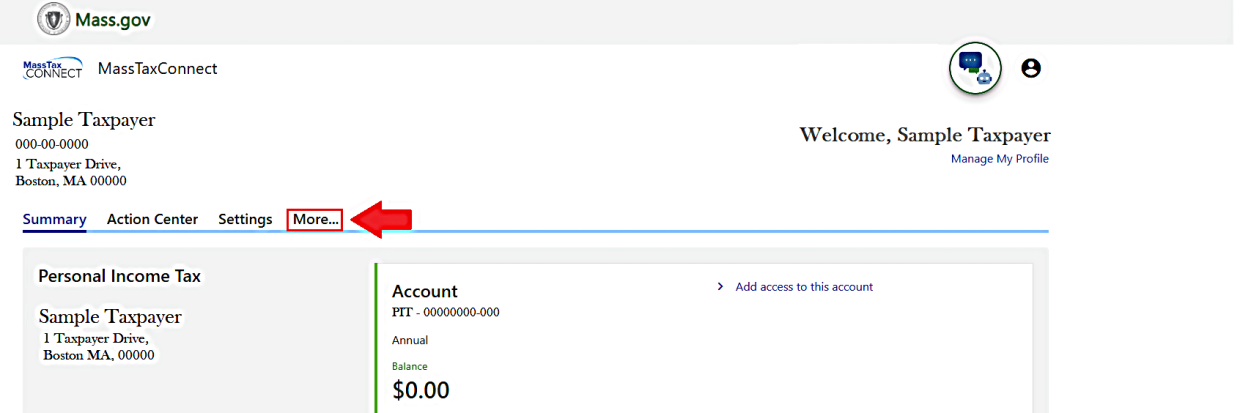

- From the MassTaxConnect Summary page, choose More.

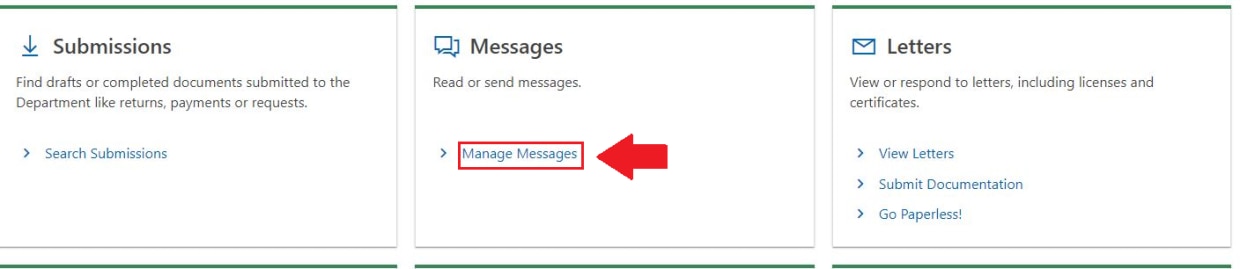

- Under Messages, choose Manage Messages.

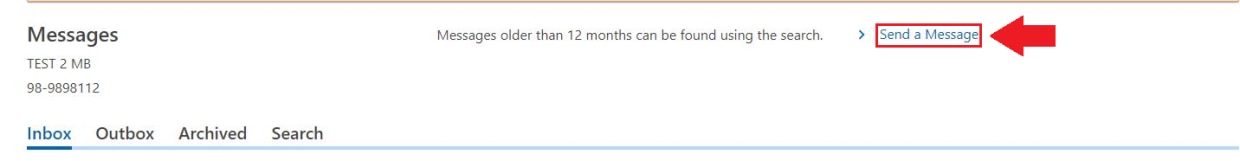

- On the right-hand side, choose Send a Message.

You do not have a MassTaxConnect account

| For Businesses | For Non-Businesses |

|---|---|

Businesses (including sole proprietors) register their businesses with MassTaxConnect. After registering, a business can send a secure e-message (see instructions above). | If you (or a third party on your behalf) previously filed MA taxes such as personal income, DOR has your information. To send an e-message, you have to create a MassTaxConnect Logon. To learn how, view these instructions below and the logon video tutorial. |

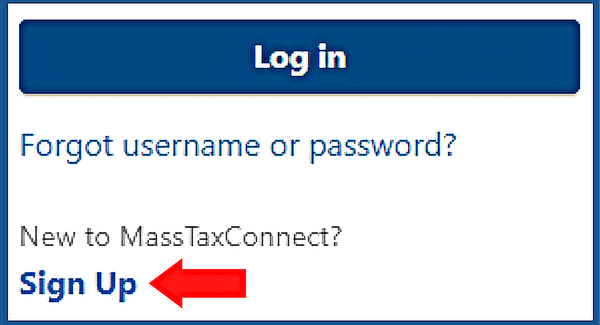

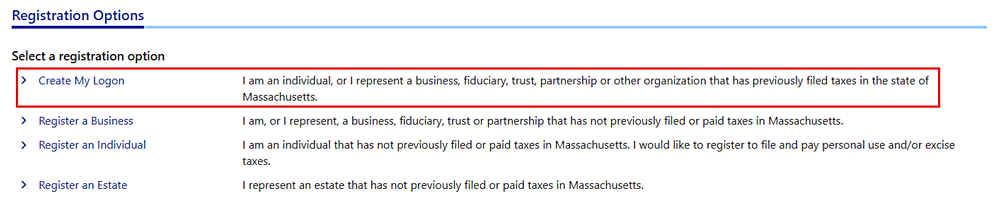

Creating a MassTaxConnect Logon

| Instructions | On the upper right-hand side of MassTaxConnect's home screen:

|

|---|

- Choose Create My Logon.

