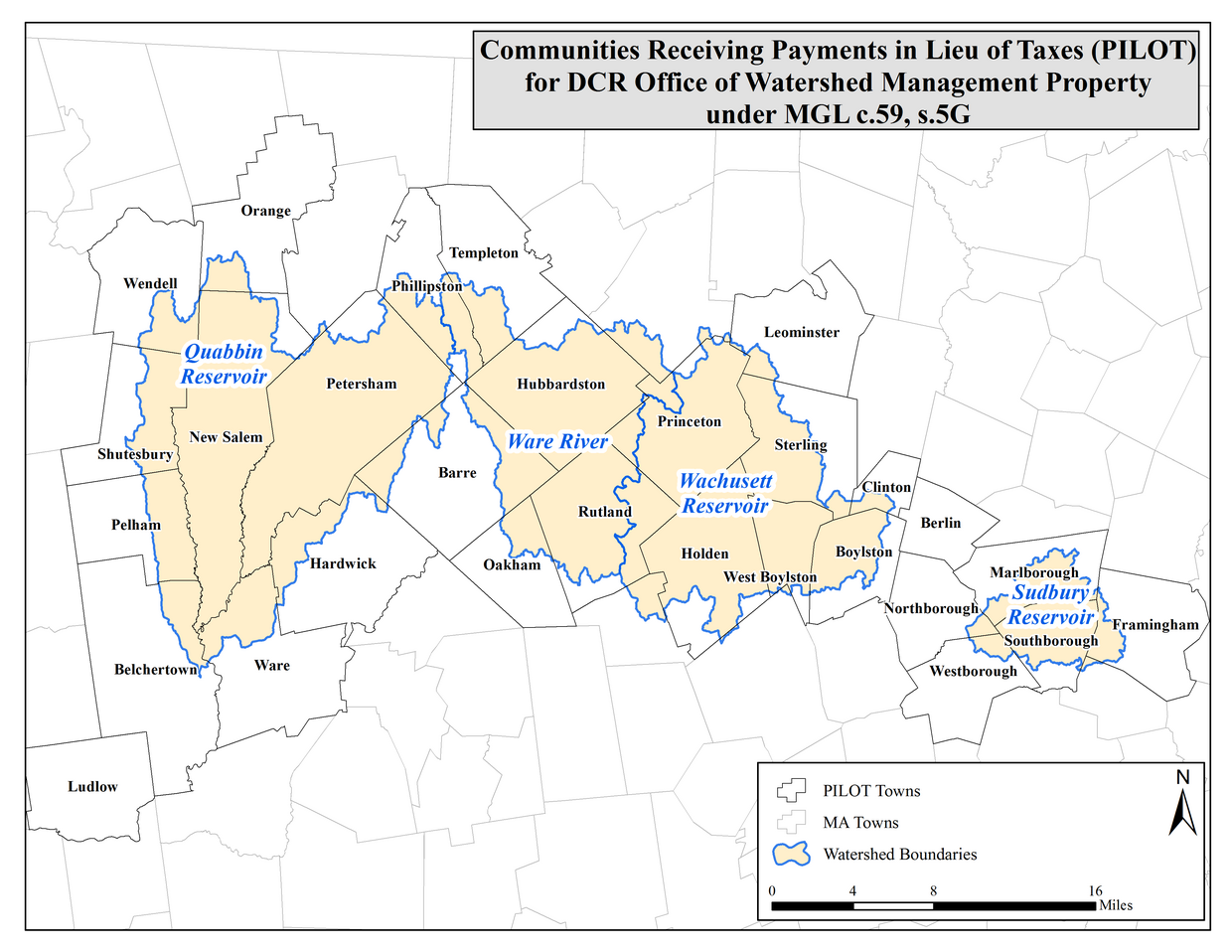

Watershed PILOT Communities

The following towns receive PILOT from DCR for Division of Water Supply Protection fee owned property in their community: Barre, Belchertown, Berlin, Boylston, Clinton, Framingham, Hardwick, Holden, Hubbardston, Leominster, Ludlow, Marlborough, New Salem, Northborough, Oakham, Orange, Pelham, Petersham, Phillipston, Princeton, Rutland, Shutesbury, Southborough, Sterling, Templeton, Ware, Wendell, West Boylston, and Westborough.

