Downloads

Twice per year (Jan 1 and July 1), we create a zip file that has all vintages of parcel data for every municipality available as shapefiles or FGDB. The current files were created on January 1, 2026. We're always interested in how this aggregate data is used. Please share any studies or research results with us at massgismail@mass.gov

View the data

Various Applications for Viewing Parcel Data

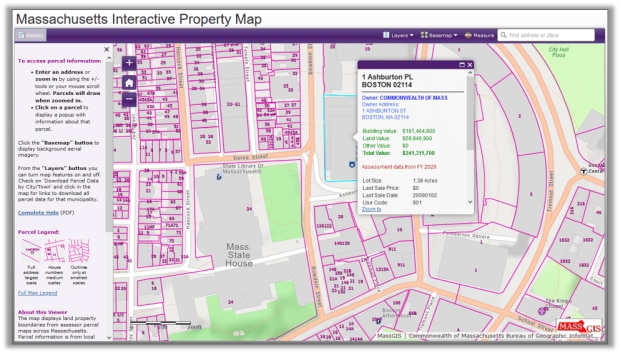

Massachusetts Interactive Property Map

View seamless property information across the Commonwealth. Our most popular online map is used by developers, banks, realtors, businesses, and homeowners to search for and view many characteristics of parcels statewide. You can also download an entire city/town's parcel data.

Open the MA Interactive Property map

Also available: an accessible, non-map-based Property Information Finder

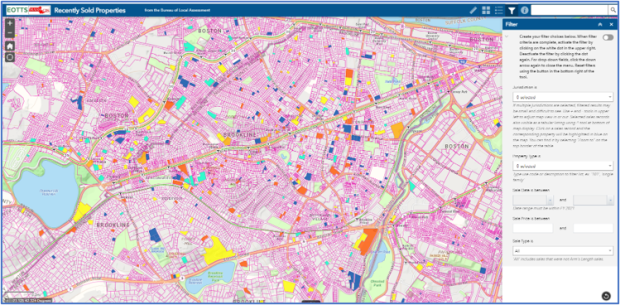

Statewide Property Sales Viewer

Map real estate sales assembled by the Bureau of Local Assessment. Search by property type, range of sale date or price, and more. Downloadable results appear color-coded based on their assessment-to-sale ratio. The source is the annual "LA3" sales reports provided by municipal assessors.

Open the Statewide Property Sales map

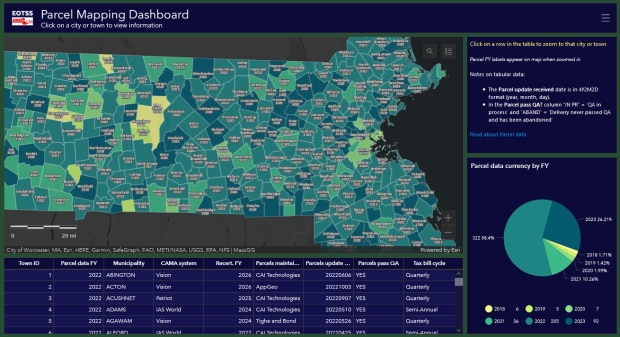

Parcel Mapping Dashboard

This Dashboard displays parcel status information by city and town in a map, table and pie chart.

Click on the map to view information about that municipality. Click on a row in the table to zoom to that city or town. The pie chart displays the fiscal year currency of parcel data updates.

Open the Parcel Mapping Dashboard

Web services

Overview

The data were developed through a competitive procurement funded by MassGIS. Each community in the Commonwealth was bid on by one or more vendors and the unit of work awarded was a city or town The specification for this work was Level 3 of the MassGIS Digital Parcel Standard.

As of July 24, 2020, with the addition of data for Boston, standardization of assessor parcel mapping has been completed for all of Massachusetts' 351 cities and towns.

MassGIS is continuing the project, updating parcel data provided by municipalities. See the L3 Parcel Fiscal Year Status Map.

