Overview

Massachusetts has a state room occupancy excise tax rate of 5.7%. Depending on the city or town, a local option room occupancy tax and other taxes and fees may also apply.

The room occupancy excise tax applies to room rentals of 90 days or less in hotels, motels, bed and breakfast establishments, and lodging houses. Beginning July 1, 2019, the room occupancy excise also applies to short-term rentals of property for 31 days or less.

For all types of rental accommodations, if the total amount of rent is less than $15 per day, no tax is due.

Generally, the room occupancy excise is collected and paid to DOR by a person or business called an operator.

As of July 1, 2019, new rules require an intermediary or other agent collecting rent to file returns and pay taxes to DOR.

All operators and intermediaries must register with DOR onMassTaxConnect.

State and Local Room Occupancy Excise Rates and Fees

The total amount of tax required to be collected depends on where the property is located. Visit the Division of Local Service’s Municipal Databank for current local option and community impact fee rates as well as information about which localities are part of the Cape Cod and Islands Water Protection Fund.

Local rates and fees must be added to the state’s room occupancy rate and reported together to the Department of Revenue on the same return.

Total tax to be collected

The state’s room occupancy excise tax rate is 5.7%. Note that while the statute provides for a 5% rate, an uncodified surtax adds .7% to that rate.

In addition to the state excise, Massachusetts cities and towns are permitted to charge a local room occupancy excise tax up to 6% (6.5% for Boston).

In the cities of Boston, Worcester, Cambridge, Springfield, West Springfield, and Chicopee, an additional 2.75% tax is charged for convention center funding. See TIR 05-01 for more information.

In Barnstable, Nantucket and Dukes Counties an additional 2.75% may be charged for the Cape Cod and Islands Water Protection Fund beginning July 1, 2019. Currently this applies for all Barnstable County municipalities.

Beginning July 1, 2019, for short-term rentals only, cities and towns are permitted to charge an additional community impact fee up to 3% if an operator has more than one property in that locality or is renting an owner-occupied 2 or 3 family house on a short-term rental basis.

Changes to local option rates or other locality-based fees

Changes to local option rates and fees require a vote by the legislative body of the city or town. Various sources, such as the city or town website and local media, may have information about upcoming votes. Cities and towns are required to notify DOR of any rate or fee changes using the notification of acceptance forms for room occupancy and community impact fee. DOR maintains a current listing of all local rates and fees, called the Municipal Databank.

Collecting the Community Impact Fee

Beginning July 1, 2019, for short-term rentals only, cities and towns that have adopted a local excise may vote to charge an additional community impact fee up to 3% on the following types of property:

- Professionally-Managed Units: one of two or more short-term rental units that are located in the same city or town, with the same operator. The property is not within a single-family, 2-family or 3-family dwelling that includes the operator’s primary residence. A short-term rental unit may be considered professionally managed for this purpose whether or not an intermediary is involved.

- By separate vote, cities and towns may choose to include 2-family and 3-family dwellings that include the operator’s primary residence.

Collecting the 2.75% Cape Cod & Island Water Protection Fund Excise on hotel rooms in Barnstable County booked prior to January 1, 2019 for occupancy on July 1, 2019 or after

For traditional lodgings (bed and breakfast establishment, hotel, lodging house or motel) the date of booking is not important. All taxes and fees that are effective on July 1 must be collected for occupancies on or after July 1, including the Cape and Island Water Protection Fund Excise.

Planning for changes in local excise rates

Generally, the tax rates in effect at the time of occupancy apply to all rentals subject to room occupancy excise. Operators may want to include provisions in lease contracts stating that all state and local taxes and fees are as of the date of occupancy so occupants will be prepared for possible increases due to rate or fee changes after a contract is signed. You can find more information about how to report and remit amounts collected in response to local rate changes in the regulation.

Definitions

Bed and breakfast

A bed and breakfast establishment is a private owner-occupied house where 4 or more rooms are rented, a breakfast is included in the rent and all accommodations are reserved in advance. A bed and breakfast establishment, as defined above, requires registration with DOR.

A bed and breakfast home is defined as a private owner-occupied house where not more than 3 rooms are rented, a breakfast is included in the rent and all accommodations are reserved in advance. A bed and breakfast home is not subject to tax. Registration with DOR is not required.

Intermediary or Operator’s Agent

An intermediary is anyone besides an operator who helps to arrange a property rental for an operator and collects rent. An intermediary can arrange a property rental and collect rent for any operator whether they operate a bed and breakfast establishment, hotel, lodging house, short-term rental or motel.

