General Questions

The following are answers to common appeals (abatement) questions. If your question is still not answered, contact DOR.

What is an appeal?

Generally, an appeal is filed when a Taxpayer disagrees with an assessment or a proposed assessment of tax and/or penalties. An appeal may also be called a request for Abatement.

An appeal filed with MassTaxConnect is the:

- Electronic version of filing Form ABT: Application for Abatement when you are disputing tax or penalties you have been assessed (billed).

- Electronic version of filing Form DR-1: Office of Appeals Form when you are:

- Appealing a proposed assessment from an audit or

- Requesting settlement based on legal issues.

Appeals submitted on paper can have a longer processing time.

How do I file an appeal?

MassTaxConnect is the fastest way to apply for an appeal (abatement).

You may apply on paper with a Form ABT if:

- You do not have access to MassTaxConnect and

- You are not required to e-file.

Go to the FAQ Instructions on this page for specific steps on how to file an appeal for an:

- Audit

- Innocent Spouse

- Penalty

- Responsible person

- Motor vehicle or trailer sales or use tax

- Boat, recreational off-highway vehicle, and snowmobile sales or use tax

- Motor vehicle or trailer excise tax.

Should I file an appeal if I made a mistake on my tax return?

No. If you made a mistake on your tax return, you should file an amended return to correct the mistake.

Be sure to include all schedules with your amended return. Sometimes a phone call or e-message through MassTaxConnect may resolve the issue.

Go to Amend a MA Individual or Business Tax Return to learn more.

Should I file an appeal if I receive a Notice of Failure to File a Return?

Only file an appeal if you believe you do not have a legal requirement to file a return.

Should I file an appeal for a missing or incorrect payment?

No. You should not file an appeal for payment-related issues.

If you have questions about a payment, you should:

- Send an e-message through your MassTaxConnect account or

- Call DOR at (617) 887-6367.

Should I file an appeal if I can’t afford to pay my bill?

No. Do not file an appeal if you cannot pay your bill in full. Instead, you should:

- Contact DOR at the number on your bill or

- Apply for a payment plan through MassTaxConnect by selecting Request a Payment Plan in the Collection Notices section under the More… tab.

Go to Frequently Asked Questions Regarding DOR Collections to learn more.

How long do I have to file an appeal?

Generally, you must file within:

- 3 years from the date of filing the return (or within 3 years from the due date, if the return was filed before the due date),

- 2 years from the date the tax was assessed or deemed to be assessed, or

- 1 year from the date the tax was paid.

For more information on time limits for filing an appeal, select the Show Additional Information hyperlink on the first screen of the appeal request on MassTaxConnect.

For more information, see Frequently Asked Questions Regarding DOR Collections.

Can I check the status of my appeal request?

Yes.

- Log in to MassTaxConnect.

- Select the Submissions hyperlink from the More… section

- The appeal will appear under the Submitted column or the Processed column.

- Select to view your submission.

Will I be notified when my appeal is assigned?

No. DOR will contact you if you requested a hearing or if the assigned Appeals Officer requires additional information to resolve your case.

If my appeal is approved, resulting in a refund, how will I receive my refund?

A refund check will be mailed to you once the appeal is resolved. If you owe money on another tax account or another tax period, DOR will apply your refund to that debt.

What is the difference between a pre-assessment appeal and a post-assessment appeal?

An appeal filed within 30 days of a Notice of Intent to Assess (NIA) is considered a pre-assessment appeal since you have not yet been assessed (billed).

Requesting a pre-assessment appeal through MassTaxConnect is the same as filing a paper Form DR-1: Office of Appeals Form.

An appeal filed after you receive a Notice of Assessment is considered post-assessment since you have been assessed (billed).

A post-assessment appeal is also known as an abatement. Requesting a post-assessment appeal through MassTaxConnect is the same as filing a paper Form ABT: Application for Abatement.

What is a pre-assessment conference?

At the conclusion of an audit, you will receive a Notice of Intent to Assess (NIA). You have 30 days from the date of the NIA to file an appeal requesting a pre-assessment conference.

A pre-assessment conference is your opportunity to speak to an Appeals Officer after you've been audited but before you receive a Notice of Assessment.

Conferences can be held:

- On web-based technology such as Microsoft Teams or Zoom

- In person at DOR’s Boston office

- By phone.

What is a settlement and why would I request settlement as part of my appeal?

A settlement is when the Commissioner and a taxpayer(s) agree in a binding document to resolve an issue(s) that cannot be clearly determined by the facts and/or law applicable.

A taxpayer may wish to make a settlement proposal if they cannot fully substantiate their claim or if they believe there is some question as to whether the tax is due.

Settlements for reduced amounts will not be considered in cases of:

- Financial hardship or

- Inability to pay.