MassGIS has assembled information and resources for those interested in maintaining standardized parcel mapping.

This layer replaces the legacy Level 0 and Level II parcels.

Digital Parcel Standard

The standard establishes requirements for how parcel boundaries are compiled. It also requires creating a few attributes in the TaxPar and OthLeg feature class polygons that are unique to the standard. In addition, the standard requires that a minimum selection of information from the assessor's database be included in a separate database table that can be linked to the parcel polygons. Finally, the standard establishes very high percentage requirements for what percentage of parcels link to an assessor tax list record and vice versa.

One of the primary objectives in developing the digital parcel standard was revising the data model to eliminate situations in which one tax listing links to more than one polygon on the assessor’s map. Sustaining this approach will, ultimately, depend on embedding a unique parcel identifier from the standard (the LOC_ID attribute) directly in the assessor tax list database. Conversations with the four primary assessing database software vendors in Massachusetts indicate that embedding the LOC_ID in this manner can be accommodated in their existing database structures. It always has been necessary to link multiple tax listings with one polygon (the most common example being condominiums), and the standard continues to model that relationship.

The standard calls for data stored in an ESRI file geodatabase (FGDB) with three feature classes, a database table, and two look-up tables. These are all briefly described below and full details can be found in the standard. The components of the FGDB are:

TaxPar Feature Class (“tax” parcels) – this feature class comprises polygons or multi-part polygons, each of which links to one or more assessor tax records (unless it is a feature for which a tax record has not been established, i.e. public right-of-way, most water, etc…). In situations where two or more contiguous parcels have common ownership, the internal boundaries of these parcels have been removed, creating a single polygon corresponding to the tax listing that it represents. Where two or more non-contiguous parcel polygons share common ownership, they have been converted to a multi-part polygon; each multi-part polygon links to one or more assessor tax listings.

OthLeg Feature Class - this feature class contains polygons representing other legal interests in land. These other legal interests include representations of the “fee simple” property parcels that comprise the combined parcel polygons described above in the TaxPar feature class. In addition, other legal interests in this feature class include various types of easements.

Misc Feature Class– this feature class contains map features from the assessor parcel maps needed to produce that tax map with the content that the assessor is used to seeing, such as water, wetlands, traffic islands, etc.

Assess Database Table – this is a standard extract from the assessor database containing about 25 elements including property valuation, site address, state use code, owner, owner address, and a selection of information about the structure. This table includes the FY (fiscal year) field, which stores the vintage of the assessed value of the parcel.

LUT Look Up Table – this is a look-up table for the MISC_TYPE attribute of the Misc feature class and the LEGAL_TYPE attribute of the OthLeg feature class.

UC_LUT Look Up Table – this is a look-up table for state use codes found in the assessing extract.

In ArcSDE, MassGIS stores the components of this data layer as follows:

- TaxPar feature class: L3_TAXPAR_POLY

- OthLeg feature class: L3_OTHLEG_POLY

- Misc feature class: L3_MISC_POLY

- The assessor data extract: L3_ASSESS

- The two look-up tables are L3_LUT and L3_UC_LUT

- A relationship class has been built to link the TaxPar feature class polygons to the assessing extract database table, named L3_TAXPAR_POLY_RC_ASSESS.

- A spatial view (L3_TAXPAR_POLY_ASSESS_SV) was created that links the assessor records to the the TAXPAR polygons. An export of this view, L3_TAXPAR_POLY_ASSESS, includes "stacked" polygons for features that link to multiple assessor records (such as condominiums); it contains all parcel polygons, except road and rail rights-of-way and water bodies, even if they do not have associated ASSESS records, and is used in Municipal Mapper and the Tax Parcels cached basemap tileset