An intermediary includes a broker, hosting platform, or operator’s agent.

An operator’s agent is anyone who manages a property for rent or books reservations of a property for rent. An operator’s agent includes a property manager, property management company, or real estate agent.

Lodging house or establishment

A lodging house or establishment is where lodgings are rented to four or more persons unrelated to the operator.

Operator

An operator is anyone operating a bed and breakfast establishment, hotel, lodging house, short-term rental or motel. An operator can be an owner, lessee, sublessee, holder of a mortgage, licensee, or anyone else operating a short-term rental. An operator does not have to be a resident of Massachusetts or a Massachusetts-based business for the room occupancy rental rules to apply.

Rental contract

A rental contract is an agreement by an operator, intermediary or operator’s agent to rent a property to an occupant for a certain time period. The rental contract must create a binding obligation between the operator, intermediary or operator’s agent and the occupant.

Rent subject to tax

For all types of rentals, as of July 1, 2019, the total amount of rent that is subject to tax includes all amounts collected by an operator or intermediary from an occupant, in exchange for occupancy. The term “rent” includes all optional charges, including but not limited to insurance, linen fees, cleaning fees, and booking fees. Specifically excluded from rent are:

- Bona fide refundable security deposits

- Amounts paid by an occupant that were previously reported by the operator as taxable gross receipts for sales or use tax purposes

- Amounts paid by an occupant for services offered by the operator on similar terms to non-occupants in the regular course of the operator’s business.

Short-term rental

A short-term rental is an occupied property that is not a hotel, motel, lodging house or bed and breakfast establishment, where at least one room or unit is rented out by an operator through the use of advance reservations. A short-term rental includes an apartment, house, cottage, and condominium. It does not include property that is rented out through tenancies at will or month-to-month leases. It also does not include time-share property or bed and breakfast homes (see definition of bed and breakfast).

Video: Short-Term Rental Law Video

Skip this video Short-Term Rental Law Video.Registration and Certificate General Information

All operators must register with DOR and obtain a Certificate of Registration for each property they offer for rent. The Certificate of Registration must be posted in the property and a copy of the Certificate (or the Certificate number) must be given to any intermediary used by the operator.

For the intermediary, the Certificate of Registration is proof that the operator has registered with DOR. Without it, DOR may ask the intermediary to remove the property from their listings. For tax returns filed by either an operator or an intermediary, the Certificate number ensures that the taxes collected are distributed to the proper localities or special funds.

Operator Registration

Register as an operator

All operators, including those who only rent their property through an intermediary, must register with DOR using MassTaxConnect. Note that operators who already use MassTaxConnect do not need to re-register. They will log in under their existing username and password and add the Room Occupancy Consolidated account type. Operators will enter a list of their properties and receive a registration certificate for each one.

Registering with your city or town

Operators should be aware that cities and towns may have separate registration or licensing requirements. Check with local officials in the city or town in which the property is located to find out more.

Registering property on MassTaxConnect if you don’t have a business

If there is no separate legal entity that owns the property (a partnership, trust, LLC, etc.) then you would register as an individual. Take the following steps:

If you already have an account on MassTaxConnect:

- Log in to MassTaxConnect

- Select the More…tab.

- Select Add an Account, New Location, or New License to register for the Room Occupancy Consolidated tax type.

- Select Room Occupancy Consolidated (for activity for July 2019 and after).

If you do not have a MassTaxConnect account:

- Go to MassTaxConnect.

- Choose Sign Up.

- Choose Create My Logon.

- Select “I am an individual who has previously filed taxes in the state of Massachusetts.”

- Choose Social Security Number as ID type, enter the number, select “Personal Income Tax” as the account type and proceed with the verification process.

- — You will be asked to provide one of the following:

- A tax return amount OR

- A tax refund amount from one of your past three Personal Income Tax returns.

- — The amount must be greater than $0. If you can’t provide a tax return or refund amount, call the Trustee Tax Contact Center at (617) 887-6367 (choose #3 for Business tax, then #2 for Trustee Tax when prompted).

- Once you have set up your account password:

- Select the More…tab.

- Select Add an Account, New Location, or New License to register for the Room Occupancy Consolidated tax type.

Registering when you own a short-term rental with someone else

Only one owner per property can register as an operator. The owner who registers as the operator will file returns and remit the tax to the Department if the owners are collecting rent directly. Although only one owner can register, file returns and remit tax, each owner remains responsible for ensuring that the proper amount of tax is collected and remitted.