If you would like to request a settlement for those reasons, contact the Collections Bureau.

For more information about collections, please see:

- Frequently Asked Questions Regarding DOR Collections

- DOR Notices and Bills

- AP 634: Offers in Final Settlement.

What is a Power of Attorney (POA)?

A Power of Attorney (POA) is required if the representative is:

- Seeking to act on behalf of a taxpayer and

- Requesting that DOR disclose information contained in tax returns and other documentations.

Where can I enter my contact information?

You must add contact information in the Provide Contact Information section when completing an appeal.

Information required in this section must include:

- Full name

- Phone number

- E-mail address.

If my appeal is denied, will I have further appeal rights?

If your pre-assessment appeal is denied you may file a request for Abatement; however, if you had a pre-assessment conference you will only be granted a second conference (hearing) if there is new information available that was not available at the time of the pre-assessment conference or a change to the law.

If your post-assessment appeal (Abatement) is denied you may file an appeal with the Appellate Tax Board within 60 days from the date of your Notice of Abatement Determination.

What does it mean to withdraw my consent to allow more than 6 months for DOR to act on my appeal request?

If you withdraw your consent to give DOR more than 6 months to act on your appeal, your appeal will be deemed denied:

- 6 months from the date of filing or

- As of the date you withdraw consent, whichever is later.

If DOR does not act on my appeal within 6 months and my appeal is denied because I withdrew my consent to allow for more time, will I have further appeal rights?

Yes. You may appeal the denial to the Appellate Tax Board within 6 months of the deemed denial. The 60-day period to file with the Appellate Tax Board stated in this notice does not apply to this case.

I have entered into a payment agreement. Can I still file an appeal?

Yes. However, when you file your appeal, your payment agreement will end. You may make voluntary payments during this time if you want.

- If your appeal is approved, any overpayment will be refunded to you.

- If your appeal is denied, you will need to request a new payment agreement.

Go to DOR Payment Agreement FAQs to learn more.

I have paid my liability in full. Can I still file an appeal?

Yes. You can file an appeal if your appeal is filed within the required time limits. If your appeal is approved, any overpayment may be refunded to you.

Will I be charged penalties and interest while my appeal is in process?

For Penalties?

Penalties for late payment of an audit assessment are not imposed while the appeal is in process. Other types of late penalties may also apply.

For Interest?

Yes. If the amounts you are appealing are unpaid, interest will be charged and added to the balance.

What is an Innocent Spouse appeal?

“Innocent Spouse” is a term often used to describe an appeal where a taxpayer asserts that they should not be held liable for a tax assessment or unpaid liability relating to their jointly filed return. Such appeals are requests for relief from joint tax liability.

For more information, go to:

What should I do if my refund was taken to pay a debt that belongs to my spouse?

If you filed a joint return, both parties are responsible for taxes owed.

If your refund was taken to pay a debt that was not a part of a joint return, you may file a non-debtor spouse claim by completing Form M-8379: Nondebtor Spouse Claim and Allocation for Refund Due.

Sometimes a refund will be taken by another agency to pay a debt, such as:

- Child Support,

- Unemployment,

- College expenses, or

- A debt to the IRS.

- If your refund was taken by another agency, do not file an appeal.

Instead, you must contact that agency directly.

How do I appeal a determination that I am personally liable as a Responsible Person?

You can appeal a determination that you are personally liable as a Responsible Person for the:

- Sales

- Meals, Food & Beverage

- Withholding or

- Other taxes of a business.

Go to the Instructions section of this page to learn how.

Also see 830 CMR 62C.31A.1: Responsible Persons to learn more.

How do I best support my case?

Whether requesting an appeal (abatement) through MassTaxConnect or on paper, your explanation should be as detailed as you think it needs to be for an Appeals Officer to understand your case.

You should attach everything you think would support your case. Adding supporting documentation to your case may allow DOR to resolve the appeal faster.

If the Appeals Officer needs more information, DOR will contact you.

Can I include additional attachments to my appeal once it is processed?

No. If your appeal has been processed, you will be unable to:

- Add attachments or

- Edit your dispute in any way.

If you requested a hearing, you will be able to provide additional documentation to the Appeals Officer at the hearing. The Appeals Officer may also contact you for more information, and you can provide the documents then.

If the appeal has not been processed, you can delete the original appeal and submit a new one, adding any additional attachments. Once your appeal has been processed, it will have a status of Submitted.

Can an appeal be withdrawn?

You can withdraw an appeal by yourself, but only if:

- You filed your appeal with MassTaxConnect and

- It is in the status of Submitted.

To do so, log in to MassTaxConnect:

- Choose the More… tab.

- Choose the Search Submissions link.

- Choose Appeal link under the Pending column.