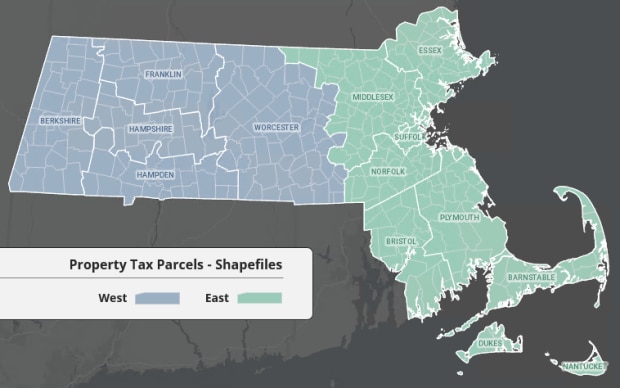

- The view export is also used for downloadable statewide shapefiles. As of 12/14/2021, these shapefiles have been split into eastern and western sections, as a single shapefile exceeds the 2GB file size limits. If you (in ArcGIS) add the layer (lyr) file included with the download, the data should draw without any need for you to account for the east/west files. However, if your workflow is to add the .shp file and you are working across the state, you’ll need to add both the east and west .shp files. The files are divided as shown in the index map image above right.

- Level 3 Parcel FTP Links, named L3_PARCEL_FTP_LINKS, stores URLs for each municipality's shapefile and file geodatabase downloads, plus the fiscal year of assessor updates and any notes regarding compliance with the standard. The source of the fiscal year column is the feature class L3_TOWNFY (this is exported from the spatial view L3_TOWNFY_SV, defined to use the view L3_TOWNFY_V and Municipalities; L3_TOWNFY_V is based on the distinct FY from L3_ASSESS).

Complying with the Standard

Important Notices

Assessor’s parcel mapping is a representation of property boundaries, not an authoritative source. The authoritative record of property boundaries is recorded at the registries of deeds and a legally authoritative map of property boundaries can only be produced by a professional land surveyor.

Representation of Parcel Boundaries - Users of parcel data, which MassGIS has approved as meeting the requirements of its standard, may find places where the boundaries conflict with visible features on orthoimagery. This is common and reflects a variety of circumstances. Often the discrepancy between the tax map and the visible road right-of-way on the orthoimagery base map is correct, as roads are not always constructed the way they were shown on the original plan. Other factors accounting for discrepancies between the boundaries and visible features on the orthoimagery are buildings that may “lean” in the imagery because of camera angle, making them appear as if they are crossing parcel lot lines. Also, while rights-of-way ordinarily have a standard width, that is not always true. In fact, we have seen countless instances where right-of-way widths are irregular. Similarly, the fence, wall, or shrub line visible on the orthoimagery is not necessarily the property boundary. In some cases, houses are built so that they straddle lot lines. Also, while MassGIS' quality assurance process is extensive and rigorous, it is not perfect and it is possible that we have missed some boundary compilation or other errors.

Municipal Boundaries - The standard requires that MassGIS’ representation of the official municipal boundaries be incorporated into the standardized assessor mapping. Checking for that is part of our QA process. However, there are discrepancies between municipalities where they share a boundary that follows a stream channel; without engaging the services of a surveyor, there is no way to determine where those boundaries are and we did not require that MassGIS’ mapping of that boundary supersede the boundary from the tax mapping. Also, MassGIS has allowed communities to represent the coastline as it is in their tax mapping. Finally, this requirement from the standard uncovered numerous discrepancies in municipal boundary lines that will require further discussion with the communities involved. Known outstanding boundary discrepancies include portions of the boundaries between the following communities: Andover-Lawrence, Lawrence-Methuen, Cohasset-Scituate, Attleboro-Rehoboth, Avon-Stoughton; Easton-Stoughton, and Dracut-Methuen.

Assessing Data Extract - The assessing data extract is an “as is” copy of the records maintained by each assessor. There are errors and discrepancies.

