Fully fund the SOL PILOT program using the aggregate tax rate method.

In order to reach full funding and resolve the concerning effects of the current formula, the Legislature should determine its appropriation for the SOL PILOT Program by following DOR’s former approach of calculating an aggregate tax rate. This rate is a three-year running average of a ratio representing total property taxes assessed to the total value of property in the state.146 Since DOR had calculated this estimate until FY2019 and the rate previously existed in SOL PILOT Program statutes, it will be straightforward to implement.147 Using the aggregate tax rate method would also increase reimbursements for all communities in its first year of implementation. For instance, the FY2020 SOL PILOT reimbursement rate is $9.54 per $1,000 of value, whereas the aggregate tax rate for FY2020 would be $14.51 per $1,000 of value.148

Recommended SOL Reimbursement = (Municipality’s SOL Value / 1,000) * Aggregate Tax Rate

Due to the variation in property values and tax levies across communities, using a three-year running average and assigning the same rate to all cities and towns will stabilize reimbursements. For example, the FY2020 aggregate tax rate is based on total values and levies from FY2016, FY2017, and FY2018.149 Therefore, the aggregate tax rate will cause far less variation in reimbursements than using either residential or commercial property tax rates in the formula and will be reflective of changes in tax collection over time. Another benefit of using an aggregate tax rate is that it will help retain needed SOL reimbursements among communities with below-average tax rates.

A potential drawback of using this approach is that the rate may disadvantage municipalities with significantly higher tax rates. SOL reimbursements may not be representative of the revenue communities would otherwise generate if the lands were held privately. Furthermore, funding for the program could decrease if the aggregate tax rate goes down (particularly in non-revalued years), but this can be resolved with a hold harmless provision in the program.

Include hold harmless provision to protect municipalities with reduced land values

When formula changes from the Municipal Modernization Act were introduced to the SOL program in FY2019, legislators employed a one-time hold harmless provision to protect against a drop in PILOT reimbursements.150 Implementing an ongoing hold harmless provision is important to address declining SOL values as well as below-average growth in values. Protections will be most helpful for communities in central and western Massachusetts that face these issues, as shown in the map highlighting the net changes in PILOT reimbursements in Figure 10.

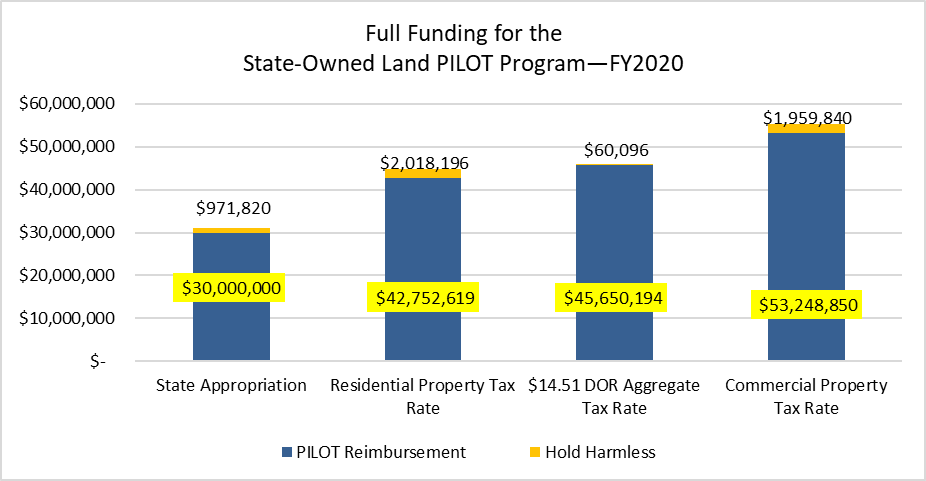

All three approaches that project full funding for the SOL PILOT program require hold harmless assistance. As seen in Figure 14, calculating reimbursements under the program with an aggregate tax rate will require the lowest investment of this supplemental funding. Moreover, the hold harmless provision will keep reimbursements the same in some communities if SOL values remain level but the aggregate tax rate lowers their reimbursement. Cities and towns should not have lower PILOT reimbursements over time if their land values have increased but not as quickly as other communities. It is important that the implementation of hold harmless protections should not restore payments for communities that lose value as a result of SOL dispositions.

Figure 14—Hold Harmless Projections and Full Funding Estimates for the SOL PILOT Program151

The Legislature should examine and fix other issues within the SOL PILOT Program.

In addition to fixing how SOL reimbursements are calculated and including a hold harmless provision for reimbursements, the Legislature needs to examine and resolve some of the other issues presented in this report. Although the SOL valuation process was simplified a few years ago, the land characteristics of newly-acquired SOL continue to influence how land is valued through the program.152 Compared to the current formula, communities will receive higher reimbursements under an aggregate tax rate, but there may be issues of fairness if the ongoing assessment process reduces the value of SOL. The Legislature needs to review SOL assessments to see if there are ways to adjust for the loss of taxable value due to state acquisitions.

The Legislature should also update statutes to include additional state agencies in the SOL program. While there are some properties under state ownership for which it may be costly to allocate reimbursements (such as the land under the State House and the John McCormack building in Boston), there are agencies that can easily be included in the list (such as the DFS, courthouses, and county correctional facilities).153 Another issue for the Legislature to consider is the state of infrastructure of SOL and the need for maintenance. Communities, such as Hawley, have noted deteriorating condition of roads that cut across SOL and a lack of municipal funds and state assistance to repair them, raising concerns for public safety.154 The Legislature should set aside some funds in a separate budget to address infrastructure maintenance for SOL.

These issues could be examined in detail and potentially addressed through legislative review. During the 2019–2020 legislative session, Sen. Adam Hinds, Sen. Jo Comerford, Rep. Joseph McKenna, and Rep. Suzannah Whipps, among others, supported legislation and/or budget amendments that would require study of the SOL program.155

| Date published: | December 10, 2020 |

|---|