IRS Guidance Issued

The IRS has issued guidance with respect to the tax consequences associated with PFML contributions and benefits. Please direct any questions or comments to the IRS as set forth in the guidance.

IRS issues extension of PFML tax ruling

Please be advised that DFML will delay its implementation of certain portions of the tax withholding and reporting requirements outlined in IRS Revenue Ruling 2025-4 due to new guidance issued by the IRS. On December 19, 2025, the Internal Revenue Service (IRS) issued IRS Notice 2026-6 which extends the implementation transition period provided to state paid family and medical leave programs and employers for an additional year.

Learn more about how this impacts employers in Massachusetts

Overview

Most workers in Massachusetts are eligible to get up to 12 weeks of paid family leave and up to 20 weeks of paid medical leave. The program will be funded by premiums paid by employees, employers, and the self-employed. Contributions to the program began on October 1, 2019, and will be managed through the Department of Family and Medical Leave (DFML) per M.G.L. c.175M.

For details regarding the benefits mandated by this new law, please visit the DFML website.

Covered Individuals Under the Law

As of October 1, 2019, businesses with at least one Massachusetts employee are required to remit PFML contributions on behalf of each employee to the Family and Employment Security Trust Fund. The following describes who is covered by the PFML program.

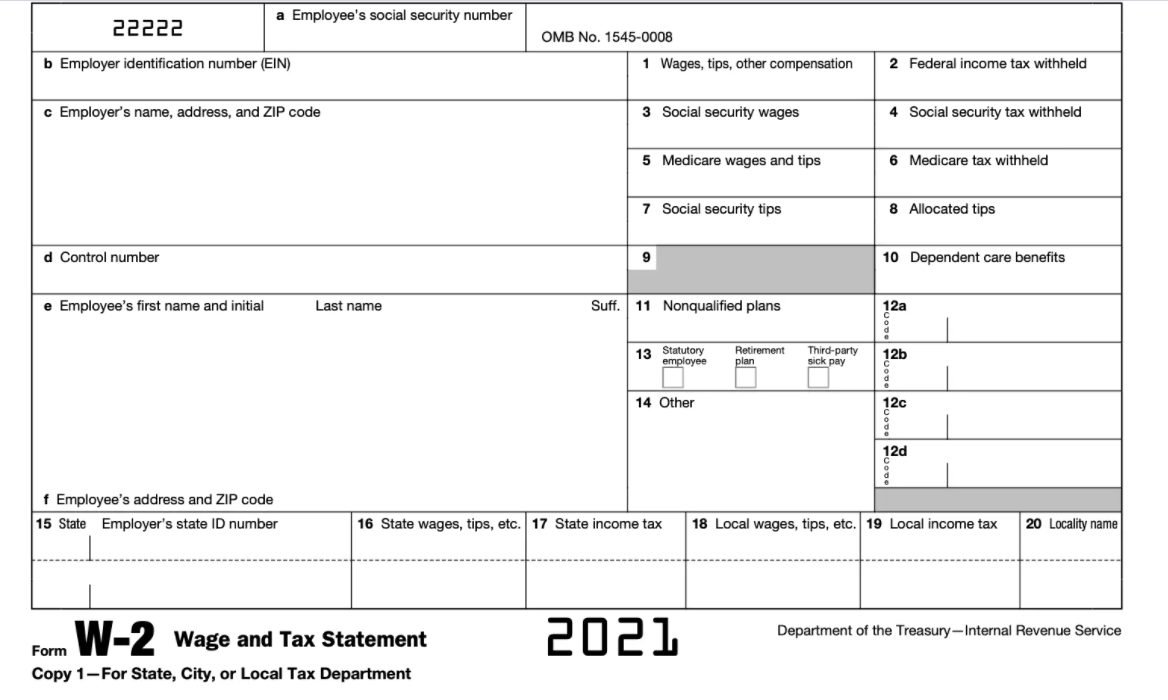

W-2

W-2 employees (full-time, part-time, or seasonal) will always count as covered individuals. Generally, the eligibility criteria under the unemployment insurance program in Massachusetts apply in determining PFML eligibility. If you are required to report a W-2 employee’s wages to the Department of Unemployment Assistance (DUA), that employee should be counted. Employees don't need to reside in Massachusetts to be covered.