Assessing Data Match Rates - The standard sets very high requirements for the percentage of parcels that must match to an assessing record, as well as vice-versa. Full details are in the standard. However, these match rates were not always achievable. In some communities, assessors do not know who owns some properties. These are almost always small fragments of land with no structure or small lots in wetland or forested areas. The NO_MATCH attribute of the TaxPar feature class has been used to track these circumstances. Although much less common, there are also occasionally records from the assessing extract beyond the allowed percentage that do not match to a parcel polygon.

Production

For each community, vendors delivered an ESRI file geodatabase to MassGIS. MassGIS staff reviewed the parcel boundary mapping, identifying potential errors. Situations that were commonly called out in the boundary QA included lot lines running through structures, inconsistent right-of-way widths (unless the mapping was known to have been compiled from deeds and plans), discrepancies compared to visible features on the orthoimagery, and discrepancies relative to the official representation of the municipal boundaries maintained by MassGIS. Additional checks include: attribute names and domain values, consistency between “TAX” and “FEE” polygons included in the TaxPar and OthLeg feature classes, linking percentages from the parcel map polygons to the assessing data extract and vice versa, and review of situations where multiple tax records link to a single parcel and one or more of the tax records is not a condominium.

Attributes

Complete descriptions of the attributes for the Level 3 feature classes, database table, and the look-up tables are found in the parcel standard. Attribute table fields and domains (valid values) and selected definitions are listed here:

| Field Name | Type | Size | Valid Values | Null | Required |

|---|---|---|---|---|---|

| Tax Parcel Attributes | |||||

| MAP_PAR_ID | C | 26 | Parcel ID appearing on the original assessor's map | YES | |

| LOC_ID | C | 18 | M_<X>_<Y>(for meters), F_<X>_<Y> (for US Survey Feet) | YES | |

| POLY_TYPE | C | 15 | FEE, TAX, ROW, WATER, PRIV_ROW, RAIL_ROW | YES | |

| MAP_NO | C | 4 | Assessor's original map sheet number | ||

| SOURCE | C | 15 | ASSESS, SUBDIV, ROAD_LAYOUT, ANR, OTHER | NO | YES(1) |

| PLAN_ID | C | 40 | Identifying information for plan used to update the digital file | YES(1) | |

| LAST_EDIT | N | 8 | Format YYYYMMDD | ||

| BND_CHK | C | 2 | null value, CC, NR, OK | ||

| NO_MATCH | C | 1 | Y, N | NO | |

| TOWN_ID | N | 3 | MassGIS town identifier (1-351) | ||

| Other Legal Interests Attributes | |||||

| MAP_PAR_ID | C | 26 | Parcel ID appearing on the original assessor's map | YES | |

| LEGAL_TYPE | C | 15 | FEE, PRIV_ROW, RAIL_OVER, RAIL_ROW, ROW_OVER, EASE, CR, APR, CRX, APRX, OTHER | YES | |

| LS_BOOK | C | 16 | Registry of Deeds book for last sale | YES(1) | |

| LS_PAGE | C | 14 | Registry of Deeds page for last sale | YES(1) | |

| REG_ID | C | 15 | The equivalent to Registry of Deeds book and page information but for registered or probate land. | YES(2) | |

| TOWN_ID | N | 3 | MassGIS town identifier (1-351) | NO | YES |

| TAXPAR_ID | C | 18 | Populated where LEGAL_TYPE = 'FEE'. The values in TAXPAR_ID represent the LOC_ID values of the POLY_TYPE = 'TAX' parcel in the TaxPar layer that the OthLeg parcel is a constituent of. This should facilitate identifying the relationships between 'TAX' parcels in TaxPar and 'FEE' parcels in OthLeg. Please consult the Digital Parcel Standard for a better explanation of how these types of parcels correlate with each other. | ||

| Miscellaneous Features Attributes | |||||

| MISC_TYPE | C | 15 | WETLAND, ISLAND, TRAFFIC_ISLAND, WATER, OUTSIDE, BLDG | YES | |

| TOWN_ID | N | 3 | MassGIS town identifier (1-351) | NO | YES |

| Extract from Assessor | |||||

| PROP_ID | C | 30 | Unlike the items below, this attribute may not come directly from the assessor’s database. It may sometimes be constructed from information typically found in multiple columns in the assessor’s database (see definition for more information). It must be unique within the city or town | NO | YES |