Registering and collecting tax for a property that is rented for only a few days a year as a short-term rental

No matter how many days your property is available for rent each year, you must register with DOR using MassTaxConnect. However, if the property is rented for 14 days or less in a calendar year, you are not required to collect any tax. If that exception applies to you, you must let us know at the time of registration that you will not be renting out your property for more than 14 days. The 14-day-exception is determined on a per-property basis every year. The deadline for claiming the exemption for each calendar year is January 15 of the year claiming the exemption.

If during the calendar year, you exceed 14 days of rentals, you will be responsible for paying the taxes that should have been collected for the first 14 days.

Renewing a 14-day rental exemption:

The exemption renewal process must be completed no later than January 15 of the calendar year claiming the exemption. To renew:

- Log in to MassTaxConnect.

- Select the Room Occupancy Consolidated Account.

- Select Property List.

- Select Manage next to a property that qualifies for the exemption.

- Select Renew then Next.

- Select Submit to claim your exemption.

Provide an intermediary with your registration information

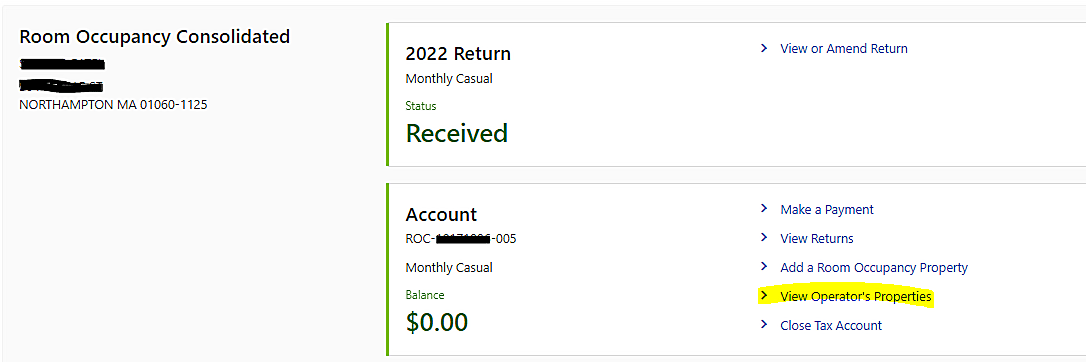

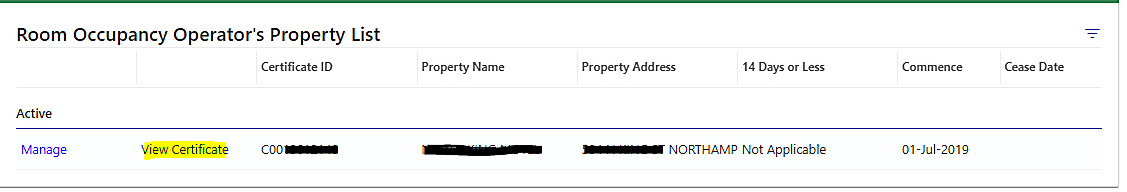

If you use an intermediary to rent your property, you must provide them with your registration certificate information. You will find your certificate number after registering by logging into your MassTaxConnect account, selecting View Operator’s Properties from the Room Occupancy Consolidated tax type and choosing the View Certificate hyperlink. Do not use your ROC account number. See below.

Registration for operators with short-term rental properties that are rented for more than 31 days

Although room occupancy excise applies only to short-term rentals of property for 31 days or less, we recommend that all operators register, even those with short-term rental properties that are always rented for periods of more than 31 days. While registration is not required under these circumstances, operators will then be in compliance in the event their short-term rental property is rented for a period of 31 days or less. Operators may find that intermediaries require registration information regardless of the term of the short-term rental.

Intermediary or Operator's Agent Registration

Register as an intermediary or operator’s agent

An intermediary or operator’s agent must register with DOR using MassTaxConnect. Note that intermediaries who already use MassTaxConnect do not need to re-register. Instead, intermediaries will log in under the existing username and password and add the Room Occupancy Consolidated account type. Intermediaries will register just once. There’s no need to register separately for each rental property.

Registering and filing returns as a real estate agent

Generally, a real estate agent works for a real estate brokerage or company and any rent associated with a listing by a real estate agent is collected by the company. In such cases, it is the responsibility of the company to register as an intermediary and file returns on behalf of its agents for all the properties that any of its agents list for rent. Individual agents only need to register and file returns if they are independent agents not affiliated with any company and collect rent directly.

Registering as an intermediary or operator’s agent if you have multiple clients who are operators

You will only need to register one time. When you file your monthly tax return, you will list each property and the rent collected for that property.

