Disadvantaged Community Designation

The Safe Drinking Water Act and the Clean Water Act allow states to define disadvantaged communities through affordability criteria as being the most in need. State Revolving Funds (SRFs) are required to provide subsidy to disadvantaged communities calculated as an annual percentage of the Clean Water and Drinking Water SRF capitalization grants. The Trust applies further subsidy through a state matching component in addition to the federal requirement.

What is a Disadvantaged Community?

A "Disadvantaged Community" is a community that falls into one of the three tiers using the Trust's annual affordability calculation. This calculation is performed to determine the adjusted per capita income (APCI) of each city and town in Massachusetts. See below to learn about the affordability calculation and APCI. For the most recent affordability calculation please see the table below.

What does this mean for my community?

The establishment of a formal Disadvantaged Communities program does not change how the Trust distributes loan forgiveness and does not require any additional actions from eligible communities beyond the requirements already in place for loan forgiveness. For more information about the SRF loan process and project selection, please visit the Trust's program partner, the Massachusetts Department of Environmental Protection web page.

Assistance for Disadvantaged Communities

Disadvantaged Communities are eligible for a percentage of loan forgiveness of their principal loan amount. Please see the Loan Forgiveness section below for additional details.

The Affordability Calculation

The affordability calculation is based on an adjusted per capita income (APCI) metric. This approach identifies communities that are most in need of additional financial assistance to construct necessary infrastructure improvements. This allows the Trust to determine financial need by using the metric below which uses publicly available sources of data.

Pursuant to the EPA’s guidance, criteria must be based upon:

- Income;

- Unemployment Data;

- Population Trends; and,

- Other data determined relevant by the state.

Calculation of Affordability Tiers

The Trust and MassDEP use the following formula to calculate the affordability tiers.

Adjusted Per Capita Income (APCI) = PCI * Employment Rate * Population Change

Per Capita Income (as listed on the most recent data tables of the Massachusetts Department of Revenue): Per Capita Income is a widely accepted metric of an ability to afford the cost of infrastructure projects.

Employment Rate (as listed on the most recent calendar year data tables of the Massachusetts Department of Revenue): The percentage of the workforce employed. Higher employment rates suggest that a community has more residents able to afford the cost of infrastructure than a community with lower employment rates.

Population Change: The percentage of gain or loss, according to the US Census data, in a municipal population between 2010 and 2020. Increase in population suggests that the community is experiencing growth, which provides a larger rate payer base to support infrastructure costs. Loss of population suggests negative growth and leaves fewer taxpayers and ratepayers to absorb the burden of the infrastructure cost.

Based on the APCI formula described above, the Trust calculates APCI for the state and its 351 individual municipalities annually. Communities that fall below the Commonwealth's APCI are considered disadvantaged communities and are assigned into one (1) of the three (3) affordability tiers.

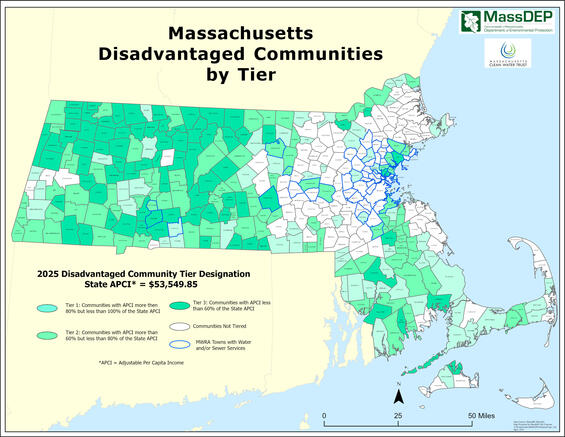

The bullets below shows how the tiers are broken down.

- Tier 1: Communities with APCI more than 80% but less than 100% of the State’s APCI.

- Tier 2: Communities with APCI more than 60% but less than 80% of the State’s APCI.

- Tier 3: Communities with APCI less than 60% of the State’s APCI.

Regional or multi-community utility districts. These districts may qualify for additional subsidy under an affordability calculation. Each municipality will have to provide the Trust with data showing the share of services each member municipality of the district receives for a project. Using prorated APCI numbers for each member, the Trust will rank the district with the other municipalities. If that blended APCI falls within the scope of the assistance tiers, the entity will be eligible for additional assistance.

