When is Sales or Use Tax Due?

Sales made in Massachusetts (including to nonresidents)

Unless exempt, a sales or use tax is due on:

- Boats (including documented boats)

- Recreational off-highway vehicles

- Snowmobiles.

If you do not pay sales tax to a registered dealer in Massachusetts, a 6.25% sales tax is due by the 20th day of the month following the:

- Purchase

- Use

- Storage or

- Other consumption.

For example, if you buy a boat in Massachusetts on June 1, sales tax would be due by July 20.

Private sales made outside of Massachusetts

A 6.25% use tax on your purchase is due by the 20th day of the following month that it entered Massachusetts, if your purchase was:

- Bought outside of Massachusetts from a private party and

- Brought into Massachusetts within 6 months for:

- Use

- Storage or

- Other consumption.

For example, a use tax would be due by July 20 if you:

- Bought a snowmobile in New Hampshire on January 1 and

- Brought it into Massachusetts on June 30.

Dealership sales made outside of Massachusetts

What if you buy from a registered dealer outside of Massachusetts?

If you paid a sales tax of 6.25% or more to another state, you do not have to pay a use tax to Massachusetts.

You would owe Massachusetts the sales tax difference if you:

- Paid less than a 6.25% sales tax to another state and

- Brought your purchase into Massachusetts for use within 6 months.

Visit TIR 03-1 for more information about use tax paid to another state.

6 Months Rule

The 6 months rule can be disputed depending on the facts of the purchase.

To be considered purchased for use within the state, your purchase does not need to be used:

- Only or

- Even primarily in Massachusetts.

You may still owe use tax if your purchase is brought into Massachusetts after 6 months.

Visit Directive 87-3 for more information.

Mass. General Laws

For sales and use tax dues dates and what is taxable, visit Mass. General Laws:

Do you need to register?

To register, you must first file and pay your sales or use tax, or file for an exemption on your:

- Boat

- Recreational off-highway vehicle

- Snowmobile.

Pay Sales or Use Tax with MassTaxConnect's Form ST-6

Filing Form ST-6 with MassTaxConnect is your fastest option.

Before you begin make sure:

- Your pop-up blockers are turned off

- You do not log into your MassTaxConnect account if you have one

- You have your payment information ready.

You will need the:

- Seller's name and

- Address.

Type Unknown if the address is unknown.

You will also need the vehicle information including:

- Description of vehicle

- Date of sale

- Gross sales price

- Serial number (also known as a VIN)

- Engine size

- Length and mooring location (boats only).

Getting started

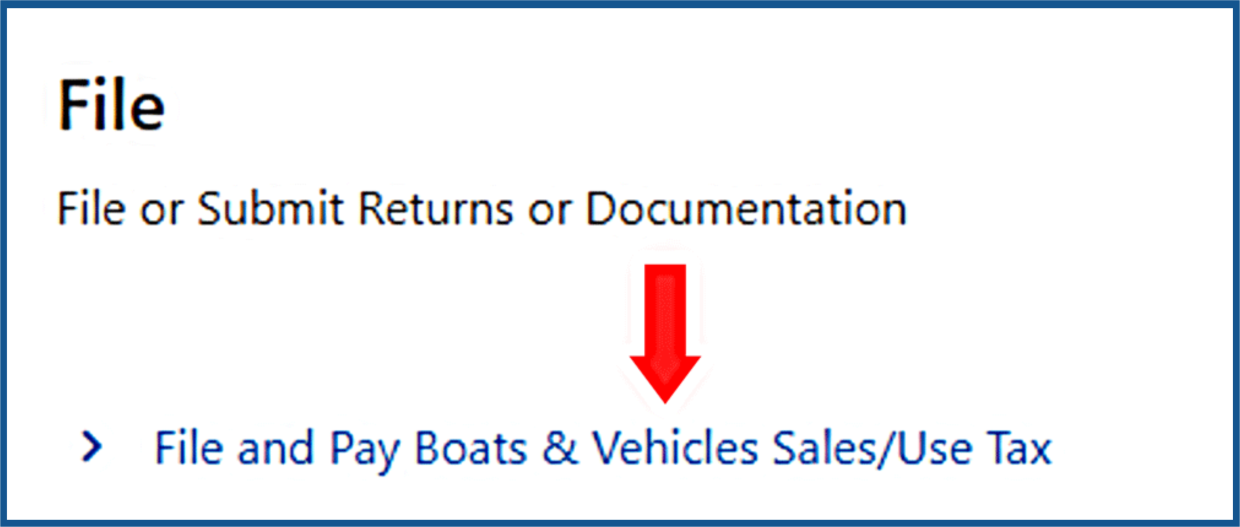

At the bottom left of MassTaxConnect's home screen:

- Step 1: Select File and Pay Boat & Vehicles Sales/Use Tax.

