Notice of Intent to Assess (NIA)

The NIA is an audit notice that is issued when the DOR believes you owe additional taxes. The NIA will identify the reason DOR believes your tax should be increased. The NIA is not a tax bill; it shows the amount you will owe if you do not dispute it.

You have 30 days from the date of the notice to:

- Discuss the proposed amount with us

- Provide additional information.

If you agree with the amount shown in the NIA, you can pay in full immediately to avoid additional interest and penalties.

If you can't pay in full, you can choose to make a partial payment.

If you have a question regarding the NIA, you can send the DOR a secure e-message by logging into MasstaxConnect, 24 hours a day, 7 days a week or you can call the Contact Center at 617-887-6367 during normal business hours.

If you disagree with the NIA, respond online! For the fastest, most secure method of responding, visit us at MassTaxConnect.

Go to Quick Links:

- Click on the “Submit documentation” link and

- Enter the Letter ID from the upper right-hand corner of your notice.

- Then attach your documents along with a copy of this notice.

This online option should only be used for correspondence and should not be used if you are filing a tax return.

In approximately 30 days the Notice of Assessment (NOA) will be issued.

Notice of Assessment (NOA)

The NOA is a bill that is sent when we determine that you owe taxes. This could be the result of:

- An audit (NIA)

- A late return

- An unpaid return

- An error on a return.

You have 30 days to respond to this bill by:

- Paying the amount due in full to avoid any additional penalties and interest from being assessed

- Applying for a monthly payment agreement

- Filing an amendment to the return.

If you have a question regarding the NOA, you can send DOR a secure e-message by logging into MasstaxConnect, 24 hours a day, 7 days a week, or you can call the Contact Center at 617-887-6367 during normal business hours.

If the amount on the NOA is not paid in full by the due date, you will be issued a demand for payment notice known as the Statement of Account.

Statement of Account

The Statement of Account is issued after the NOA has been sent to the taxpayer and payment in full was not made by the due date.

The Statement of Account will include a Demand for Payment section showing balances that remain unpaid and will include a $30 demand penalty.

Collection activity can take place at this time if:

- Any amount remains unpaid 10 days after the Statement of Account is issued.

- You have not disputed the assessment by amending the return or filing for an abatement.

Final Notice

A Final Notice is issued when the previous bills have been issued and there is no response or payment from you. If you are receiving a Final Notice, you will want to contact the DOR or pay the total amount owed immediately in order to avoid collection activity from taking place.

Collection activity consists of:

- Bank Levy

- Wage Levy

- Liens

- Suspended licenses

Payment Agreement Reminder

If you have entered into a payment agreement, a monthly Payment Agreement Reminder will be sent to you. You must make the minimum monthly payment by the due date in order for the agreement to remain in good standing.

A payment agreement is subject to the discretion and approval of DOR. DOR reserves the right to deny your proposal for any reason.

For individuals and businesses, there are two types of payment agreements.

- For total (individual or business) tax liabilities of $10,000 or less

- For total (individual or business) tax liabilities of $10,001 or greater

Note:

- You may be subject to tax collection activity until your payment agreement is approved.

- An individual and business tax liability cannot be combined on a payment agreement (unless responsible person case or sole proprietorship). They must be created separately.

- You must have a Notice of Assessment (1st bill) or a Statement of Account (2nd bill) to be eligible for a payment agreement.

- If you received a Notice of Intent to Assess you must wait until you receive the Notice of Assessment to set up a payment agreement.

Go to DOR Payment Agreement Frequently Asked Questions to learn more about setting up a payment agreement.

NIA Information Request

The NIA Information Request is sent if the DOR needs more information in order to continue processing your tax return. The request will indicate the information you need to send in.

We may ask for more information regarding your:

- Massachusetts withholding credit

- Earned Income Credit

- Circuit Breaker Credit.

The NIA Information Request is not a tax bill.

The request shows the amount of the credits that will be taken away if you don't provide the information requested.

You have 30 days from the date of the notice to send in all requested information. It's important to include page 2 of the notice with your response.