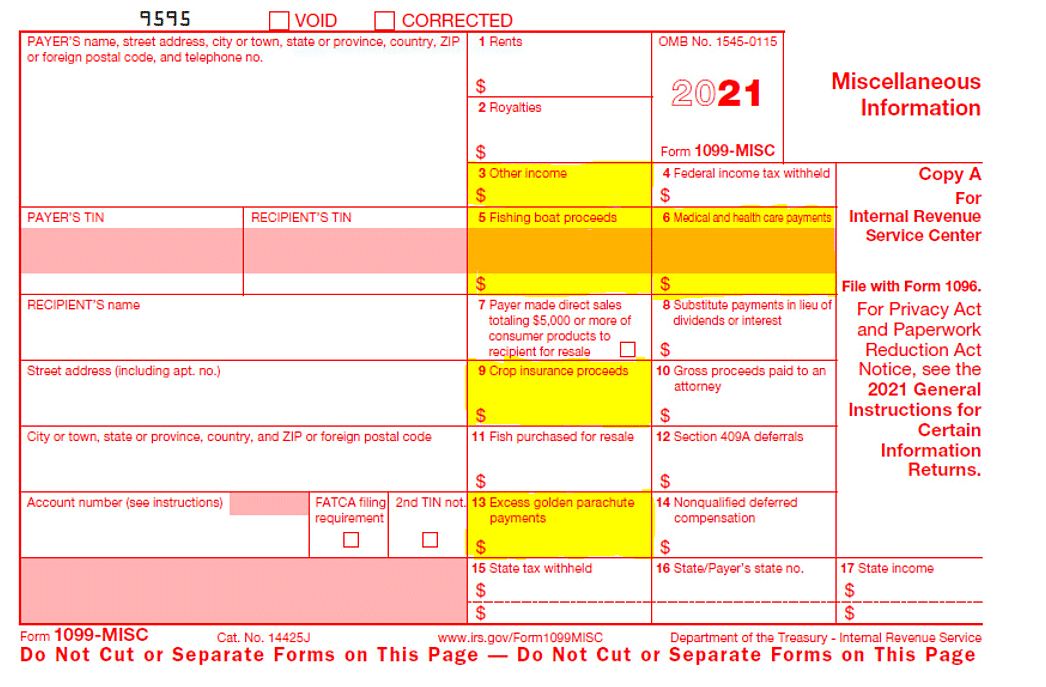

1099-MISC independent contractors

Workers whose payments are reported on IRS Form 1099-MISC (1099-MISC workers) count toward your total number of covered individuals only if they make up more than 50% of your total workforce (W-2 employees and 1099-MISC workers combined). Otherwise, an employer is not required to contribute or report with respect to 1099-MISC workers.

Payments made to individuals and reported on IRS Form 1099-MISC remain covered by the PFML program. These payments include certain prizes, awards, and other income reported in Box 3; fishing boat proceeds reported in Box 5; medical and health care payments reported in Box 6; crop insurance proceeds reported in Box 9; and excess golden parachute proceeds reported in Box 13. Further guidance from the IRS regarding IRS Form 1099-MISC payments can be found here. The PFML program only applies to individuals receiving these payments when such individuals make up more than 50% of a business’s workforce. Information about how a business makes this determination about its workforce can be found here.

DFML has determined that all non-employee compensation paid on or after January 1, 2020 and reported in Box 1 of IRS Form 1099-NEC is exempt from PFML program withholding and contributory requirements. Please note that, prior to January 1, 2020, such compensation was reported on IRS Form 1099-MISC. Accordingly, from October 1, 2019 through December 31, 2019, workers whose payments were required to be reported on IRS Form 1099-MISC were subject to the PFML program.

Counting 1099-MISC independent contractors as covered individuals

For a 1099-MISC worker to be considered part of your Massachusetts workforce count, the 1099-MISC worker MUST:

- Receive payments reported on IRS Form 1099-MISC

- Perform services as an individual entity

- Live in Massachusetts

- Perform services in Massachusetts

The Massachusetts unemployment statute defines independent contractors as workers who meet this three-part test.

If a worker meets the criteria to be a covered individual and you have determined that the worker is not an independent contractor under the three-part test, then you should count him or her as a member of your Massachusetts workforce.

Payments made to individuals and reported on IRS Form 1099-MISC are covered by the PFML program. These payments include certain prizes, awards, and other income reported in Box 3; fishing boat proceeds reported in Box 5; medical and health care payments reported in Box 6; crop insurance proceeds reported in Box 9; and excess golden parachute proceeds reported in Box 13. Further guidance from the IRS regarding IRS Form 1099-MISC payments can be found here. The PFML program only applies to individuals receiving these payments when such individuals make up more than 50% of a business’s workforce. Information about how a business makes this determination about its workforce can be found here.

