Before You Begin

This page shows how to request copies of filed tax returns, payments, and records from MA DOR.

Keep in Mind

DOR does not keep records past a certain time, and may not necessarily still have what you are asking for.

For guidance regarding how long you should keep Massachusetts (DOR) tax records go to 830 CMR 62C.25.1: Record Retention.

For guidance regarding how long you should keep Federal (IRS) tax records go to How long should I keep records?

For all other inquiries go to DOR Contact Us.

For the Fastest Response, Request Through MassTaxConnect

MassTaxConnect is DOR's online application for registering, filing and paying taxes.

With MassTaxConnect you can also view and request copies of:

- Previously Filed Tax Returns

- Payments (Including estimated)

- Bills and records (including from an Audit).

If you are not registered for MassTaxConnect, you will still be in DOR's system if you (or a third party on your behalf) have previously filed MA taxes such as personal income.

To access your tax documents, you now need to create a MassTaxConnect logon.

To learn how, view these instructions below and the logon video tutorial.

How to Create a MassTaxConnect Logon

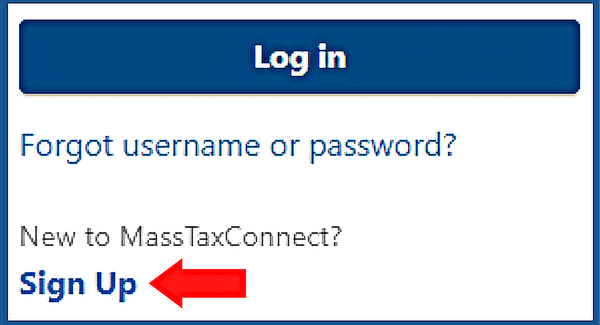

| Getting Started | On the upper right-hand side of MassTaxConnect's home screen:

|

|---|

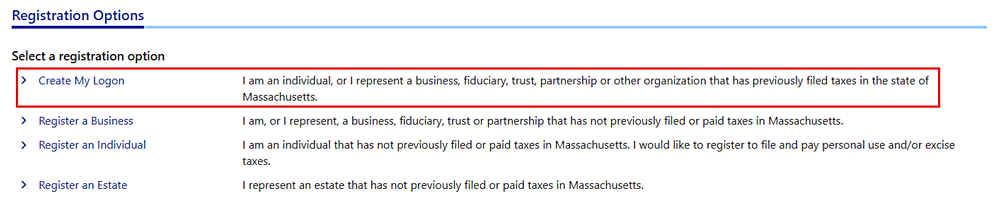

- Choose Create My Logon.

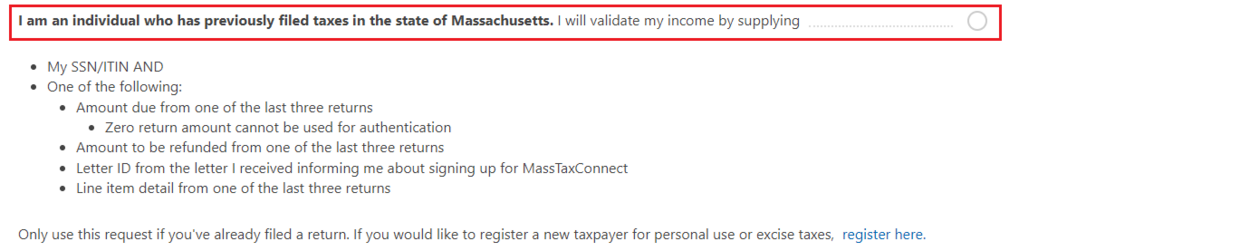

- Choose I am an individual who has previously filed taxes in MA.

If you can't find tax information to verify who you are when creating your logon, contact DOR, and request a Notice of Account ID.

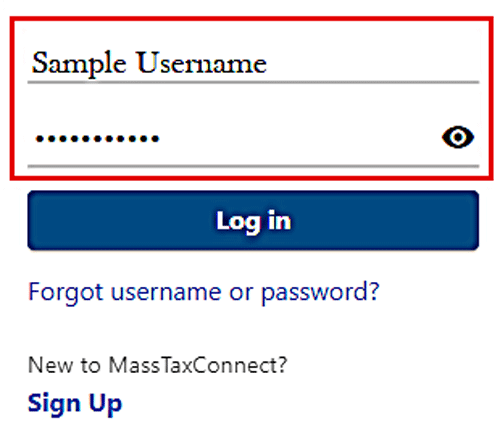

| Finish the remaining instructions. |

|

|---|

Please note: DOR strongly recommends that taxpayers, whether businesses or individuals, choose their own username and password and take responsibility for their MassTaxConnect account and the access rights granted to third parties. There are many security risks when a third party impersonates a taxpayer or when passwords are shared.

Keep in mind: Your request for a copy of a previously filed personal income tax return may take several days to process.

Request By Email

For taxpayers: Taxpayersmay request taxpayer-specific records by emailing their request with a clear copy of their Driver's License to taxpayer-records@dor.state.ma.us

For representatives with Power of Attorney (POA): If you are a representative with a POA, then you must include a copy of Form M-2848: Power of Attorney and Declaration of Representative. (Go to DOR's POA page for more information.) Email your request and POA to taxpayer-records@dor.state.ma.us

Please note: Taxpayers and POA's who need to obtain copies of previously filed returns must also email a Form M-4506: Request for Copy of Tax Form.

For U.S. government departments or agencies: If you are a U.S. government department or agency, then in some circumstances your Inspector General may administratively subpoena quarterly wage records for a particular employer or employee. Email your Inspector General's administrative subpoena to taxpayer-records@dor.state.ma.us

Need Translation Help

Do you need to change this page's language?

Go to How to Translate a Website, Webpage or Document into the Language You Want.