Qualifying for reimbursement

Your organization may be eligible for reimbursement of benefits paid to your employees on or after January 1, 2021 if you offer a paid temporary disability, family, or medical leave policy, or an extended illness leave bank, that provides equal or more generous benefits than those provided under the PFML law.

In addition, your organization:

-

Must not be exempt under the law

-

Must not have been approved for an exemption for the same type of benefits by the Department of Family and Medical Leave (the Department)

In order to qualify for and receive reimbursement, you and your employees must also follow this process:

-

An employee must first apply for and establish eligibility for PFML benefits with the Department.

-

A completed application for benefits must be filed within 90 calendar days of the start of their leave or it will be denied by the Department. If the employee is ineligible for other reasons, they will be denied by the Department. If an employee is denied, employer reimbursement requests will also be denied.

-

Employees are provided the opportunity to appeal the denial decision. In the absence of a successful appeal filed by the employee, the employer reimbursement request will be denied.

-

-

A leave administrator must create and verify an accountwith the Department.

-

A leave administrator from your organization will be notified that the application is ready for review, if an employee’s application meets the eligibility criteria.

-

When reviewing the employee’s application, the leave administrator must report any paid or anticipated reimbursement payments as other income received by the employee. Failure to do so (so that DFML pays the employee) will result in an overpayment. If this occurs, no reimbursement will be issued and the organization will be liable for repayment to DFML for failure to provide this information.

-

The leave administrator should then request reimbursement through a link on the dashboard (see “How to” below). Before requesting reimbursement, make sure the payments made to the employee are eligible.

-

The leave administrator should also indicate in the open text field of the review page that they are pursuing reimbursement so the Department does not act on the application.

-

Payments eligible for reimbursement

An employer may seek reimbursement from the Department if:

-

Payments come from an employer’s temporary disability policy, or paid family or medical leave policy, if it is a self-insured plan funded by the employer for purposes of benefit payments or

-

Payments are made from an extended illness leave bank

Payments not eligible for reimbursement

An employer may NOT seek reimbursement from the Department if:

-

The Department made payments to your employee for the same period of time for which you are submitting a reimbursement application

-

The payments are for an employee’s earned time, including PTO, sick, and vacation time

-

The benefits are paid through an exempted self-insured or fully-insured plan

How to request a reimbursement

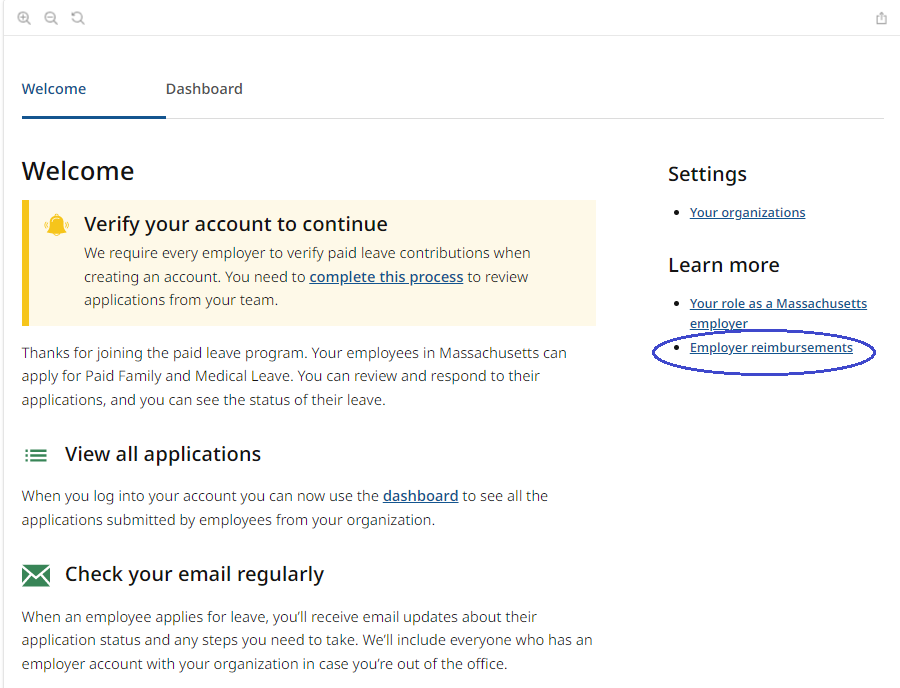

To request reimbursement, a leave administrator for your organization should log in to PaidLeave.mass.gov where they will find a link to a form to request reimbursement. The Department cannot accept a request for reimbursement from any business or organization that does not have a leave administrator contact set up with the Department.

To complete the reimbursement form, the leave administrator needs to provide:

-

The name of the business or organization to be reimbursed

-

The organization’s FEIN

-

Contact information for the leave administrator filling out the application

-

A copy of the business or organization’s paid leave plan

-

The employee’s PFML application ID number

-

The name of the entity that sent or will send payment to the employee in connection with the claim

-

Proof of the number and amount of payments to the employee

-

The dates and amounts of each payment

-

The qualifying reason (See 458 CMR 2.00) for the leave

-

The dates of leave approved by the employer

-

If reimbursement is approved, who within the organization should receive reimbursement payments

-

The mailing address where payment should be sent

The leave administrator also must provide confirmation that the business or organization’s paid leave plan:

-

Is self-insured and fully funded by the employer and not funded by an external insurer

-

Is paid separately from any of your employees' earned accrued time, not including an extended illness leave bank

-

Allows employees to use other accrued time, such as sick leave, to supplement this plan

-

Allows employees to use the plan only for one of PFML’s qualifying reasons

-

Provides that leave will run concurrently with the leave period provided in M.G.L. c. 175M

-

Affords employees job protection provided in 458 CMR 2.16

Employers will also need to agree to the terms and conditions involving the request for reimbursement payments.

Please allow up to 30 days following reimbursement approval for the Department to issue payment. All reimbursement payments will be sent via check.

Appealing a reimbursement decision

Your organization has the right to appeal DFML's decision. To exercise this right, you must file an appeal within 10 calendar days of receiving notification of the decision. If you do not submit a timely appeal, you waive your right to do so.

To appeal a reimbursement decision, fill out our form.

Once you file your appeal, you will have a right to a hearing. The hearing will be conducted according to the Standard Rules of Practice and Procedure, as found in M.G.L Ch30A and 801 CMR 1.02 (Informal/ Fair Hearing Rules).

Contact

Phone

Department of Family and Medical Leave - Hours of operation: Monday-Friday, 8 a.m. - 4:30 p.m.

Department of Family and Medical Leave - Hours of operation: Monday-Friday, 8 a.m. - 4:30 p.m.

Department of Revenue - Hours of operation: Monday-Friday, 8:30 a.m. - 4:30 p.m.

| Date published: | August 1, 2022 |

|---|