Required Contributions

Each quarter, you'll be required to submit contributions for all covered individuals in your workforce. You may deduct a part of the required contribution from wages that you pay your employees and payments you make to 1099-MISC workers who qualify as covered individuals. An employer may choose to pay the employee contribution in full or in part. If your workforce has fewer than 25 covered individuals, you are not responsible for paying the employer share of the contribution. However, you may elect to cover some, or all, of the covered individuals' share.

Contribution Split

Employers with 25 or more employees will be required to remit a contribution to DFML of 0.68% (0.56% for the medical leave contribution and 0.12% for the family leave contribution) of eligible payroll. This contribution can be split between employee payroll deductions and an employer contribution and will support both types of leave.

1099-NEC

DFML has determined that all non-employee compensation paid on or after January 1, 2020 and reported in Box 1 of IRS Form 1099-NEC is exempt from PFML program withholding and contributory requirements. Please note that, prior to January 1, 2020, such compensation was reported on IRS Form 1099-MISC. Accordingly, from October 1, 2019 through December 31, 2019, workers whose payments were required to be reported on IRS Form 1099-MISC were subject to the PFML program.

Exemption from Paid Family and Medical Leave FAQs

My company currently provides our Massachusetts employees paid family and medical leave benefits that extend beyond those provided under the Commonwealth’s plan. Can I apply for an exemption?

Yes. Employers and businesses that currently provide paid family and medical leave benefits equaling or exceeding those provided under the Commonwealth’s plan are eligible to apply for a Private Plan Exemption. Exemption requests are processed through MassTaxConnect, accepted on a rolling basis and, if approved, are valid for one year. Only duly authorized representatives can apply for a Private Plan Exemption on a company’s behalf. Learn more.

If my company adopts a private plan sometime in the future and that plan is approved for an exemption, when can I stop contributing to the Fund?

The first day of the following quarter in which your exemption was approved.

If my exemption request is denied, can I have the decision reviewed?

Yes. You can request a review through MassTaxConnect.

- Log in to MassTaxConnect

- Choose your Paid Family and Medical Leave account

- Choose Exemption Requests

- Choose Manual Review

Requirements for Self-Insured Paid Leave Plans

Self-insured employers seeking an exemption from making Paid Family and Medical Leave (PFML) contributions must provide a bond. These employers must furnish a bond running to the Commonwealth in an amount based on MA workforce size.Learn more.

How do I renew an exemption?

An employer with an approved exemption from making paid leave contributions may renew their exemption by its expiration date. In most cases, the exemption period is for four quarters. Therefore, businesses should log into their PFML accounts via MassTaxConnect and complete their exemption renewal applications prior to expiration date. You may begin this process during the quarter prior to the expiration of your current exemption. (i.e., If your exemption expiration date is September 30, you can begin the renewal process starting July 1).

What happens if I don’t renew the exemption by the exemption expiration date?

Businesses that do not have an approved exemption in effect will be responsible for remitting employee and employee contributions, if applicable, until such time as an exemption is approved and in effect.

If you do not intend to renew your employer exemption, you must notify the covered individuals and the Department no later than 30 calendar days prior to the exemption expiration date.

You may notify the Department by sending an e-message via your MassTaxConnect account explaining you do not intend to renew your PFML exemption.

Registration Process FAQs

Are all Massachusetts businesses required to register with DOR?

Businesses with at least one Massachusetts employee are required to register through MassTaxConnect.

Can a third party have access to a taxpayer’s PFML account?

Yes. A third party can have access to the PFML account with taxpayer’s approval.

- The third party will log in to MassTaxConnect.

- Choose Manage My Profile (upper right) and select the More…tab.

- Choose Request to Manage Other Taxpayers’ Accounts under Third Party Access.

- Follow prompts to request access to the taxpayer’s PFML account

The third party can choose whether the taxpayer will authorize access through MassTaxConnect or by signing a printed authorization form.

Determine Workforce Count FAQs

How do I calculate my company’s workforce count?

Workforce count is determined by using different methods to calculate annual workforce averages. To determine your responsibilities as an employer, you need to count your workforce from the previous year. For employers and other businesses that employ W-2 employees and/or individuals that are 1099-MISC workers, an individual providing services to a business is a 1099-MISC worker covered under the new law only if (1) payments made to him or her for services are required to be reported on IRS Form 1099-MISC, and (2) 1099-MISC workers make up greater than 50% of the business’s workforce. More information regarding how to calculate your workforce count can be found here.