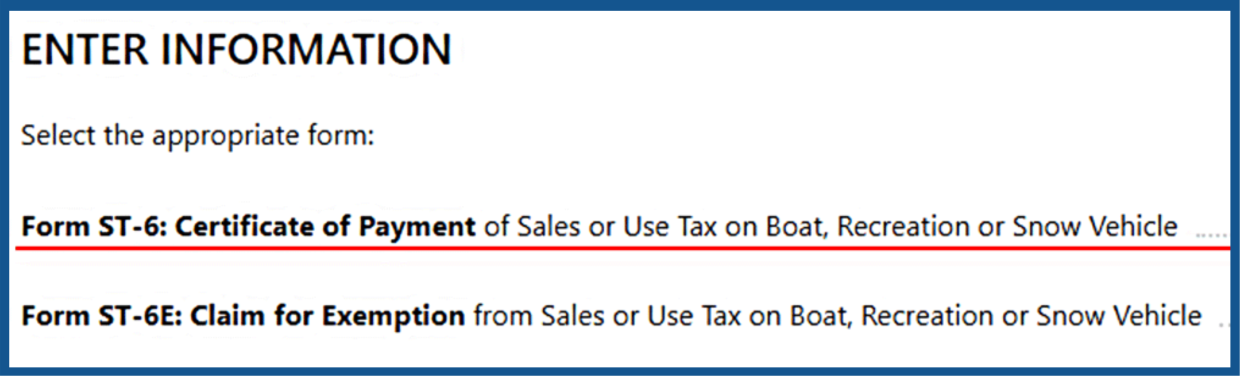

- Step 2: Select Form ST-6: Certificate of Payment from Sales or Use Tax on Boat, Recreation or Snow Vehicle.

When finished, before clicking on OK, don't forget to print:

- A copy of the confirmation page, then

- Two copies of the Form ST-6 payment receipt.

Keep these copies for your records.

If you click on OK before printing your ST-6 payment receipt, you can get copies of your receipt by:

- Selecting Find a Submission under Quick Links.

- Visit the Find a Submission tutorial video.

You can only print a copy of your payment receipt if you filed a Form ST-6 using MassTaxConnect.

To register, you must show your exemption certificate.

Get your ST-6 receipt from a registered dealer

If you purchased from a registered dealer and paid the tax, you can't use MassTaxConnect to get a copy of your receipt.

Please contact the dealer for a copy:

- If one wasn't provided to you at the time of your purchase or

- You misplaced your original copy.

Registered dealers using MassTaxConnect

Registered dealers, be sure to:

- Select the Is this application being prepared by a registered dealer? option at the beginning.

- This will allow a registered dealer to print a receipt indicating that they have collected the required tax from their customer.

- Give a copy of the ST-6 paid receipt to your customer

- Remit sales tax to DOR with all other sales taxes collected on your sales tax return.

Please don't complete an exempt form unless you are not collecting tax on the vehicle.

File Form ST-6 by mail

To file Form ST-6 by mail, you will need a copy of the bill of sale.

Mail a completed Form ST-6 with a copy of the bill of sale to:

Massachusetts Department of Revenue

Trustee Tax Bureau – Contact Center

200 Arlington St. 4th Floor

Chelsea, MA 02150

When filing on paper, there is up to a 4-6 week wait to receive an exemption certificate from DOR.

If you file Form ST-6 on paper, you cannot get a reprint of your Form ST-6 receipt using MassTaxConnect.

To register, you must show your exemption certificate.

DOR audit review

Form ST-6 filers are subject to DOR audit review.

You may be required to present:

- Your bill of sale (if filed with MassTaxConnect) and

- Other supporting documentation.

File for an Exemption with MassTaxConnect's Form ST-6E

Filing Form ST-6E with MassTaxConnect is your fastest option.

Before you begin make sure:

- Your pop-up blockers are turned off and

- You do not log into your MassTaxConnect account if you have one.

You will need the:

- Seller's name and

- Address.

Type Unknown if the address is unknown.

You will also need the vehicle information including:

- Description of vehicle

- Date of sale

- Gross sales price

- Serial number (also known as a VIN)

- Engine size

- Length and mooring location (boats only).

Getting started

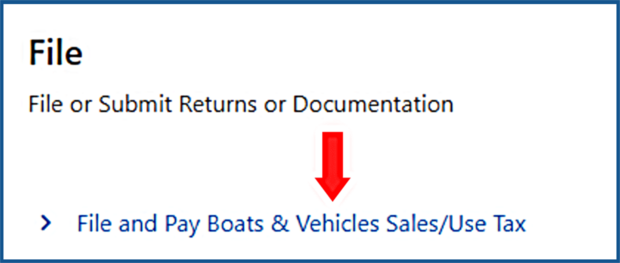

At the bottom left of MassTaxConnect's home screen:

- Step 1: Select File and Pay Boat & Vehicles Sales/Use Tax.