PILOT Values

Over $200 million has been distributed since 1985 in DCR watershed protection PILOT payments.

Click here for the Department of Revenue website showing details of Watershed PILOT calculations.

You can also view a year-by-year break down by community of the Payment in Lieu of Taxes made by DCR Office of Watershed Management.

How Payments Are Calculated

The Watershed Management PILOT amount is determined by multiplying the Department of Revenue (DOR) valuation of DCR Division of Water Supply Protection land by the local commercial tax rate. The process used by DOR for valuing State Owned Land (SOL – which includes DCR Watershed Management ) under MGL c. 58 was established by the Mass Municipal Modernization Act – Chapter 218, Section 108 of the Acts of 2016.

Under this process, DOR determined a base year SOL valuation for each community as of January 1, 2017. This base year valuation used DOR guidelines on segmenting lands into prime lots (the requisite frontage and area needed to build a single family home in each community), rear acreage, and un-buildable acreage, as well as discount adjustments for the total number of prime lots and total acreage. After a hearing and appeal process, base year SOL valuations were finalized.

The base year valuations are adjusted every two years by a percentage equal to the change in a city or town’s equalized cash value (EQV). Valuations are also updated annually to include the value of any acquisitions and/or dispositions in a community. Calculations for acquired lands will be made using the cost per acre average for each town, adjusted by the EQV.

There is a wide variation in the per-acre PILOT payment from community to community. This is due to varying real estate prices, which are a key factor in determining land valuation, and local tax rates.

Additional Resources

Hold Harmless

Legislative provisions state that the Watershed Management PILOT payment can never be less than that of the previous year, even if the value of the land or tax rates decrease. This "hold harmless" clause provides the watershed communities the security of level funding even if a drop in valuation or tax rate combines to lower the calculated PILOT.

The "hold harmless" amount has added approximately $2 million per year since 2018 from the minimum due each community (DOR valuation times the local commercial tax rate) and the final amount that is paid to the watershed towns.