Do I need to include contracted workers in my workforce count?

Payments that are not non-employee compensation to contracted workers, and which are still reported on IRS Form 1099-MISC, will be included as part of your workforce count as 1099-MISC workers.

DFML has determined that employers are not required to make contributions on behalf of contracted workers whose compensation, as of January 1, 2020, will now be reported on IRS Form 1099-NEC as non-employee compensation.

W-2 Employers

Workforce counts for employers that strictly employ W-2 employees are determined by calculating the number of employees, of all ages (whether union-represented or not), including full-time, part-time and seasonal employees, on the payroll during each pay period and dividing that number by the number of pay periods. These employees do not need to reside in Massachusetts to be covered.

In the below example, Company A had 276 employees on its payroll across 12 pay periods. Company A’s final workforce count is calculated by dividing the number of its W-2 employees (276) by the number of pay periods (12) which equates to an average annual workforce of 23.

Example 1: Company A Payroll

| Pay Periods (12) | W-2 Employees |

|---|---|

| 1 | 20 |

| 2 | 21 |

| 3 | 22 |

| 4 | 23 |

| 5 | 24 |

| 6 | 25 |

| 7 | 26 |

| 8 | 25 |

| 9 | 24 |

| 10 | 23 |

| 11 | 22 |

| 12 | 21 |

| Total | 276 |

| Annual Average | 23 |

Businesses Employing W-2 Employees and 1099-MISC workers

A three-step process is used for calculating average annual workforce counts for businesses that employ both W-2 employees and 1099-MISC workers. This three-step process is outlined below.

Step 1 - W-2 Employee Count

Average annual W-2 employee workforce count is determined by calculating the number of W-2 employees, including full-time, part-time and seasonal employees, on the payroll during each pay period and dividing that number by the number of pay periods.

Step 1 Example:Company B Payroll

| Pay Periods (12) | W-2 employees |

|---|---|

| 1 | 5 |

| 2 | 7 |

| 3 | 9 |

| 4 | 11 |

| 5 | 13 |

| 6 | 15 |

| 7 | 17 |

| 8 | 19 |

| 9 | 21 |

| 10 | 23 |

| 11 | 25 |

| 12 | 27 |

| Total | 192 |

| Annual Average | 16 |

Step 2 - 1099-MISC worker Count

Average annual 1099-MISC worker counts are determined by totaling the number of 1099-MISC workers paid for services for each pay period and then dividing that number by the number of pay periods.

Step 2 Example:Company B Payroll

| Pay Periods (12) | 1099-MISC workers |

|---|---|

| 1 | 3 |

| 2 | 4 |

| 3 | 5 |

| 4 | 6 |

| 5 | 7 |

| 6 | 8 |

| 7 | 9 |

| 8 | 10 |

| 9 | 15 |

| 10 | 12 |

| 11 | 14 |

| 12 | 15 |

| Total | 108 |

| Annual Average | 9 |

Step 3 – 1099-MISC workers as a Percentage of Total Workforce

Add your company’s prior year W-2 employee average to its 1099-MISC worker average to arrive at the total workforce average. If your 1099-MISC worker average is less than 50% of your total workforce average, do not include your 1099-MISC workers in your PFML Workforce Count. If your 1099-MISC worker average is more than 50% of your total workforce average, then those 1099-MISC workers are covered contract workers, and you need to add your covered contract worker count to your W-2 employee count. This combined count represents your company’s final PFML Workforce Count.

Step 3 Example: Company B

| Total Workforce Annual Average | 1099-MISC worker Annual Average | 1099-MISC workers of Total Workforce |

|---|---|---|

| 25 | 9 | 36% |

In the above example, Company B’s 1099-MISC workers as a percentage of total workforce is 36%. As this percentage is less than 50%, Company B’s 1099-MISC workers are not covered contract workers. Therefore, Company B’s final Workforce Count is 16.

If Company B’s 1099-MISC worker annual average had been 17, which is 51.52% of Company B’s total workforce average, then Company B’s 1099-MISC workers would have been covered contract workers. In this example, Company B’s final Workforce Count for the prior year would be 33.

How do I determine workforce count if my company is a startup?

You should make a good faith estimate as to what you expect your payroll will look like over the next 12 months.

Are specific categories of employers and/or employees exempt from the PFML requirements?

