Improving Police Training

One of the most significant issues faced by Massachusetts lawmakers this year was police accountability. The work of the OSA helped to inform this debate and point the way on steps the Commonwealth can take to bolster public trust in law enforcement.

A study released last year by the OSA looked at municipal police training in Massachusetts. It found the state had no way of holding police accountable for meeting training standards, did not provide enough opportunities for them to meet training requirements.

Among the recommendations included in the report was the establishment of a Police Officer Standards and Training (POST) system. Such a system would set minimum training standards, regulate training programs and curricula, and set standards for maintenance of police licensure or certification.

In June, as a nationwide debate on police accountability began, lawmakers and advocates used the OSA report to craft solutions.

Video: Police Training in Massachusetts

Skip this video Police Training in Massachusetts.In December, the legislature passed its final proposed police reform legislation, which included a robust POST system. It now awaits the signature of Governor Baker.

Additional Resources

- Auditor Bump on Police Reform Bill Passage: “An Important Step Forward in Both Public Safety and Civil Rights”

- Testimony of State Auditor Suzanne M. Bump to the House of Representatives on Police Training in the Commonwealth

- Auditor Bump Calls for Expanded Resources and Accountability for Municipal Police Training in the Commonwealth

- Auditor Bump's Statement on Governor Baker’s Proposal to Implement a Statewide Police Officer Standards and Accreditation System

A National Leader in Accountability

Since 2011, the Massachusetts Office of the State Auditor has become a national leader in government accountability. This year was no different.

In March, the OSA learned that it had received the highest possible rating on its triennial peer review for the third consecutive time. The review is administered by the National State Auditors' Association and was conducted by auditors from Illinois, Missouri, Oregon, Tennessee, Texas, and Vermont. It examined the office's policies, procedures, work products, and compliance with Generally Accepted Government Auditing Standards (GAGAS).

The office also received several awards this year in recognition of its contributions to government accountability.

In February, State Auditor Suzanne M. Bump was presented with the Excellence in Government Leadership Award by the Association of Government Accountants (AGA) at its National Leadership Training in Washington, D.C. In a citation presented to Bump, the AGA cited her use of data and technology to address complex challenges facing government, improvements to child welfare, public benefit programs, and overall government operations as primary reasons for selecting her to receive the award.

“"The National Leadership Awards recognize the best in the field and those who consistently demonstrate the highest personal and professional standards.” - AGA CEO Ann Ebberts.”

In August, Auditor Bump accepted the National Association of State Auditors, Comptrollers and Treasurers' (NASACT) President's Award for her commitment to government transparency and her leadership related to the prevention of Medicaid fraud.

Video: Auditor Bump Accepts the 2020 NASACT President's Award

Skip this video Auditor Bump Accepts the 2020 NASACT President's Award.Each year, the President’s Award is given to one state auditor, one state comptroller, and one state treasurer to recognize their service to NASACT, its members, and the field of government accountability and financial management.

Additional Resources

Protecting and Supporting Children

More than any other issue, child welfare has been a consistent focus of the OSA's work since 2011. This continued in 2020.

In January, Auditor Bump testified in support of a bill brought forward by Rep. Kay Khan to create an "electronic backpack" for students who are in foster care. This backpack would contain digital copies of relevant electronic records for the student, including past academic performance and information about past educational providers.

A report released by the OSA in 2019 examined the challenges schools face in meeting the educational needs of students in foster care. It noted that schools expend significant time and effort ensuring children in foster care receive the right educational services and called for the creation of an electronic backpack program to address this problem.

While the bill did not ultimately become law, the momentum generated behind the proposal will increase its chance of success in future legislative sessions.

“"The electronic backpack can’t solve everything, but it certainly would help cut through the bureaucratic nightmare these students — and the educators, social workers, and foster parents trying to serve their needs — often have to endure." - Boston Globe”

Through its audit work, the OSA continued to identify areas where state government was not taking every opportunity possible to ensure the safety of children.

An audit released in May, which looked at the Department of Early Education and Care (EEC), found deficiencies related to investigations of suspected child abuse or neglect, background record checks of program employees, and the timeliness of investigations and licensing visits of group care programs. Most notably, the audit showed miscommunications between EEC and the Department of Children and Families (DCF) resulted in some allegations of abuse not being properly investigated.

The OSA also completed its series of audits examining compliance with background check requirements for undergraduate students participating in early childhood education programs at colleges. The audits, which looked at the early childhood education programs at Quinsigamond Community College and Mount Wachusett Community College, found neither school could show that all students participating in the program had undergone required criminal background checks before interacting with kids.

Both schools indicated they are taking action to address the audits' findings.

Additional Resources

- Auditor Bump Testifies in Support of Legislation that would Establish an Electronic Backpack for Students in Foster Care

- Auditor Bump Calls for Improvements to State’s System Providing Educational Services to Children in Foster Care

- Boston Globe: Improving outcomes for state’s foster kids

- Audit Provides Recommendations to Improve Child Safety at State-Licensed Group Care Programs

- Audit Calls for Improved Oversight of Background Checks at Quinsigamond Community College’s Early Childhood Education Program

- Audit Calls for Improved Oversight of Background Checks and Financial Activities at Mount Wachusett Community College

PILOTs and Solar Taxation

As the year wound down, the OSA released a municipal impact study highlighting issues with two important state policies: the state-owned land (SOL) payments in lieu of taxes (PILOT) program, and taxation of solar facilities in Massachusetts.