If additional information is required, another NIA Information Request will be issued- Second Information Request. Please be sure to submit all documentation requested with your first notice to avoid delays in processing your tax return.

For the fastest, most secure method of responding, you can submit documentation on MassTaxConnect.

If you don't respond, the credits described in the notice will be taken away. This may result in a reduced refund or a tax bill.

If you disagree with the information on the notice, you can dispute it. To dispute it, you must first create an account on MassTaxConnect and attach the requested information to your dispute.

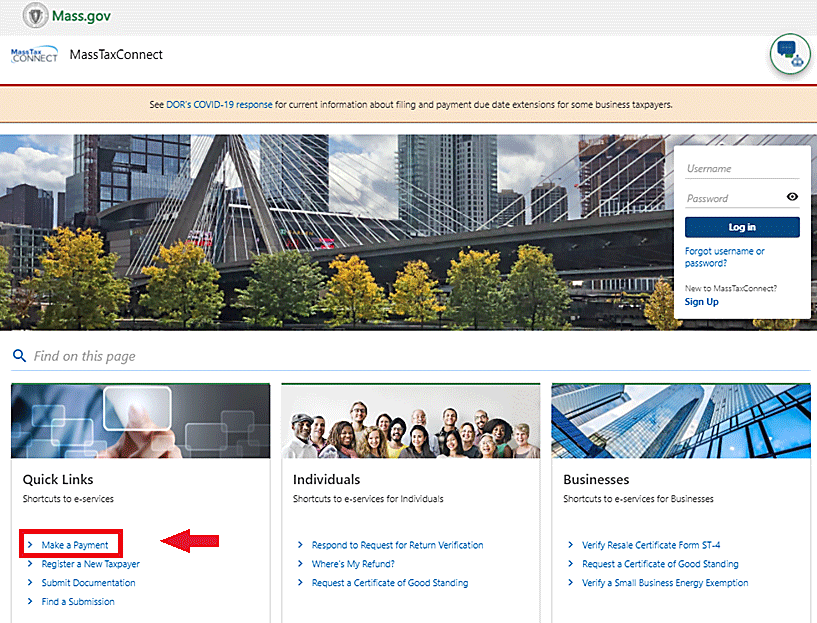

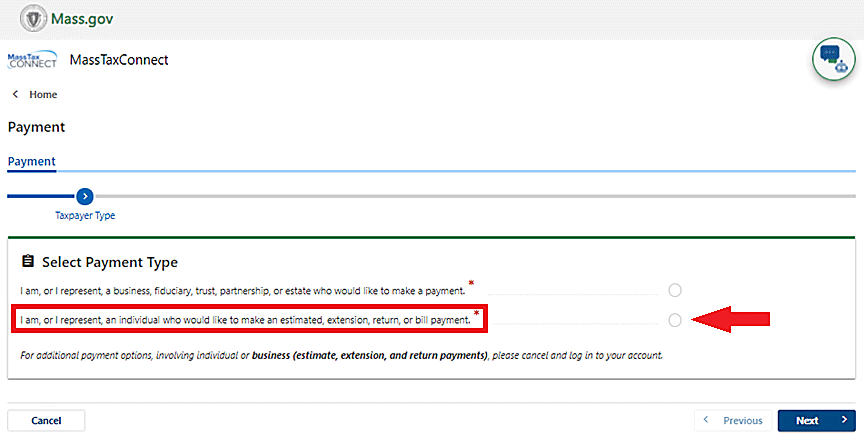

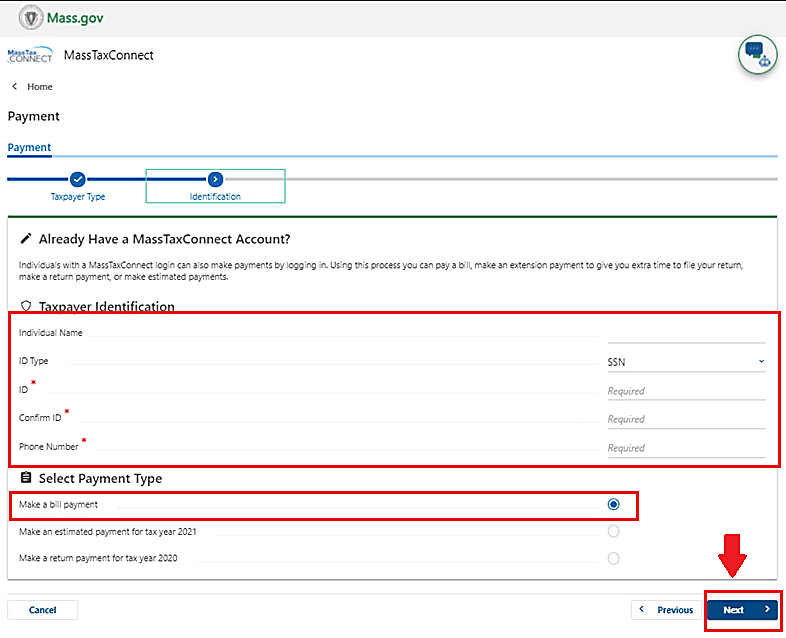

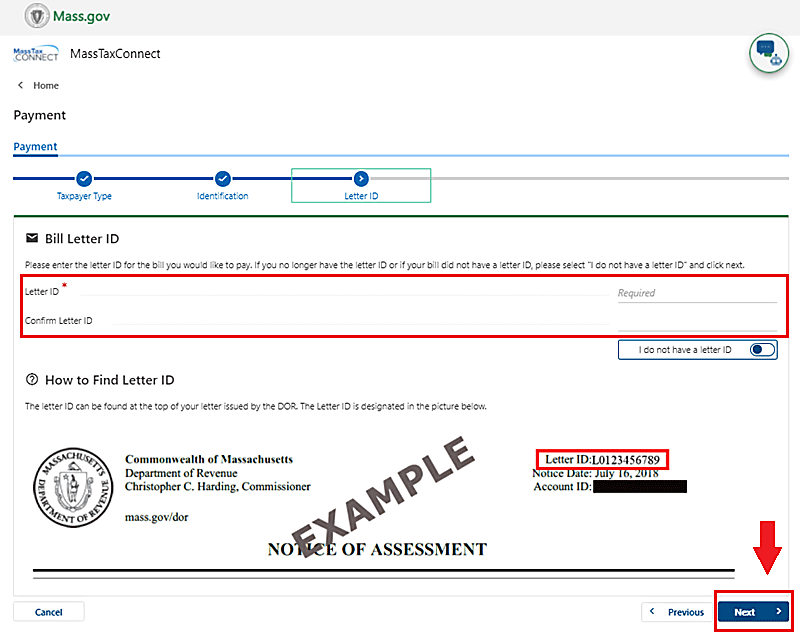

Online Bill Payments for Individuals

When you receive any type of bill, you have the option to pay it online through MasstaxConnect. We have provided step by step instructions for you to follow.

- Under the Quick Links column you will choose Make a payment

- For Payment Type you are going to click on I am, or I represent an, Individual.

- Complete all required fields, check off Bill Payment and click Next.

- Enter Letter ID from your bill twice.

- You will then choose your payment type, which is either Bank Debit or Credit Card. Your payment will be processed through a third party payment processor who will charge a 2.39% convenience fee for credit card payments and a 2.09% convenience fee for debit card payments.

- There is no fee when using Bank Debit.

Amend an Individual or Business Return

If you filed a return and want to increase or decrease the amount of tax, amend a return to report an:

- Error

- Omission or

- Change.

Note

- If you are amending to decrease your tax, you need to attach supporting documentation.

- You should not file an amended return to dispute an audit assessment.

- Do not file a Form ABT with your amended return.

Go to Amend an Individual or Business Tax Return to learn more.

File an Appeal or Abatement

Generally, an appeal is filed when a Taxpayer disagrees with an assessment or a proposed assessment of tax and/or penalties. An appeal may also be called a request for Abatement.

Go to File an Appeal or Abatement FAQs to learn more.

Contact

Phone

9 a.m.–4 p.m., Monday through Friday