Before You Begin & What You Need

MassTaxConnect is DOR's online application for registering, filing and paying taxes.

Before registering, you should answer the following:

- What kind of business structure do I want?

- Do I need an Employer Identification Number (EIN) from the IRS?

- What kind of taxes do I need to register for?

To register your business with MassTaxConnect, you will need your:

- Social Security number if registering as a sole proprietor with no employees

- EIN - Required for all businesses including sole proprietors with employees

- Start date of your business

- Your business's legal and mailing addresses.

All businesses except sole proprietorships will need the above information along with:

- Contact information for owners/officers including their

- Titles and Social Security numbers.

Non profit organizations will need an IRS Determination Letter recognizing an organization as a 501(c)(3).

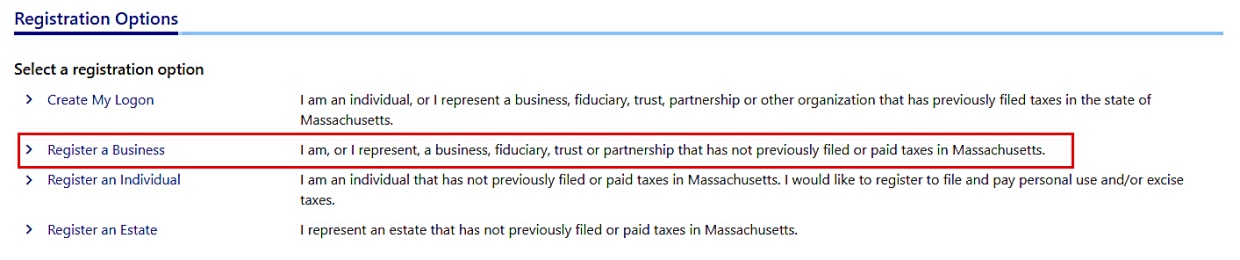

Register as a Business (Including Sole Proprietorships) That have Never Filed MA Taxes

Businesses are required to register with an EIN in MassTaxConnect.

Sole proprietors must register under their Social Security number. A sole proprietor with employees must also provide an EIN.

To learn how, view the instructions below and the registration video tutorial.

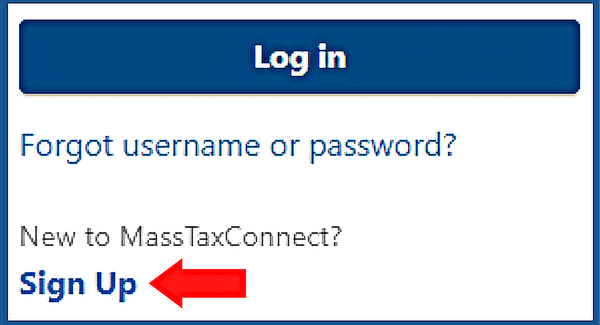

| Getting Started | On the upper right-hand side of MassTaxConnect's home screen:

|

|

|---|

- Choose Register a New Business.

- Provide the required registration information.

- When complete, you will receive a confirmation email.

- When you log in for the first time, you will be prompted to set up two-step verification.

Once approved, you will receive a mailed registration certificate depending on the tax(es) you register for.

Register as a Sole Proprietorship That has Filed Personal Income or Other MA Taxes

You will already be in DOR's system if you (or a third party on your behalf) have previously filed MA taxes such as personal income.

If you have filed taxes with DOR, but do not have a MassTaxConnect logon, there are 2 steps to register your business as a sole proprietorship in MassTaxConnect.

