Overview

You may be able to claim the child and family credit on your Massachusetts personal income tax return if you're taking care of a:

- Child

- Dependent or spouse with a disability, or

- Dependent age 65 or over.

You may claim this credit if you are a:

- Single taxpayer

- Taxpayer filing as head of household

- Married taxpayer filing jointly.

Married taxpayers filing separate returns do not qualify for this credit.

Qualifying Individuals

When filing your Form 1 or Form 1-NR/PY return, you may be eligible to claim the child and family credit if your household has any of the following individuals at the end of the tax year

- A dependent child under age 13;

- A disabled dependent or spouse; and/or

- A dependent age 65 or over. The dependent cannot be you or your spouse at the end of the tax year.

A dependent or spouse with a disability is an individual who is physically or mentally incapable of caring for himself or herself and who principally lives with the taxpayer for more than one-half of the taxable year.

Starting with tax years beginning on or after January 1, 2024, a noncustodial parent may claim the credit with respect to a child dependent that is age 13 or older and who is physically or mentally incapable of caring for himself or herself.

There is no limit to the number of individuals for which a taxpayer can claim a credit. This means that for the 2023 tax year, the credit is $310 for each individual for which a taxpayer can claim a credit. For the 2024 tax year and thereafter, the credit is $440 for each eligible individual for which a taxpayer can claim a credit.

To Claim the Credit on Your Tax Return

Residents

- Enter the number of dependent children under age 13, dependents age 65 or over (as of December 31, 2025), and disabled dependents or spouse on Form 1, Line 46a.

- Multiply Line 46a by $440.

- Enter the total on Form 1, Line 46.

Part-year Residents

- Enter the number of dependent children under age 13, dependents age 65 or over (as of December 31, 2025), and disabled dependents or spouse on Form 1-NR/PY, Line 50a.

- Multiply Line 50a by $440.

- Enter the result on Form 1-NR/PY, Line 50b.

- Multiply Line 50b by Line 3.

- Enter the result on Form 1-NR/PY, Line 50.

Nonresidents

You cannot claim this credit if you are a nonresident taxpayer for the entire taxable year.

SSN/ITIN Not Available for Qualifying Individual(s)

Starting with tax year 2023, a Massachusetts taxpayer may claim the Child and Family Tax Credit for one or more qualifying individuals that do not have a Social Security number (SSN) or an Individual Taxpayer Identification number (ITIN). To do so, the taxpayer must file a return using a Massachusetts Alternative Taxpayer Identification number (MATIN) for the qualifying individual. Note that the taxpayer must still have an SSN or ITIN.

Instructions for Requesting a MATIN:

- Do not e-file your return, it must be mailed in paper form.

- Complete a Massachusetts Resident Income Tax Return (if an amended return, check the appropriate box).

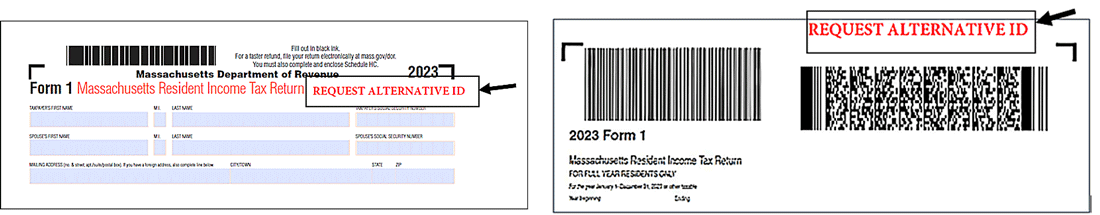

- Once completed and printed, write REQUEST ALTERNATIVE ID on the top right corner of the form (see images below). Note: Do not write over the bar codes. This will cause delays in the processing of the return.

- Provide a letter with the return with the information below for each qualifying individual requiring a MATIN:

- The name, address, and date of birth of the individual

- An explanation of why the individual is a qualifying individual for purposes of the Child and Family Tax Credit. (see “Qualifying Individual” section above).

- Provide copies (do not send originals) of two of the following valid (not expired) documents for each qualifying individual requiring a MATIN:

- Civil birth certificate(s), including foreign birth certificates

- Foreign passports or US visa

- National identification card (with name, photo, address, date of birth, and expiration date)

- U.S. Citizenship and Immigration Services (USCIS) photo identification

- Massachusetts medical records

- Massachusetts school records

- Documents related to custody and/or guardianship

- Military or government-issued photo identification.

- Mail the completed, signed tax return, with REQUEST ALTERNATIVE ID written on the top of the form, and copies of the required documentation to:

Department of Revenue

Revenue Refund Unit

PO Box 7026

Boston, MA 02204-7026

- Please note, you may receive a Request for Information requesting additional verification in relation to the qualifying individual. Also, if you or your spouse are a first-time filer, you may be required to verify your identity.

- Once the qualifying individual is verified, the return will be processed with the MATIN and you will be issued a notice with the MATIN by mail to your address of record. Please retain this notice for your records as it will not appear on your account.

Resources

Additional Resources

Contact

Phone

9 a.m.–4 p.m., Monday through Friday