| LOC_ID | C | 18 | M_<X>_<Y> (meters), F_<X>_<Y> (US Survey Feet); use to join to parcel polygons | NO | YES |

| BLDG_VAL | N | 9 | Current assessed value for the main building(s) on the property | YES | |

| LAND_VAL | N | 9 | Current assessed value for land | YES | |

| OTHER_VAL | N | 9 | Other structures or physical improvements that are separately valued | YES | |

| TOTAL_VAL | N | 9 | Current total assessed value for land and structures. Because some databases include other categories of valuation not included above, this may not represent the total of the fields above | YES | |

| FY | N | 4 | Fiscal year of assessed value formatted as YYYY (number, 4; cannot be null). | NO | YES |

| LOT_SIZE | N | 11 | Deed area in EITHER square feet OR acres, but not both, to two decimal places | YES | |

| LS_DATE | C | 8 | Last sale date formatted as YYYYMMDD | YES | |

| LS_PRICE | N | 9 | Last sale price | YES | |

| USE_CODE | C | 4 | Land use code as set by Dept. of Revenue | NO | YES |

| SITE_ADDR | C | 80 | This field will contain the complete original site address as listed in the tax record | YES | |

| ADDR_NUM | C | 12 | This field will contain address number information, either a single house number with suffix (e.g., 25, 103 ½ or 12A) or a range of numbers (e.g., 12-16 or 12A–12B). | YES(2) | |

| FULL_STR | C | 60 | This field will contain the full street name, which may be stored in separate fields in the assessor database. | YES(2) | |

| LOCATION | C | 60 | This is the place to put secondary location information. Frequently, descriptors such as “Side”, “South Side”, “Rear”, “Basement” as well as building and unit descriptors such as “#1” or “Unit A” are found in assessor data | YES(2) | |

| CITY | C | 25 | City or town where the property is located | YES | |

| ZIP | C | 10 | Zip code where the property is located, if available | YES | |

| OWNER1 | C | 80 | Name of first owner of record | YES | |

| OWN_ADDR | C | 80 | The complete owner mailing address, including the street number, name, etc. Where the tax bill is sent. | YES | |

| OWN_CITY | C | 25 | The city for the property owner’s address | YES | |

| OWN_STATE | C | 2 | For US addresses, the state where the property owner resides, using the postal service abbreviations for state | YES(3) | |

| OWN_ZIP | C | 10 | The zip code of the owner’s address | YES | |

| OWN_CO | C | 30 | The country where the owner lives | YES | |

| LS_BOOK | C | 16 | Last sale Registry of Deeds book | YES(1) | |

| LS_PAGE | C | 14 | Last sale Registry of Deeds page | YES(1) | |

| REG_ID | C | 15 | This is the equivalent to Registry of Deeds book and page information but for registered or probate land | YES(2) | |

| ZONING | C | 8 | This is the code to indicate the zoning district within which the property lies not including overlay zoning districts | YES | |

| YEAR_BUILT | N | 4 | format YYYY | YES | |

| BLD_AREA | N | 9 | Applies primarily to apartment buildings and commercial/industrial properties; assessor’s data is based on exterior building measurements. Building area may be recorded as gross square-feet, adjusted gross square-feet, or finished area. Basement area may or may not be included in finished area. Partial story-heights and attic areas may be treated differently by different CAMA systems. Gross area may include non-living areas such as porches and decks, or attached garages. | YES(2) | |

| UNITS | N | 4 | Number of living/dwelling units and also other units, for example, commercial condos and storage units in a warehouse. | YES(2) | |