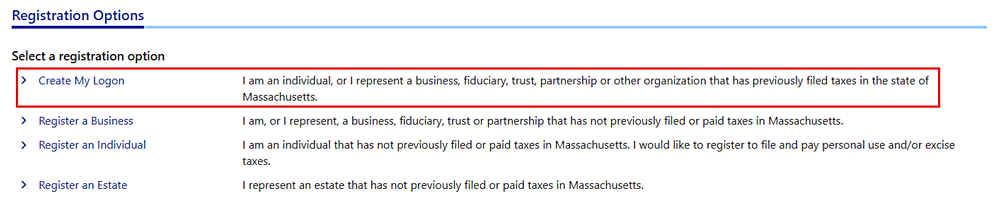

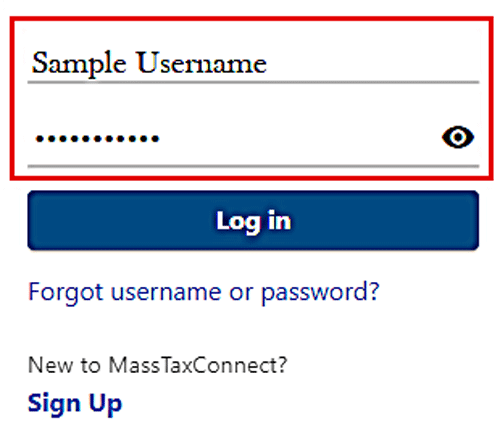

Step 1: Create a MassTaxConnect Logon

To learn how, view the instructions below and the logon video tutorial.

| Getting Started | On the upper right-hand side of MassTaxConnect's home screen:

|

|---|

- Choose Create My Logon.

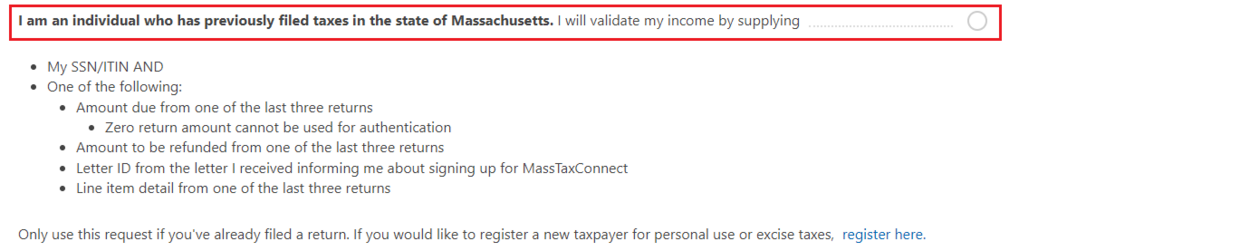

- Choose I am an individual who has previously filed taxes in MA.

If you can't find tax information to verify who you are when creating your logon, contact DOR, and request a Notice of Account ID.

- Finish the remaining instructions.

| After Finishing the Instructions |

|

|---|

When complete, you will be on your Summary page and ready to register your business.

Step 2: Register Your Business

To learn how, view the instructions below and the registration video tutorial.

