Overview

Auto insurance policies that may be subject to the SDIP include:

- Policies that are assigned through the Massachusetts Auto Insurance Plan (MAIP). The Massachusetts Auto Insurance Plan is an insurance plan for drivers who are unable to find coverage on their own.

- Policies written by insurers who use the SDIP as their merit rating plan. A merit rating plan is used by an insurer to adjust auto insurance premium based on the operator's driving record.

Contact your insurance company or your insurance agent to find out if they use the Safe Driver Insurance Plan as their merit rating plan.

Relevant vehicles, policies, and incidents

The SDIP sets the specific surcharges for certain traffic violations and accidents and the specific credits for incident-free years. Insurance companies are not required to use the SDIP. Instead, insurers may choose to develop their own merit rating plan and submit it for approval by the Division of Insurance.

Regulation 211 CMR 134.00 facilitates the operation of the SDIP and merit rating plans by authorizing the Merit Rating Board to collect and report auto insurance claims and traffic law violations. The following vehicles, policies, and incidents are subject to the SDIP and to an insurer's merit rating plan:

- Any private passenger vehicle rated in accordance with the Massachusetts Private Passenger Automobile Insurance Manual.

- Any Massachusetts private passenger auto insurance policy that provides the compulsory coverages (Bodily Injury To Others, Personal Injury Protection, Damage To Someone Else's Property) and/or Collision coverage for one or more vehicles subject to the Regulation.

- Any at-fault accident that results in a claim payment of more than $1000 (in excess of any applicable deductible) for damage to or caused by a vehicle subject to the Regulation. An at-fault accident is one in which an operator is determined to be more than 50 percent at fault for causing the accident. Claim payments are for specific coverages: Damage To Someone Else's Property, Collision, and Limited Collision. Bodily Injury To Others claims may also be subject to the Regulation, but only if there is no Collision or Damage To Someone Else's Property claim over $1000 as a result of the same incident

Please note that insurers are required to report Comprehensive claims to the Merit Rating Board. At-Fault Personal Injury Protection claims with incident dates on or after April 1, 2008, with any monetary loss must also be reported to the Merit Rating Board.

- Any traffic law violation that results in a conviction of an operator for a violation of a surchargeable traffic law. This includes payments made or assessed for a citation, or any assignment of an operator to a driver alcohol education program or controlled substance abuse treatment or rehabilitation program.

- Any minor or major out-of-state traffic law violation that is listed in the Massachusetts SDIP Surchargeable Traffic Law Violations (Appendix A). This includes any conviction of a traffic law violation reported by another state to the Massachusetts Registry of Motor Vehicles as the result of any agreement for exchanging information between states.

Check with your insurance company or agent to find out more about the merit rating plan your company is using to rate your auto insurance premium.

Compute your Operator SDIP Rating

An Operator SDIP Rating is equal to the sum of the surcharge points of the surchargeable incidents in the driver's 6-year policy experience period.

If there are no surchargeable incidents in the experience period, the total number of surcharge points is 0 (zero). The Operator SDIP Rating is 00 points, unless the operator is eligible for a discount:

Excellent Driver Discount Plus (Credit Code 99)

Any licensed driver with 6 or more years of driving experience and no surchargeable incidents in the 6-year policy experience period is eligible for the Excellent Driver Discount Plus (99).

Excellent Driver Discount (Credit Code 98)

Any licensed driver with 5 years of driving experience and no surchargeable incidents during the most recent 5 years is eligible for the Excellent Driver Discount (98). An operator with 1 (one) surchargeable incident may also be eligible for this discount (refer to SDIP Incentives and Your Policy).

These examples show how an Operator SDIP Rating is computed. Experienced operators (6 years or more of driving experience) with valid drivers licenses are used in these examples. The policy effective date is January 1, 2010.