PILOT programs help municipal governments replace some or all revenue lost from certain state property tax exemptions, such as those associated with nonprofit organizations, recreational areas, and properties owned by the Commonwealth.

The SOL PILOT Program provides reimbursement payments to municipalities for tax-exempt land owned by the Commonwealth. In the last twenty years, the program’s funding has not met statutory obligations to reimburse municipalities.

In addition, under the SOL PILOT Program’s funding formula, reimbursements are partly based on each municipality’s state-owned land value. This means communities with decreasing, stagnant, or slowly increasing property values have seen reductions in their PILOT payments. As a result, communities in the eastern part of the state, where property values have consistently risen, have seen their SOL PILOT reimbursements increase. In contrast, reimbursements to communities in the western part of the state have generally decreased.

Among the solutions proposed in the report, Auditor Bump calls on the legislature to fully fund the SOL PILOT and add a hold harmless provision to the program, so communities do not see their reimbursements decrease.

““The State-Owned Land PILOT Program represents a pact: cities and towns will house and provide critical services for untaxed properties that benefit the public, such as universities, recreational lands, and government buildings, and in exchange, the state government will ensure they are fairly compensated. But years of underfunding of this critical program have strained this agreement and local budgets.” - Linda Dunlavy, Executive Director of the Franklin Regional Council of Governments”

The study also shows how decisions by the Appellate Tax Board have allowed large commercial solar facilities to avoid paying personal property taxes on their equipment by taking advantage of an exemption on solar equipment that was designed to promote residential and small commercial solar installations. These rulings have created confusion for local officials and may result in slower rates of solar development in the future. The study calls on the Legislature to clarify the solar property tax exemption and the tax status of solar facilities that may be eligible to enter into a PILOT agreement.

Additional Resources

Stopping Public Benefit Fraud

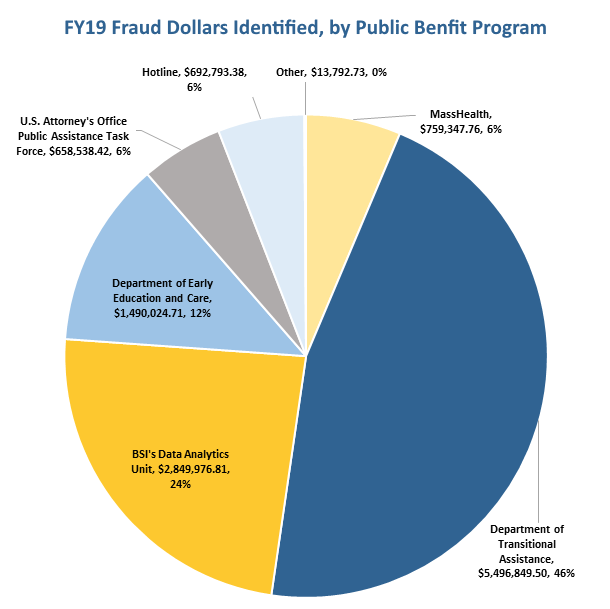

One of the core functions of the OSA is investigating fraud in public benefit programs, such as MassHealth and the Supplemental Nutrition Assistance Program (SNAP). This work is done by the OSA's Bureau of Special Investigations.

In January, BSI announced that it had identified nearly $12 million in public benefit fraud during the previous fiscal year.

BSI also worked to build strategic partnerships with other entities that investigate public benefits fraud, including district attorneys. Through these partnerships, the organizations work together to identify, investigate, and, if appropriate, prosecute individuals who are believed to have defrauded these public benefit programs.

In November, BSI announced that, in collaboration with the Norfolk District Attorney's Office, they had secured a guilty plea from a Quincy woman to fifteen indictments of defrauding public benefits programs and providing false or misleading information. The woman was ordered to spend a year under house arrest and pay a six-figure restitution.

Also, in November, the director of BSI, Gina Cash, received a Top Women in Law Award from Massachusetts Lawyer's Weekly. She was recognized for her work to address public benefits fraud across the state and for shifting BSI’s focus to higher-impact violators.

Additional Resources

Making MassHealth Efficient & Accountable

MassHealth is by far the largest state government program in the Commonwealth. It provides access to healthcare to more than 1.9 million eligible low- and moderate-income children, families, seniors, and people with disabilities. In fiscal year 2018, MassHealth paid more than $15 billion to healthcare providers. MassHealth spending represented approximately 39 percent of the Commonwealth’s total fiscal year 2018 budget.

Due to MassHealth's size and complexity, the OSA has an audit unit exclusively dedicated to auditing this important program. In 2020, the OSA released eleven audits examining topics related to MassHealth.

Four of these audits examined MassHealth's processes for verifying the reported income of people applying to become members of MassHealth. A 2012 audit from the OSA found significant problems in this area. The audits released this year showed MassHealth had taken action to address these deficiencies.