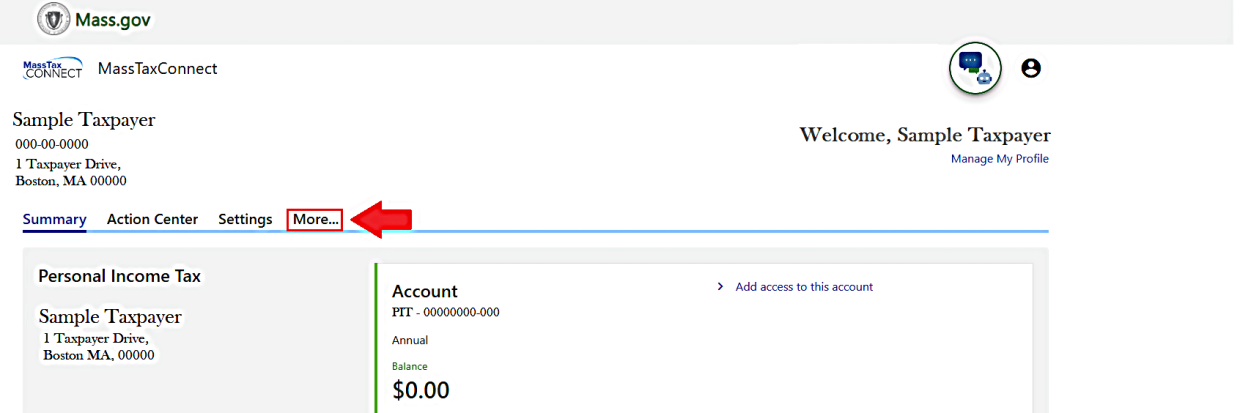

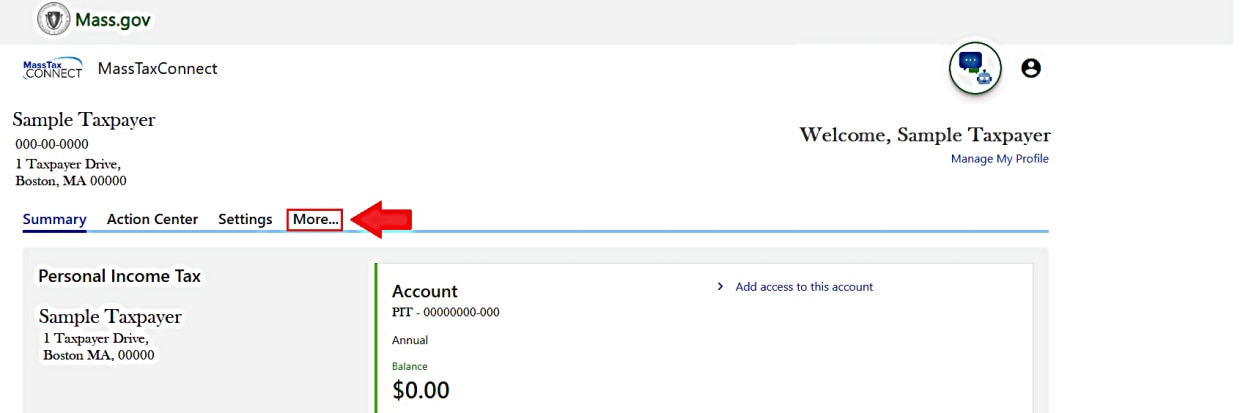

- From the Summary page, choose More.

| Remaining instructions |

|

|---|

Once approved, You will receive a mailed registration certificate depending on the tax(es) you register for.

Register as a 501(c)(3) Nonprofit Organization

A 501c3 nonprofit organization must register with MassTaxConnect to request a sales tax exemption. Only 501(c)(3) nonprofits are eligible for the sales tax exemption.

If your 501(c)(3) nonprofit organization has not previously registered with DOR, you must follow the same steps as a business registering for the first time (see above).

When asked, you will have to indicate that:

- Your business is a nonprofit and

- Which type of non-profit it is.

You will need to attach your IRS determination letter.

If your already registered with DOR but didn't identify as a nonprofit, you will need to:

- Log in to MassTaxConnect and

- Send a secure e-message requesting the exemption and send the IRS determination letter.

Once approved, DOR will mail you a Form ST-2: Certificate of Exemption.

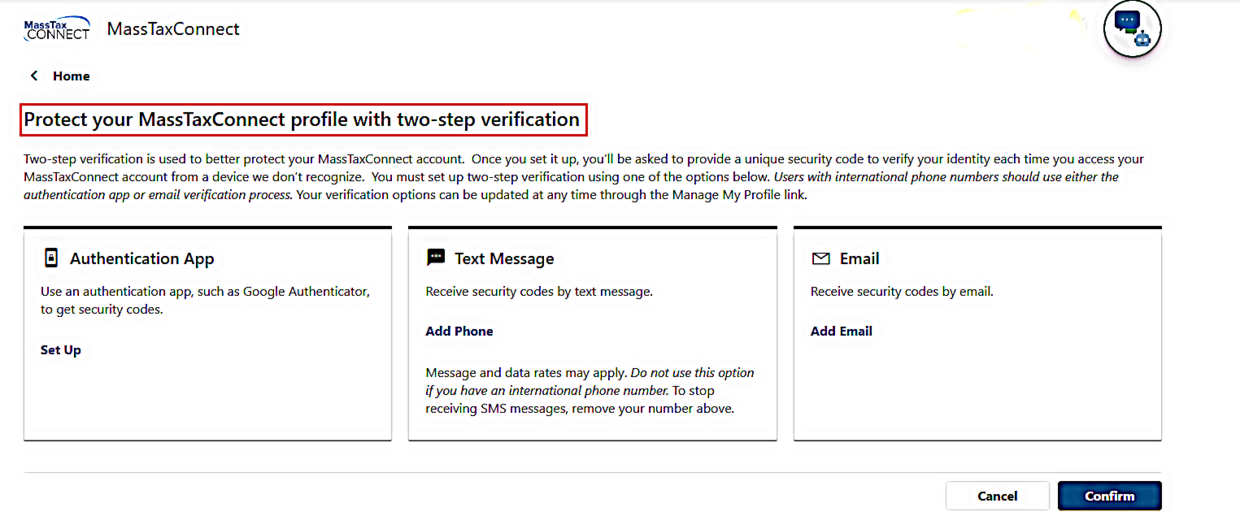

First Time Log In with Two-step Verification

DOR uses two-step verification to protect your MassTaxConnect account. After your registration is approved, MassTaxConnect will prompt you to set up two-step verification.