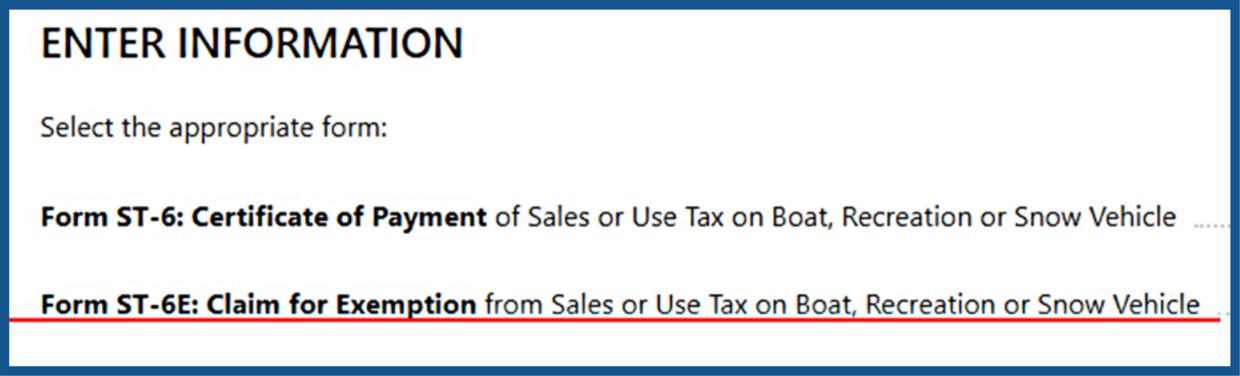

- Step 2: Select Form ST-6E: Claim for Exemption from Sales or Use Tax on Boat, Recreation or Snow Vehicle.

When finished, before clicking on OK, don't forget to print:

- A copy of the confirmation page, then

- Two copies of the Form ST-6E exemption certificate receipt.

Keep these copies for your records.

If you click on OK before printing your exemption certificate receipt, you can get copies of your receipt by:

- Selecting Find a Submission under Quick Links.

- Visit the Find a Submission tutorial video.

You can only print a copy of your exemption if you filed a Form ST-6E using MassTaxConnect.

To register, you must show your exemption certificate.

File Form ST-6E by mail

To file ST-6E by mail, you will need a copy of the bill of sale.

Mail a completed Form ST-6E with a copy of the bill of sale to:

Massachusetts Department of Revenue

Trustee Tax Bureau – Contact Center

200 Arlington St. 4th Floor

Chelsea, MA 02150

When filing on paper, there is up to a 4-6 week wait to receive an exemption certificate from DOR.

If you file Form ST-6E on paper, you cannot get a reprint of your Form ST-6E receipt using MassTaxConnect.

To register, you must show your exemption certificate.

DOR audit review

Form ST-6E filers are subject to DOR audit review.

If you claim an exemption for commercial fishing, you may be required to:

- Document that the boat is used directly and exclusively for commercial fishing and are

- Reporting such income on the appropriate federal and state tax returns.

Registration

To register, you must first file and pay your sales or use tax, or file for an exemption on your:

- Boat

- Recreational off-highway vehicle

- Snowmobile.

When you go to register, you will need to show a copy of your payment receipt or exemption certificate from:

- Proof of payment (Form ST-6) or

- Proof of exemption (Form ST-6E).

Visit the Boat and Recreation Vehicle Registration and Titling Bureau for more information.

File for an Abatement (appeal)

MassTaxConnect is the fastest way to apply for an abatement (appeal).

Apply for an abatement if you paid tax and your purchase was:

- Returned

- Acquired from a contest, drawing or raffle (donor paid the sales or use tax)

- Received as a gift

- Transferred to you from parents, a spouse, or sibling only

- Transferred to you by intestacy, will, or otherwise

- Purchased outside of Massachusetts and you have fulfilled your tax obligation.

Yon can also apply for an abatement if you are:

- Requesting a reduction or the complete removal of penalties

- Disputing an assessment from an audit.

Apply with MassTaxConnect

How do you apply?

- Go to your MassTaxConnect account.

- Select File an Appeal under More.

Need to register for MassTaxConnect?

On the upper right-hand side of MassTaxConnect's home screen:

- Select Sign Up.

Apply with Form ABT

You can apply by mail if you do not have to file with MassTaxConnect.

To apply, complete and mail the Form ABT.

MassTaxConnect is fastest way to apply for an abatement.

For a faster response, be sure to include all your:

- Facts

- Statements

- Documentation.

Trailer Sales and Use Tax

The method for paying sales or use tax, or filing for an exemption on a trailer is different. The Form ST-6 or ST-6E are not to be used.

Visit the Motor Vehicle and Trailer Sales and Use Tax Guide for more information.

Trailer Excise

If you own a registered motor vehicle or trailer, you have to pay a tax, called a motor vehicle and trailer excise, each year. Visit the Motor Vehicle Excise Guide for more information.

Contact

| Sales or Use Tax Questions | Form ST-6 and ST-6E Questions |

|---|---|

| (617) 887-6367 Option 3, then option 2, then option 2 again | (617) 887-6400 Option 3 |

Translation Help

Do you need to change this page's language?

Visit How to Translate a Website, Webpage, or Document into the Language You Want.