| RES_AREA | N | 7 | Applies primarily to 1, 2 & 3 family dwellings based on exterior building measurements or residential condominiums based on deeded unit areas. Building area may be recorded as gross square-feet, adjusted gross square-feet, or finished area. Basement area may or may not be included in finished area. Partial story-heights and attic areas may be treated differently by different CAMA systems. Gross area may include non-living areas such as porches and decks or attached garages. | YES(2) | |

| STYLE | C | 20 | Code indicating style of structure (“colonial”, “ranch” etc.) | YES | |

| STORIES | C | 6 | This is not the wall height. Story height is typically recorded as a full story for each floor, except under roof-line floors, which are adjusted by factors ranging from 10% to 90% of a full story depending on roof slope and wall height; examples include one-half stories and attics. Note that in the Patriot AssessPro database, letters (e.g. A, H) may be assigned to indicate partial story heights. | YES | |

| NUM_ROOMS | N | 3 | Total room count as determined by the assessor; primarily applied to residential properties. | YES | |

| LOT_UNITS | C | 1 | S (sq. ft.) or A (acres) (Added by vendor, not from assessor database) | YES | |

| TOWN_ID | N | 3 | MassGIS town identifier (1-351), added by MassGIS | NO | YES |

| MA_PROP_ID | C | 60 | Unique identifier for ASSESS record, added by MassGIS | NO | YES |

- Only required if information is available

- Only required if information needed is available in the assessor's database

- Not required for owners with non-US addresses unless needed

Maintenance

MassGIS receives submissions from cities and towns weekly and when they pass our QA procedures they are are published in batches approximately once a month (see the Updates section below).

The fiscal year for each municipality is listed in the popup for each town in the download viewer and on the Parcel Fiscal Year Status Map.

MassGIS has assembled information and resources for those interested in learning more about maintaining standardized parcel mapping.

For questions or to submit municipal data for inclusion into this dataset please contact craig.austin@mass.gov.

Updates

December 2025 - 19 municipalities: Bellingham, Berkley, Bolton, Boxford, Bridgewater, Cambridge, Charlton, Lancaster, Leominster, Newton, Orleans, Peabody, Plymouth, Princeton, Sterling, Ware, West Brookfield, Whately, and Wrentham.

November 2025 - 23 municipalities: Conway, Florida, Goshen, Great Barrington, Halifax, Hamilton, Hawley, Heath, Hudson, Leicester, Lowell, Mashpee, Middlefield, Millville, Pittsfield, Plainfield, Scituate, Taunton, West Bridgewater, West Tisbury, Westfield, Weston, and Wilbraham.

October 2025 - 22 municipalities: Ashland, Berlin, Brewster, Canton, Cohasset, Dartmouth, Franklin, Gloucester, Hopedale, Lanesborough, Lynn, Monterey, Oxford, Palmer, Sheffield, Swansea, Topsfield, Truro, Tyringham, Wareham, Warren, and Wendell.

September 2025 - 31 municipalities: Amesbury, Andover, Chelsea, Chilmark, Clinton, Dedham, Essex, Grafton, Hardwick, Harvard, Kingston, Marshfield, Maynard, Nahant, New Braintree, New Salem, Orange, Otis, Paxton, Peru, Quincy, Rockland, Rockport, Russell, Sudbury, Sunderland, Swampscott, Townsend, West Boylston, Westwood, and Winchester.

August 2025 - 31 municipalities: Acushnet, Ashburnham, Ayer, Becket, Beverly, Blackstone, Blandford, Brockton, Chester, Concord, Duxbury, East Bridgewater, Erving, Everett, Hull, Ipswich, Lincoln, Natick, New Bedford, North Reading, Norwell, Norwood, Oak Bluffs, Oakham, Plymouth, Saugus, Seekonk, Shirley, Sturbridge, Westminster, and Whitman.

July 2025 - 25 municipalities: Ashby, Bernardston, Brookfield, Carver, Charlemont, East Longmeadow, Edgartown, Granville, Harwich, Holliston, Hubbardston, Lakeville, Littleton, Mattapoisett, Medway, Northbridge, Plympton, Randolph, Sharon, Stow, Tewksbury, Wakefield, Watertown, Wellfleet, and Weymouth.