Example 1:

An experienced operator with 1 minor non-criminal traffic law violation:

| Speeding Violation surcharge date is 6/30/09 (Year 1) | 0 | No surcharge points are assigned to the first minor, non-criminal traffic law violation in the operator's policy experience period. |

|---|---|---|

| Total surcharge points | +0 | Surcharge points added to 00 |

| Operator SDIP Rating | =00 |

Example 2:

An experienced operator with 2 surchargeable incidents:

| Speeding Violation surcharge date is 6/30/05 (Year 5) | 0 | No surcharge points are assigned to the first minor, non-criminal traffic law violation in the operator's policy experience period. |

|---|---|---|

| Major At-Fault Accident Violation surcharge date is 6/30/08 (Year 2) | 4 | Number of surcharge points assigned to the major at-fault accident |

| Total surcharge points | +4 | Surcharge points added to 00 |

| Operator SDIP Rating | =04 |

If you have further questions about the system of surcharges and credits that apply in the Safe Driver Insurance Plan, you can reach a Customer Service Representative at the Merit Rating Board any weekday from 8:30 a.m. to 5:00 p.m. by calling (857) 368-8100.

Check with your insurance company or agent to find out more about the merit rating plan your company is using to rate your auto insurance premium.

Insurance coverages impacted by SDIP

The following applies only if your insurance company uses the Safe Driver Insurance Plan (SDIP) as its merit rating plan.

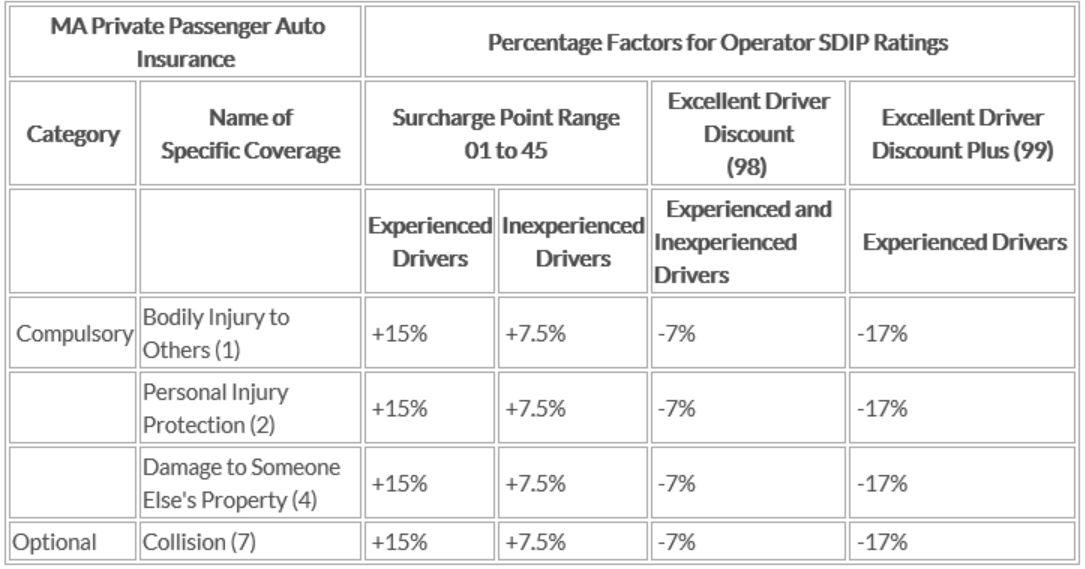

4 parts of coverage on a Massachusetts private passenger auto insurance policy are impacted by the SDIP. The specific coverages are:

- Part 1: Bodily Injury to Others

- Part 2: Personal Injury Protection

- Part 4: Damage to Someone Else's Property

- Part 7: Collision

A surcharge percentage factor is used to increase the premium on each of these four coverages. For experienced operators, each surcharge point represents a 15% increase in the compulsory coverages (Parts 1, 2, and 4) and the optional coverage (Part 7) Collision. For inexperienced operators, each surcharge point represents a 7.5% increase in the compulsory coverages (Parts 1, 2, and 4) and the optional coverage (Part 7) Collision.

Credit code percentage factors are used to decrease the premium on each of these four coverages. For experiences operators with an SDIP rating of 99, a credit code represents a 17% decrease in the compulsory coverages (Parts 1, 2, and 4) and the optional coverage (Part 7). For inexperienced operators and experienced operators with an SDIP rating of 98, a credit code represents a 7% decrease in the compulsory coverages (Parts 1, 2, and 4) and the optional coverage (part 7).

- An experienced operator has been actively licensed for 6 or more years.

- An inexperienced operator has been actively licensed for fewer than 6 years.

Check with your insurance company or agent to find out more about the merit rating plan your company is using to rate your auto insurance premium.