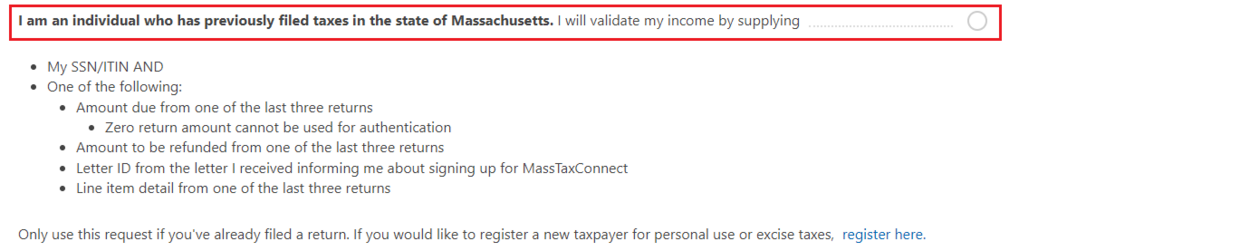

- Choose I am an individual who has previously filed taxes in the state of Massachusetts.

If you can't validate your income by supplying the required tax information when creating your logon, contact DOR, to request a Notice of Account ID.

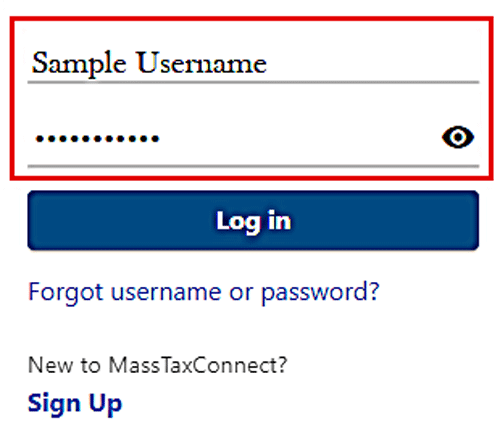

| Complete the remaining instructions. |

|

|---|

When complete, you will be on your Summary page and ready to send an e-message (see instructions above).

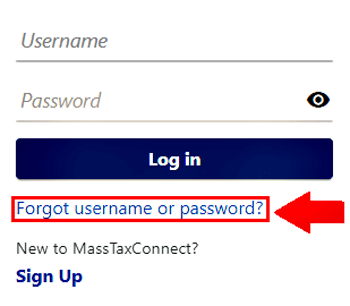

Forgot Your MassTaxConnect Username or Password?

| If you need to reset your password or recover your username: |

|

|---|

Phone

Before you call, you might be able to resolve your issue by going to DOR's tax guides and videos. Other helpful resources are on DOR's website.

Contact Center hours are 9 a.m. – 4 p.m., Monday through Friday. (617) 887-6367 or (800) 392-6089 (toll-free in Massachusetts).

For a complete listing of DOR phone numbers, go to Who to Call at DOR.

Child Support and Local Services contact information is located on this page.

Non-secure Email

To protect your privacy, do not send confidential taxpayer information (e.g., your Social Security number, tax liability amounts or other taxpayer-specific information).

If you choose to send a non-secure email, DOR is not responsible if the confidential information you sent is accessed by third parties.

If you have specific questions about your tax account, we recommend that you send us a secure e-message through MassTaxConnect.

To send a non-secure email to DOR, choose one of the following:

Child Support Services (CSS)

Connect with DOR's Child Support Services by phone, in-person or online through a virtual zoom meeting.

Before you reach out, you might be able to resolve your issue by going to Child Support's website.

By Phone

Child Support hours are 8:30 a.m. – 4:30 p.m., Monday through Friday. (617) 660-1234 or (800) 332-2733 (toll-free in Massachusetts)

In-person

DOR’s Child Support offices offer in-person help at the following locations:

Virtual Counter

The Virtual Counter is a way for our customers to meet face-to-face with a child support specialist online over Zoom. Go to the Child Support Virtual Counter to learn more.

Division of Local Services (DLS)

Before you reach out, you might be able to resolve your issue by going to the DLS website.

For contact information, go to the DLS Staff Directory. To receive the latest news, sign up for DLS Alerts.

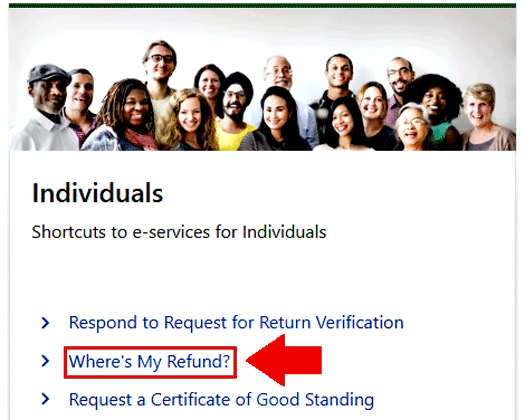

Check Personal Income Tax Refund Status

Check the status of your personal income tax refund on MassTaxConnect.

| You do not have to be registered with MassTaxConnect to use this feature, but you will need: |

To access from MassTaxConnect's home screen, choose Where's My Refund? under Individuals. |

|---|

When your refund is approved, you will see the date your refund was direct-deposited or mailed.

Learn how to Avoid Massachusetts Income Tax Refund Delays.

Report Tax Identity Theft

If you believe you are a victim of tax identity theft, contact DOR at (617) 887-6350.

To learn more, go to Protect Yourself Against Tax Identity Theft.

Additional Resources

| Addl. Resources A - E | Addl. Resources F - T |

|---|---|

|

Translation Help

Do you need to change this page's language?

Go to How to Translate a Website, Webpage, or Document into the Language You Want.