- Choose Delete in the upper right-hand corner of the page.

- Click OK to confirm.

You must contact DOR or your Appeals Officer if your appeal:

- Is being processed (no longer Submitted status) in MassTaxConnect or

- You mailed your appeal with a Form ABT and got confirmation that it had been received by DOR.

Instructions

These FAQs for instructions have answers for how to file an appeal (abatement) for an:

- Audit

- Innocent Spouse

- Penalty

- Responsible person

- Motor vehicle or trailer sales or use tax

- Boat, recreational off-highway vehicle, and snowmobile sales or use tax

- Motor vehicle or trailer excise tax.

How do I appeal an Audit?

You may file an appeal of an Audit with MassTaxConnect or with a paper Form ABT.

As part of the appeal, you may request a pre-assessment conference. This is your opportunity to speak to an Appeals Officer after you've been audited but before you receive a Notice of Assessment (NOA).

If filing a pre-assessment appeal by paper, mail a completed Form DR-1.

Pre-assessment conferences can be held:

- On web-based technology such as Microsoft Teams or Zoom

- In person at DOR’s Boston office or

- By phone.

At the conclusion of an audit, you will receive a Notice of Intent to Assess (NIA). You have 30 days from the date of the NIA to file an appeal requesting a pre-assessment conference.

With MassTaxConnect

To file an Audit appeal, log in to MassTaxConnect, then:

- Choose the More… tab

- In the Other Actions box, choose File an Appeal

- Choose No in the type of appeal section at the bottom of the first page. Yes is only for a Responsible Person appeal

- Choose the Audit Appeal type of appeal action in the drop-down.

- Choose the tax account that the audit appeal concerns

- Click Next at the bottom right-hand-side

- Choose the Notice that you received that is related to this audit appeal

- Click Next

- Provide a detailed Explanation of the Reasons for Your Appeal. You’ll be able to attach documents later.

- Choose the Audit Available from the list at the bottom of the page.

- Click Next

- Choose Yes or No if you would or would not like to request a hearing

- Click Next

- Choose Yes or No if you would or would not like to request settlement consideration

- Click Next

- Fill in your full contact information

- Click Next

- Provide any attachments (supporting documentation) including a Power of Attorney

- Click Next

- Click the Signature box on the right-hand side

- Click Submit to complete the request.

By Paper

Mail a completed Form ABT.

- Filling in the appeal an audit oval and

- Providing supporting documentation.

For a pre-assessment appeal, mail a completed Form DR-1.

How do I appeal as an Innocent Spouse?

"Innocent Spouse” is a term often used to describe an appeal where a taxpayer asserts that they should not be held liable for a tax assessment or unpaid liability relating to their jointly filed return.

Go to General Laws c. 62C, Section 84 for timing for filing.

With MassTaxConnect

To file an Innocent Spouse appeal, log in to MassTaxConnect, then:

- Choose the More… tab

- In the Other Actions box, choose File an Appeal

- Choose the No option under Type of Appeal to tell us that you are filing an Innocent Spouse appeal

- Click Next on the bottom right-hand side

- The Appeal Request page will list the required documentation.

- Choose Innocent Spouse for the type of action you need taken.

- Choose the Personal Income Tax account for this appeal

- Click Next

- Enter the optional letter ID for a notice you received related to the appeal

- Click Next

- On the Appeal Details page provide details specific to the Innocent Spouse appeal.

- In this area, provide an explanation of the reasons for your appeal.

- Provide as much detail as possible. You will be able to attach documents to this appeal at the end

- On this page, you also need to tell us which tax periods are part of the appeal. Select the box next to each Filing Period

- Click Next

- Follow the remaining prompts

- Click Submit to complete the request.

Go to Relief from joint tax liability to learn more.

By Paper

Mail a completed Form ABT by:

- Filling in the other oval and

- Providing supporting documentation.

Also complete and mail:

How do I appeal a penalty?

With MassTaxConnect

To file a Penalty appeal, log in to MassTaxConnect, then:

- Choose the More… tab.

- In the Other Actions box, choose File an Appeal.

- Choose No in the Type of Appeal section at the bottom of the first page. Yes is only for a Responsible Person appeal.

- Click Next on the bottom right-hand-side

- Choose the Penalty Waiver type of appeal action in the drop-down on the right-hand-side

- Choose the tax account that you are appealing a penalty for

- Click Next

- Enter the letter ID if the appeal concerns a notice you received from DOR, but it is not required

- Click Next

- Choose a Penalty Waiver Reason from the drop-down list

- Fill in the Explanation for the Reasons for Your Appeal

- Choose the period(s) for your appeal and fill in the requested amount(s)

- Choose Yes or No if you would or would not like to request a hearing

- Click Next

- Choose Yes or No if you would or would not like to request settlement consideration

- Click Next

- Fill in your contact information

- Click Next

- Provide any attachments (supporting documentation) including Power of Attorney

- Click Next

- Click the Signature box on the right-hand side

- Click Submit to complete the request.

