Creating a leave administrator account

- Go here to create a leave administrator account.

- When prompted to enter an email address, you should use your work email address; do not use a personal email address for your leave administrator account.

- PFML uses MyMassGov. When you set up your PFML account through MyMassGov, you will need to set up multi-factor authentication (MFA). Visit the MyMassGov website for details on account creation, including troubleshooting tips and frequently asked questions.

Following a successful confirmation, you can log in to your employer account with the email and password you provided. Once you’re signed in, you can confirm access to your organization. If another leave administrator already added you, you will be able to see that organization listed on the Organizations page. If your organization is not listed there, it will need to be added to your account. Learn how to add an organization.

Get added as a leave administrator

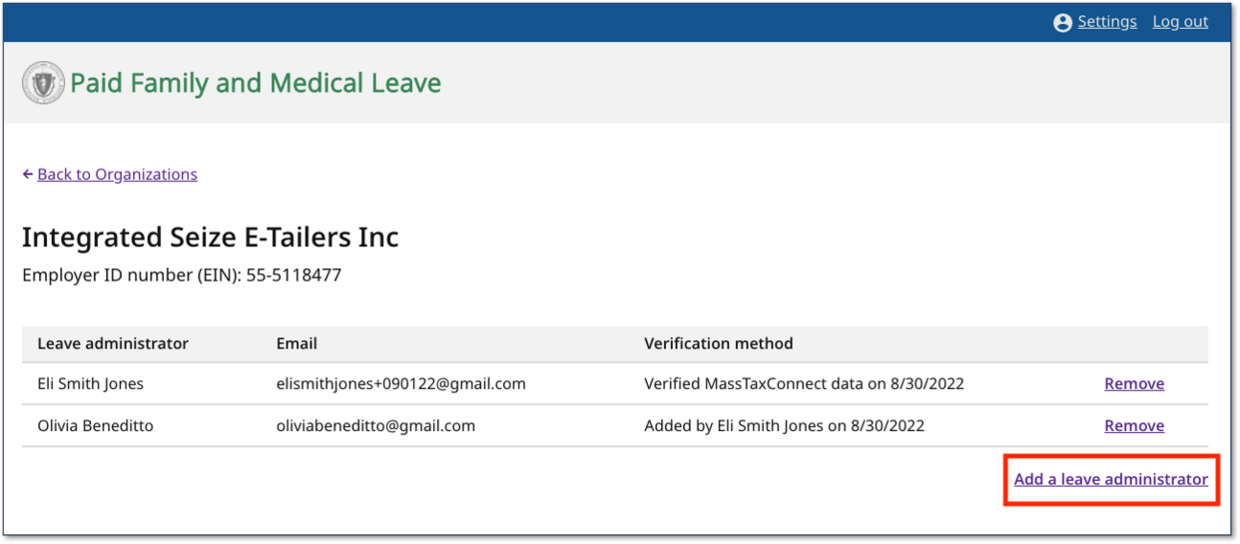

If you are not verified yet, the easiest way to get access to an organization is to ask an existing leave administrator to add you.

If your organization does not have any leave administrators, or if you need to add yourself, you can use information from your MassTaxConnect account or work with the person who manages that account to complete the process.

Verify your access to an organization with Paid Leave Contributions

How to verify access using paid leave contributions:

- Log in to MassTaxConnect to get contribution information from the most recent period for which the employer has filed. This data will allow you to access your organization as a leave administrator.

- If you’re not the tax administrator registered to manage the employer’s MassTaxConnect account, ask them to complete steps 1-3 for you to get the data you need. Then proceed to step 4.

- On the Summary page, scroll down to the Paid Family and Medical Leave section on the left. In the Account portion, select Returns.

- Make note of the amount that the leave administrator will use to verify access:

- If the employer has sent contributions, make note of the amount for the most recent period for which a return has been received.

- Log in to your PMFL leave administrator account.

- Go the Organizations page

- Click the Add organization button and enter the EIN.

- If you previously entered the EIN, the organization may already be listed on the Organizations page with Verification required next to it. If so, click the name of the organization instead.

- Enter the amount from step 3 in the Paid Leave Contributions field.

- After successfully verifying your access, you should see the organization listed on the Organizations page and you will be able to use the leave administrator dashboard to review applications..

Verify your access to an organization with PFML account ID

Leave Administrators will be guided to this verification option if their organization is eligible.

How to verify access using MassTaxConnect PFML account ID

- Log in to MassTaxConnect to get the account ID.

- If you’re not the tax administrator registered to manage the employer’s MassTaxConnect account, ask them to complete steps 1-3 for you to get the information you need to access your organization as a leave administrator. Once you have the required information, go to step 4.

- From the Summary tab, scroll down to locate the Paid Family and Medical Leave panel.

- Under Account, you will see an account ID beginning with the letters PFM followed by numbers (example: PFM-xxxxxxxx-xxx). This will be used to verify access. Make note and proceed to step 4.

- Log in to your PMFL leave administrator account.

- Go the Organizations page.

- Click the Add organization button and enter the EIN.

- If you previously entered the EIN, the organization may already be listed on the Organizations page with Verification required next to it. If so, click the name of the organization instead.

- Enter the account ID number acquired in step 3 in the MassTaxConnect PFML account ID field.

After successfully verifying your access, you should see the organization listed on the Organizations page and you will be able to use the leave administrator dashboard to review applications.

Contact

Phone

Department of Family and Medical Leave - Hours of operation: Monday-Friday, 8 a.m. - 4:30 p.m.

Department of Family and Medical Leave - Hours of operation: Monday-Friday, 8 a.m. - 4:30 p.m.

Department of Revenue - Hours of operation: Monday-Friday, 8:30 a.m. - 4:30 p.m.