Legal Authority

Loan Forgiveness

Loan forgiveness is an additional subsidy provided by the Trust and works by reducing the principal amount of the loan. By providing loan forgiveness, the Trust is further reducing the cost of projects in addition to the standard, low-interest rate loans offered. Loan forgiveness is only offered to projects that appear on the annual Intended Use Plans (IUPs) issued by MassDEP.

The amount of loan forgiveness a community receives is linked to their affordability tier from the APCI results. The Trust provides a fixed percentage of subsidy based on affordability tiers and the specific State Revolving Fund program.

Loan Forgiveness Percentages by Tier and Program

| Tier | Clean Water Projects and Drinking Water PFAS Mitigation Projects | Drinking Water |

|---|---|---|

| 1 | 3.3% | 6.6% |

| 2 | 6.6% | 13.2% |

| 3 | 9.9% | 19.8% |

Loan Forgiveness Example

| Tier | % of Forgiveness | Forgiveness Amount | Savings from a Market Loan1 |

|---|---|---|---|

| 1 | 3.3% | $330,000 | $1,815,019 |

| 2 | 6.6% | $660,000 | $2,225,838 |

| 3 | 9.9% | $990,000 | $2,636,657 |

| Tier | % of Forgiveness | Forgiveness Amount | Savings from a Market Loan1 |

|---|---|---|---|

| 1 | 6.6% | $660,000 | $2,225,838 |

| 2 | 13.2% | $1,320,000 | $3,047,476 |

| 3 | 19.8% | $1,980,000 | $3,869,114 |

1. Savings from Market Loan - is calculated by comparing a 2% interest, 20-year loan with a 20-year loan at an interest rate of 3.15% (the market rate interest rate was determined by calculating a one-year average for a 20-year AA MMD maturity).

Loan Forgiveness Requirements

Contract Deadline. Loan Forgiveness will only be applied to eligible communities’ construction contracts that are executed by June 30th of the following calendar year (e.g. 2022 IUP project must execute construction contracts by June 30, 2023).

Enterprise Funds. The Acts of 2014 – Chapter 259: An Act Improving Drinking Water and Wastewater Infrastructure requires municipalities to establish a sewer enterprise fund or water enterprise funds (or equivalent separate restricted accounts) to be eligible for loan forgiveness. Additionally, the Acts disqualify any municipality from receiving loan forgiveness if any transfers from the enterprise fund are not related to the funds intended purposes. Any disqualifying transfer made after January 1, 2015, will disqualify the municipality from receiving loan forgiveness for five (5) years from the transfer date.

Additional Eligibility

Renewable Energy. Projects that have a renewable energy component will qualify as a Tier 1 community regardless of their tier status for the respective IUP year unless the community is Tier 2 or 3. Loan forgiveness will only be applied for the portion of the loan that is financing the renewable energy component.

Environmentally Disadvantaged Community

To better support all communities within the Commonwealth MassDEP and the Trust introduced the Environmentally Disadvantaged Community (EDC) designation. This new designation only applies to DWSRF projects and is only on a project-to-project basis. An EDC is a public water supplier that has lead in the water supply and/or lead service lines in the system. Funds for these projects are limited to funding provided by the Bipartisan Infrastructure Law – Lead Service Line grant and was retroactively applied to projects on the calendar year 2022 and 2023 IUPs. Projects with this designation were not eligible to receive additional subsidy under the Disadvantaged Community designation.

Disadvantaged Community Designation (Affordability Calculation) and Loan Forgiveness Distribution

The table below provides the results of the annual Affordability Calculation adopted by the Massachusetts Clean Water Trust to identify Disadvantaged Communities. Details on the calculation methodology are noted below.

Loan Forgiveness by IUP Year

The table below provides the loan forgiveness distribution voted by the Massachusetts Clean Water Trust Board of Trustees.

| IUP Year | |

|---|---|

| 2024 | Loan Forgiveness |

| 2023 | Loan Forgiveness |

| 2022 | Loan Forgiveness |

| 2021 | Loan Forgiveness |

| 2020 | Loan Forgiveness |

| 2019 | Loan Forgiveness |

| 2018 | Loan Forgiveness |

| 2017 | Loan Forgiveness |

| 2016 | Loan Forgiveness |

| 2015 | Loan Forgiveness |

| 2014 | Loan Forgiveness |

| 2013 | Loan Forgiveness |

| 2012 | Loan Forgiveness |

| 2011 | Loan Forgiveness |

| 2010 | Loan Forgiveness |

Loan Forgiveness Distribution Methodology

| Years Applied |

|---|

| 2019 to Present |

| 2016-2018 |