June 2025 - 20 municipalities: Acton, Carlisle, Chesterfield, Dover, East Brookfield, Fitchburg, Florida, Hadley, Hingham, Manchester, Marlborough, New Marlborough, North Adams, North Attleborough, Norton, Rehoboth, Shelburne, Shutesbury, Wenham, and Williamsburg.

May 2025 - 26 municipalities: Arlington, Chicopee, Clarksburg, Dalton, Easton, Aquinnah, Hopkinton, Ludlow, Methuen, Middleborough, Millis, Monson, Norfolk, North Andover, North Brookfield, Northampton, Pembroke, Rowley, Southborough, Spencer, Stockbridge, Stoughton, Templeton, Tisbury, Walpole, and Worthington.

April 2025 - 35 municipalities: Adams, Agawam, Attleboro, Braintree, Burlington, Chelmsford, Cheshire, Dennis, Dudley, Granby, Holden, Lenox, Malden, Mansfield, Medford, Mendon, Milford, Milton, Monroe, Montague, Newburyport, Northfield, Petersham, Savoy, South Hadley, Southampton, Southwick, Sutton, Uxbridge (The previous FY2025 database has been replaced by the FY2024 version of the database as per request from the assessor due to unapproved valuations), Wales, West Brookfield, West Newbury, Westfield, Williamstown, and Windsor.

March 2025 - 20 municipalities: Alford, Ashfield, Athol, Auburn, Bourne, Colrain, Foxborough, Georgetown, Gill, Hatfield, Leverett, Longmeadow, Melrose, New Ashford, Newbury, Phillipston, Rowe, Upton, Uxbridge, and Warwick.

February 2025 - 17 municipalities: Abington, Brimfield, Douglas, Easthampton, Egremont, Fairhaven, Greenfield, Holland, Lee, Leominster, Lunenburg, Medfield, Rutland, Somerville, Springfield, Webster, and Westford.

January 2025 - 19 municipalities: Barnstable, Belchertown, Bellingham, Billerica, Bolton, Cummington, Deerfield, Freetown, Huntington, Leicester, Leominster, Middleton, Newton, Plainville, Raynham, Richmond, Waltham, Wellesley, and West Stockbridge.

December 2024 - 21 municipalities: Barre, Boxford, Boylston, Brewster, Buckland, Cambridge, Charlton, Douglas, Framingham, Lancaster, Mashpee, Needham, Newton, Northborough, Orleans, Peabody, Rochester, Southbridge, Spencer, Westwood, and Wrentham.

November 2024 - 27 municipalities: Acushnet, Blackstone, Brookfield, Chester, Cohasset, Fairhaven, Fall River, Grafton, Hanover, Hinsdale, Leyden, Marion, Mattapoisett, Millbury, Millville, Pittsfield, Russell, Scituate, Spencer, Stoughton, Tisbury, Ware, West Bridgewater, Westborough, Westport, Whately, and Winthrop.

October 2024 - 23 municipalities: Ayer, Danvers, Groton, Hanson, Haverhill, Hingham, Leverett, Lowell, Lynn, Merrimac, Monson, Nahant, Natick, Orange, Shutesbury, Tewksbury, Truro, Walpole, Wareham, West Boylston, West Tisbury, Winchendon, and Woburn.

September 2024 - 21 municipalities: Acton, Berkley, Canton, Clinton, Edgartown, Everett (Only a data error edit, see Note on downloads page), Franklin, Great Barrington, Harvard, Lincoln, Lynnfield, Mansfield, Millis, Montgomery, New Ashford, North Reading, Oxford, Provincetown, Rockland, Sturbridge, and Weston.