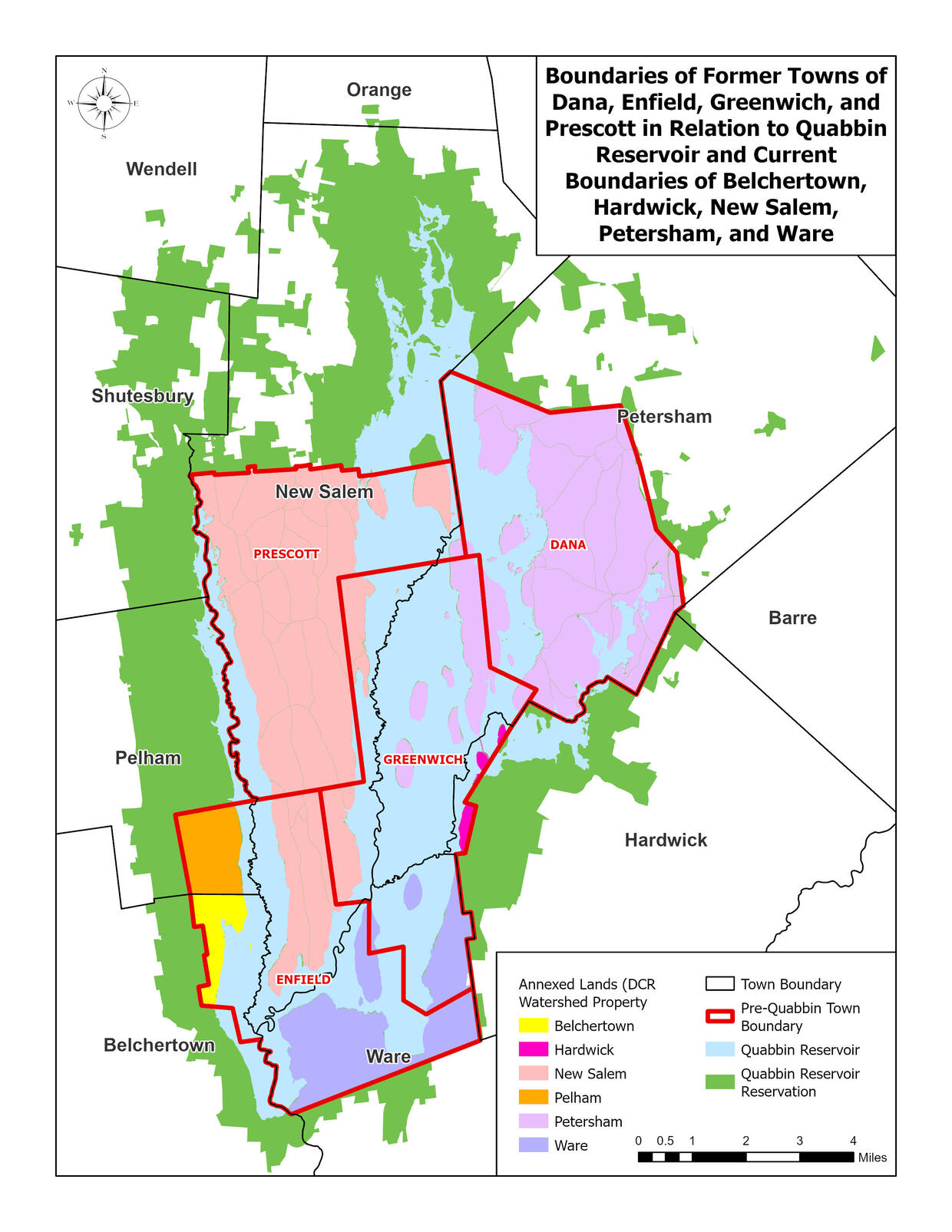

Annexed Lands

Four towns were lost due to the creation of the Quabbin Reservoir: Dana, Enfield, Greenwich, and Prescott. The area from the four towns was added (or annexed) to six towns that surround the reservoir: Belchertown, Hardwick, New Salem, Pelham, Petersham, and Ware.

The Watershed PILOT legislation requires a second payment to be made for these annexed lands. The 27,345 acres are valued separately by the Department of Revenue and classified as "Annexed Lands" within PILOT calculations. Approximately $660,000 is paid annually for Annexed Lands, which is about a quarter of the PILOT made to the Quabbin communities and around 8% of the total annual PILOT.

Additional Resources

Funding

Money for the PILOT program comes from the Massachusetts Water Resources Authority (MWRA) rate payers who use the reservoir waters. They pay their water bills to the MWRA, which provides the DCR with the funds needed to make the PILOT payment. The DCR makes an annual payment in full to each community in the program.

Watershed Management PILOT vs. other state Payments in Lieu of Taxes

Many towns also receive compensation for other State Owned Lands that are not used for water supply protection. The Watershed PILOT program differs from this program in several ways:

- MWRA ratepayers pay the bill. Funds for the Watershed Management PILOT payments come from Massachusetts Water Resources Authority (MWRA) rate payers who use the reservoir waters; the MWRA provides funding to the DCR to make PILOT payments to the watershed towns. Unlike the reimbursement program for other state-owned lands, which are disbursed through the State's Local Aid program ("Cherry Sheets") and is based on legislative allocation, the Watershed Management program is paid in full directly to each community. The DCR payment does not appear on the Cherry Sheet.

- DCR PILOT utilizes the local commercial tax rate. Watershed Management PILOT is required to utilize each community's commercial tax rate in calculating the PILOT obligation.

- The payment can never be less than the previous year. MGL c. 59, s. 5G states that Watershed Management PILOT can never be less than the previous year's payment. This "hold harmless" clause provides the watershed communities the security of level funding even if a drop in valuation or tax rate combines to lower the calculated PILOT.

Private Property Conservation Programs

The Watershed Management PILOT program compensates towns for land owned "in fee" by DCR for water supply purposes. The DCR Watershed Management program also relies on other conservation lands that are private property. Watershed towns, however, do not receive PILOT for these lands.

AWatershed Preservation Restriction (WPR) is a legal agreement between DCR and a private landowner where the landowner sells or donates the development rights of their property to DCR for water supply protection purposes while keeping ownership of the land. The WPR remains in effect permanently and carries forward even if the landowner sells the property.

"Chapter 61" land is privately owned with property taxes significantly abated in exchange for a commitment to keep the land in active forest use for 10 year intervals. The Chapter 61 program is managed by DCR's Bureau of Forest Fire Control and Forestry.

Contact

Joel Zimmerman

DCR Division of Water Supply Protection

10 Park Plaza, Suite 6620

Boston, MA 02116

(857) 286-0371

joel.zimmerman@mass.gov