Set up your two-step verification by choosing one of the following:

- Authentication App (such as Google Authenticator)

- Text Message

- Email.

View the two-step verification video tutorial.

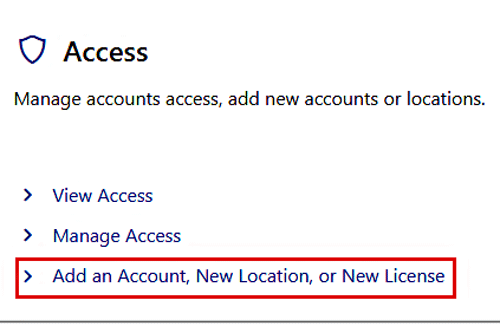

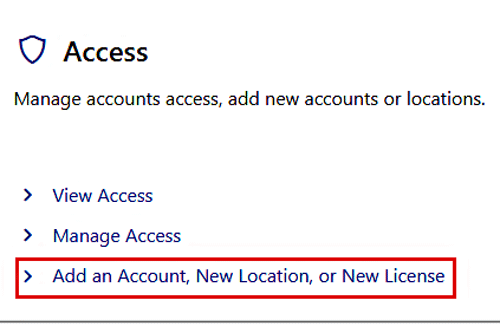

Add an Account (Tax Type), New Location, or New License

If your business is already registered with MassTaxConnect, you can easily add an:

- Account (tax type)

- New location

- New license.

Examples

- You are registered for sales and use tax and now need to register for withholding.

- You are opening another store where you sell TVs and appliances.

- You have a convenience store and now want to sell cigarettes.

Getting Started

- Log in to MassTaxConnect.

- From the Summary page, choose More.

| Remaining Instructions |

|

|---|

Once approved, you will receive a mailed registration certificate depending on the tax(es) you have register for.

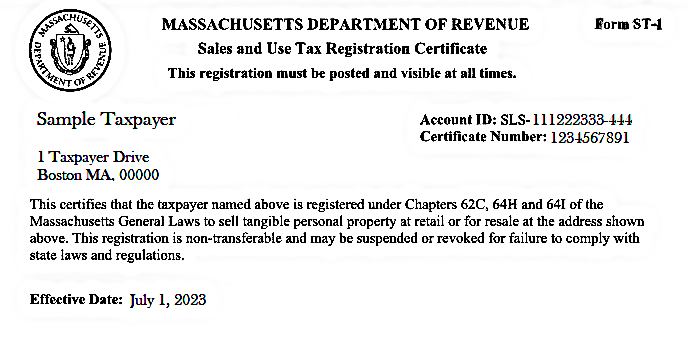

Registration Certificates

Once approved, DOR will mail you a certificate for each location you have, if you are registered for any the following:

| Business/Tax Type | Certificate Name |

|---|---|

| Cigarette License | Form CT-3 |

| Cigars License | Form CT-37 |

| Electronic Nicotine Delivery Systems License | License for Sale of Electronic Nicotine Delivery Systems |

| Marijuana Retail | Form MRT-1 |

| Meals, Food & Beverage | Meals, Food & Beverage Registration Certificate |

| Nonprofit 501(c)(3) | Form ST-2 |

| Sales and Use | Form ST-1 |

| Telecommunications Services | Form ST-3 |

| Room Occupancy | Room Occupancy Excise Registration |

Each certificate must be posted and visible at all times.

Sample Sales and Use Tax Registration Certificate

Form ST-4 & Exempt Purchase & Use Forms

For a complete listing, go to DOR Sales and Use Tax Forms.

Related Resources

Contact

Phone

9 a.m.–4 p.m., Monday through Friday