Confirming operator registration as an intermediary

As an intermediary, you must confirm that the operator whose rent you are collecting has registered with the Department of Revenue through MassTaxConnect. Include the operator’s registration certificate number on your return. If you are unable to get the operator’s certificate number, you will need to include the operator’s Federal ID number or Social Security number on your return. If the operator does not provide this identifying information, you may not allow the operator to list their rental property with you.

Exemptions

Although operators have until January 15 to claim or renew a 14-day rental exemption for the calendar year, if the operator does not claim the exemption by that date for a property, it will be the responsibility of the intermediary or operator’s agent to collect sales tax on that rental as of January 1.

Aside from the limits on the length of a rental (90 days or less for traditional lodgings, 31 days or less for short-term rentals), there are a number of other exemptions to the excise. You will find more information on these exemptions in the regulation.

Returns and Payments

Requirement for filing returns and paying taxes and fees to DOR

Generally, all operators are required to collect taxes and fees from the occupant when they collect rent and remit these amounts to DOR. An operator may enter into an agreement with an intermediary to collect rent. An intermediary who collects the rent is also responsible for collecting and remitting the related taxes and fees. Operators do not report or pay taxes and fees on rent amounts collected by an intermediary.

Return and payment due dates

Room occupancy returns are due monthly on or before the 30th day following the month represented by the return. The state excise and any local option excise, including the Convention Center Financing fee, the new Cape Cod and Islands Water Protection Fund excise, and any community impact fee are to be paid with the return. For more information, go to DOR's Tax Due Dates page.

New! Advance payment requirements for Room Occupancy Excise

Beginning April 2021, a provision in the FY21 budget requires that taxpayers with over $150,000 in cumulative tax liability in the prior year will be required to make advance payments. To learn more, visit New Advance Payment Requirement for Vendors and Operators in G.L. c. 62C, § 16B.

Filing returns and making payments as an operator

Returns and payments are submitted to DOR through MassTaxConnect.

There are two options. You can enter information for one property or you can upload a consolidated return for multiple properties using Excel. An Excel template is available for uploading through MassTaxConnect with all the appropriate cells in the appropriate order. If you choose to attach your own spreadsheet, the cells must be in the same order as the template.

See the video tutorials for how to file and pay and how to upload a spreadsheet.

Filing returns as a short-term rental operator who does not rent every month

A return is only required to be filed for a month that tax is due. If no tax is due, no return is required to be filed.

Filing returns and making payments as an intermediary

Returns and payments are submitted to DOR through MassTaxConnect.

There are two options. You can enter information for one property or you can upload a consolidated return for multiple properties using Excel. An Excel template is available for uploading through MassTaxConnect with all the appropriate cells in the appropriate order. If you choose to attach your own spreadsheet, the cells must be in the same order as the template.

As an intermediary, the return must include each operator’s registration certificate number or Federal ID [or Social Security Number], along with the name and address of the operator and the amount of taxes and fees collected. The certificate number ensures that the taxes collected are distributed to the proper localities or special funds.

See video tutorials for how to file and pay and how to upload a spreadsheet.

Reporting exempt rent on a return

Exempt rents should generally be included in line 1, total rent, but not included in line 2, taxable rent. Operators should only report rents they collected directly. Rents collected and reported by an intermediary are not considered exempt rents for the operator.

Reporting exempt rent from short-term rental contracts entered into before January 1, 2019

When you file your room occupancy consolidated tax return, include all rents in line 1, total rent. On line 2, taxable rent, do not include exempt rent from pre-January 1, 2019 contracts.

Record Keeping and Other Responsibilities

Keeping records as an operator

An operator is required to keep records relating to charges and receipts for all transfers of occupancy, as well as copies of returns filed. You can find more information on specific records to be kept by reviewing the Record Retention Regulation.

Responsibilities other than filing returns and paying taxes for intermediaries

Like operators, intermediaries are required to keep records related to amounts collected and provide those records to the Department upon request. Intermediaries must also make sure the operator they are working for is registered with the Department before collecting any rent from the occupant. It is the responsibility of the intermediary to notify the operator of its responsibility to comply with all applicable municipal, state and federal laws.

Intermediaries are also required to provide a notice to operators within 30 days of filing a return with DOR that details the amount of rent collected with each occupancy as well as the taxes and fees they have collected and remitted to the Department.

For Municipal Officials

The Division of Local Services has compiled Frequently Asked Questions (FAQs) to explain the changes for municipal governments.

You can find information about local rules, including whether a city or town is a member of the Cape Cod and Islands.

Contact

Phone

9 a.m.–4 p.m., Monday through Friday