August 2024 - 37 municipalities: Amesbury, Andover, Ashburnham, Bedford, Bernardston, Carver, Charlemont, Chelsea, Chesterfield, Douglas, Gardner, Aquinnah, Groveland, Hampden, Kingston, Lakeville, Lenox, Littleton, Manchester, Marshfield, Maynard, Montague, Monterey, New Salem, North Adams, Norwell, Plympton, Randolph, Rockport, Saugus, Seekonk, Shrewsbury, Topsfield, Townsend, Warren, Washington, and Wendell.

July 2024 - 30 municipalities: Beverly, Brockton, Carlisle, Chilmark, Clinton, Cohasset, Concord, Dartmouth, Deerfield, Dover, East Bridgewater, East Brookfield, Hadley, Lexington, Marblehead, Medway, New Marlborough, Newbury, Norton, Norwood, Royalston, Salisbury, Shirley, Southborough, Stow, Taunton, Wenham, Westminster, Whitman, and Worthington.

June 2024 - 30 municipalities: Abington, Amherst, Berkley (Edited SITE_ADDR values in the Assess table), Boxborough, Dennis, Duxbury, Easton, Gloucester, Halifax, Heath, Hingham, Hopkinton, Lanesborough, Medford, New Braintree, North Attleborough, North Brookfield, Norwell, Palmer, Peru, Petersham, Plainfield, Rochester, Somerset, Tolland, Tyngsborough, Wakefield, Weymouth, Williamsburg, and Worthington (Added use code descriptions to the UC_LUT).

May 2024 - 32 municipalities: Adams, Auburn, Burlington, Chicopee, Clarksburg, Conway, Foxborough, Gosnold, Granby, Greenfield, Hardwick, Harwich, Holden, Marlborough, Middleborough, Norfolk, Oak Bluffs, Otis, Pembroke, Phillipston, Rehoboth, Rowe, Savoy, Sharon, Shelburne, Southwick, Sterling, Uxbridge, West Newbury, West Stockbridge, Westhampton, and Winchendon.

April 2024 - 26 municipalities: Belchertown, Bellingham, Billerica, Brimfield, Cheshire, Colrain, Dudley, Fitchburg, Gill, Hatfield, Holyoke, Hopedale, Lancaster, Melrose, Milford, North Andover, Princeton, Quincy, Reading, Richmond, Rowley, Stockbridge, Sutton, Templeton, Windsor, and Worthington.

Late March 2024 - 26 municipalities: Athol, Avon, Braintree, Dalton, Easthampton, Erving, Freetown, Hamilton, Ipswich, Leominster (FY value updated from '2023' to '2024' in Assess table from March 2024 update), Longmeadow, Malden, Medfield, Mendon, Northfield, Peabody, Sandisfield, Sheffield, South Hadley, Southampton, Sunderland, Wales, Wayland, Wellfleet, Westfield, and Yarmouth.

March 2024 - 18 municipalities: Agawam, Arlington, Chelmsford, Dighton, Hancock, Hanson, Holland, Leominster, Lunenburg, Middleton, Newton, Northborough, Northbridge, Rutland, Springfield, Upton, West Tisbury, and Williamstown.

February 2024 - 18 municipalities: Barnstable, Belmont, Blackstone, Bridgewater, Carlisle, Hubbardston, Marion, Medfield, Newburyport, Oak Bluffs, Orleans, Plainville, Salem, Sandwich, Ware, Wareham, Wellesley, and Westport.

January 2024 - 33 municipalities: Ashland, Barre, Boxford, Brewster, Brookline, Cambridge, Charlton, Chester, Conway, Dartmouth, Egremont, Fall River, Great Barrington, Hawley, Hull, Lawrence, Leverett, Lynn, Mattapoisett, Monterey, Scituate, Shrewsbury, Shutesbury, Somerville, Stoneham, Tewksbury, Wales, Waltham, Washington, West Bridgewater, West Springfield, Wilbraham, and Wrentham.

View 2014-2023 updates

| Last updated: | December 24, 2025 |

|---|