By Paper

Mail a completed Form ABT by:

- Filling in the appeal penalties oval and

- Providing supporting documentation.

Health Care Penalty

The File an appeal option should not be used for healthcare penalties. To learn how to challenge a health care penalty, go to the appeal the health care penalty page.

How do I appeal a determination that I am personally liable as a Responsible Person?

You can appeal a determination that you are personally liable as a Responsible Person for the:

- Sales

- Meals, Food & Beverage

- Withholding or

- Other taxes of a business.

Go to 830 CMR 62C.31A.1: Responsible Persons to learn more.

With MassTaxConnect

To file a Responsible Person appeal, log in to MassTaxConnect, then:

- Choose the More… tab

- In the Other Actions box, choose File an Appeal

- Choose the Yes option under Type of Appeal to tell us that you are filing a Responsible Person appeal

- Click Next at the bottom right-hand side

- The next page will list the businesses for which you have been held responsible.

- Choose the appropriate business(es) that you want to appeal and click Next

- Choose the RP Determination letter(s) you received related to your appeal and click Next

- The Account Type(s) and periods associated with the letter will be listed

- Next is the area where you provide an explanation of the reasons for your appeal. Provide as much detail as possible. You will be able to attach documents to this appeal at the end

- On this page, you also need to tell us if you are appealing the fact that you are a responsible person (Appeal Responsibility) and whether you disagree with the amounts that the business owes (Appeal Liability). Select the appropriate box next to each Filing Period. There may be additional pages of tax periods.

- Click Next

- Follow the remaining prompts

- Click on Submit to send your appeal.

By Paper

Mail a completed Form ABT by:

- Filling in the appeal a responsible person determination oval and

- Providing supporting documentation.

How do I appeal motor vehicle or trailer sales or use tax?

MassTaxConnect is the quickest way to file a motor vehicle sales or use tax appeal.

However, if you do not have access, you may also appeal with a paper Form ABT.

Go to Request a motor vehicle sales or use tax abatement to learn more.

How do I appeal Boat, Recreational Off-Highway Vehicle, and Snowmobile sales or use tax?

With MassTaxConnect

The steps are the same as described under the How Do I File an Appeal section of this page.

Apply for an appeal if you paid sales or use tax and your purchase was:

- Returned

- Acquired from a contest, drawing, or raffle (donor paid the sales or use tax)

- Received as a gift

- Transferred to you from parents, a spouse, or sibling only

- Transferred to you by intestacy, will, or otherwise

- Purchased outside of Massachusetts, and you have fulfilled your tax obligation.

Go to Boats, Recreational Off-Highway Vehicles, and Snowmobiles to learn more.

By Paper

Mail a completed Form ABT by:

- Filling in the other oval and

- Providing supporting documentation.

How do I appeal a motor vehicle or trailer excise tax?

Unless you are notified by the DOR, you must file an application for abatement (appeal) with your local board of assessors.

Go to the abatement section of the Motor Vehicle Excise Guide to learn how.

Contact

General questions should be directed to DOR's Contact Center at:

- (617) 887-6367 or

- (800) 392-6089 (toll-free in Massachusetts).

- 9 a.m. – 4 p.m., Monday through Friday.

If you have been contacted by DOR's Office of Appeals, please leave a voicemail at:

- (617) 626-3300

- Fax: (617) 626-3349

For more ways to connect, go to Contact DOR.

Do you have a question about your tax account?

If you are registered, log in to your MassTaxConnect account and send DOR a secure e-message.

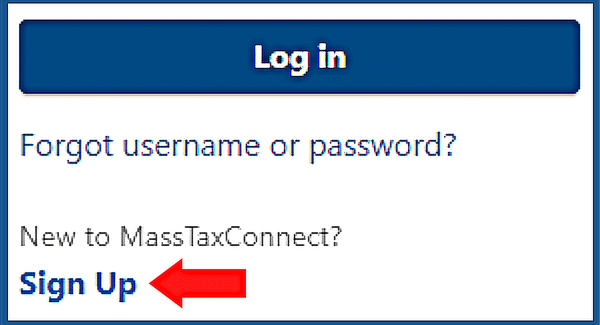

Do you need to register with MassTaxConnect?

On the upper right-hand side of MassTaxConnect's home screen:

- Select Sign Up

- Select Create My Logon.

You may also register by clicking on Register a new taxpayer under Quick Links.

Translation Help

Do you need to change this page's language?

Go to How to Translate a Website, Webpage, or Document into the Language You Want.