The audits showed enrollment centers were properly comparing income information provided by applicants to official data sources, including those maintained by the Internal Revenue Service, the Massachusetts Department of Revenue, and the Social Security Administration, to ensure accuracy and determine whether the applicants qualified for benefits.

This year, another series of audits released by the OSA examined MassHealth billing by six elder service providers from across the Commonwealth. The audits found two primary issues. First, some of the providers reviewed received payments for services that were not properly authorized. Second, it appears some providers received payment for duplicative services.

In January, the OSA examined billings from a Lynn physical therapist. It found he improperly billed MassHealth for $359,266 for claims he submitted to the program using his billing identification number when those services were actually provided by physical therapy assistants. State regulations do not allow for payments for therapy services provided by physical therapy assistants, even while under the supervision of a licensed therapist.

Additional Resources

- MassHealth Has Made Improvements to Applicant Income Eligibility Verifications, Audit Shows

- Audits Show Elder Service Organizations Provided Potentially Unallowable Services to MassHealth Members

- Auditor Bump Says Lynn Physical Therapist Must Repay $359,266 to MassHealth for Improper Claims

- MassHealth Audits

Keeping the Commonwealth Safe

From protecting our air and water and securing our infrastructure to ensuring communities are prepared for an unexpected disaster, state government plays a critical role in keeping the public safe. This year, the OSA examined several agencies responsible for running important public safety programs.

A February audit of the Massachusetts Emergency Management Agency (MEMA), called on the agency to take steps to comply with federal guidelines designed to ensure cities and towns are prepared to respond to chemical emergencies effectively. The audit found the state had not established Emergency Planning Committees (EPCs) for 53 cities and towns where businesses use and store significant levels of hazardous chemicals. These committees are responsible for developing plans to respond to chemical emergencies in their areas. In its response to the audit, MEMA indicated it was taking steps to address these issues.

An audit released in April highlighted deficiencies at the Massachusetts Bay Transportation Authority (MBTA) that allowed terminated and retired employees to continue to access MBTA facilities after they ended their employment with the agency. This leaves MBTA facilities vulnerable to unauthorized access, placing the security and safety of MBTA property, passengers, and employees at risk. The audit found that the MBTA did not ensure the retrieval and deactivation of employee access cards when an employee left employment, although written policies dictated that it do so. In its response, the MBTA indicated it has implemented or plans to implement the audit’s recommendations to address this issue.

The Massachusetts Department of Environmental Protection (DEP) is responsible for protecting and enhancing the Commonwealth’s natural resources, including air, water, and land, and advancing sustainable economic development. However, a June audit of the agency found it is not providing important information to the federal government and the public about Massachusetts watersheds' safety and usability in a timely manner.

The audit found DEP had not released reports required by the federal Clean Water Act. Under this law, each state must provide the U.S. Environmental Protection Agency with an Integrated List of Waters Report every two years that contains details on its water quality, including information on bodies of water that are impaired by pollutants. The audit found DEP did not finalize its 2016 edition of this report, which was due in April 2016, until December 2019, and had not filed its 2018 edition. Additionally, the audit shows DEP has not made water quality testing data it has gathered available to the public since 2015. Without these two sources of information, the public does not know whether watersheds in the state are safe for their designated uses. To address these issues, the audit called on DEP to reevaluate its data collection and processing methods, use labs not run by the state to test samples, and consider using external sources that may assist with data collection and reporting.

Additional Resources

- Audit Calls on State to Do More to Ensure Cities and Towns Are Prepared to Respond to Chemical Emergencies

- Department of Environmental Protection Leaving Public with Murky Picture of Water Quality, Audit Shows

- Audit Offers Steps to Address Security Vulnerabilities at MBTA Vehicle Maintenance and Storage Facilities

Holding State Government Accountable

There are numerous other ways the OSA improved government accountability in 2020.

An April audit of the Massachusetts Environmental Police showed significant issues related to overtime payments for officers. Auditor Bump attributed the issues to inadequate technology and historically lax management and warned these factors leave the agency vulnerable to abuse.

Video: WCVB: Environmental police failed to track officers’ whereabouts

Skip this video WCVB: Environmental police failed to track officers’ whereabouts.In January, the OSA called on the Department of Correction (DOC) to improve inmate health and reentry services after an audit found serious problems in the areas. The audit showed DOC did not always provide inmates with requested healthcare services within the required timeframes. Further, the audit shows DOC could not show all inmates received Individual Reentry Plans (IRPs) or that necessary medical appointments were scheduled before their release. The audit notes that these deficiencies could lead to inmate health issues worsening, jeopardize inmates' physical or mental health upon their release, and expose DOC to legal risk. In its response to these findings, DOC reported taking steps to improve oversight of its inmate sick call request process and enhance staff management and training for reentry services.

In a year when many communities had to dramatically change how they administer elections, the OSA advocated to ensure cities and towns receive adequate funding to run their early voting locations. The office helped to return $727k to municipalities to cover their costs to administer early voting in the presidential primary. It continues to work with lawmakers and municipal officials to reimburse communities for expenses associated with the state primary election and general election.