Yes. Municipalities, districts, political subdivisions or its instrumentalities along with their employees are not subject to PFML. However, these entities may opt in by a majority vote of the local legislative or governing body that authorizes a public or quasi-public to take such a vote.

Are certain types of employment excluded from the PFML law?

Yes. Certain types of employment that are excluded under section 6 of the unemployment statute are also excluded from the PFML law, including:

- Services performed for a son, daughter, or spouse

- If under 18, services performed for one’s father or mother

- Services performed by inmates of penal institutions

- Independent contractors as defined by this three-part test

- Employment in the railroad industry

- Services provided by real estate brokers/salespeople and insurance agents/solicitors in commission only jobs

- Newspaper sales and delivery by persons under 18

- Employment by churches and certain religious organizations

- Services of work-study students, student nurses and interns, work trainee programs administered by non-profit or public institutions

Please review Section 6 of M.G.L. c. 151A for a complete list of excluded employment.

Are sole proprietors, members of limited liability companies or partnerships eligible to participate in PFML?

Yes. Self-employed individuals (SEIs) may elect coverage under PFML. Self-employed individuals can request to opt in by completing the Department's Self-Employed Notice of Election (PDF) and filling out the Statutorily Excluded Employers Request to opt-into the Commonwealth's PFML program form. Once the request is received, reviewed, and approved the Department of Family and Medical Leave will provide a Notice of Approval of Optional Coverage Request.

Once the Notice of Approval of Optional Coverage Request is received self-employed individuals can create their Paid Family and Medical account.

- Log in to MassTaxConnect

- Add Paid Family and Medical Leave as a tax type

- After filing the PFML wage report, choose “opt in.”

If you do not have a MassTaxConnect username and password, contact customer service about registering for PFML. SEIs will not be eligible to apply for PFML benefits until they have contributed to the PFML Fund for at least two (2) of their last four calendar quarters. Individuals whose payments of non-employee compensation are reported on IRS Form 1099-NEC may also opt to participate in PFML. More information regarding the opt-in process and eligibility requirements for the self-employed can be found by visiting Opt in and contribute to PFML as a self-employed individual.

Withholding and Remittance FAQs

When is my company required to begin withholding PFML contributions from my employees’ wages and certain 1099-MISC worker payments?

Employers and other businesses are required to begin withholding PFML contributions from employee and 1099-MISC worker payments beginning on October 1, 2019. Please note, however, that payments of non-employee compensation previously reported on Box 7 of IRS Form 1099-MISC are reported on Box 1 of IRS Form 1099-NEC as of January 1, 2020. Such payments are subject to PFML for the October 1, 2019 through December 31, 2019 period, but are not for subsequent periods.

Is there an income limit for PFML contributions?

Yes. PFML follows the same annual income limits as those set by the Social Security Administration for the Social Security Program. Social Security income limits typically reset annually and remain in effect on a calendar year basis.

Please visit the Social Security Administration's Contribution and Benefit Bases page to view their current wage limit.

My company only employs workers whose payments are reported on IRS Form 1099-NEC. Is my company required to withhold and remit PFML contributions based on these payments?

No. DFML has determined that any payments to individuals that are reported on IRS Form 1099-NEC are exempt from PFML. This exemption applies to all payments reported on IRS Form 1099-NEC made on or after January 1, 2020. More information regarding DFML’s IRS Form 1099-NEC policy can be found here.

Are employers of temporary foreign workers, international students and foreign exchange program participants required to remit contributions on behalf of those employees?

H-2A visa holders (seasonal agricultural workers) are categorically exempt from making PFML contributions. Therefore, employers of H-2A visa holders are not required to remit PFML contributions on behalf of such employees. However, employers employing all other temporary foreign worker visa programs (e.g., H-1B, H-2B, O-1, and O-2, etc.,) are required to remit contributions on behalf of those employees. Employers of holders of international student and foreign exchange program visas (e.g., F-1, OPT, J-1, and J-2) are similarly required to remit contributions on behalf of those employees when those employees are permitted to work in the United States.

My business employs workers whose primary source of compensation is tips. These employees often receive zero-dollar paychecks as all of their wages have gone toward making federal, state and FICA tax payments. In such cases, are employers required to make up their tipped employees’ PFML contribution shortfalls?

Yes. Employers of tipped employees are still required to remit the full contribution on behalf of those tipped employees, even where net wages are insufficient to cover the employee’s contribution. It is up to the employer to determine whether and how to recover the employee’s portion from the employee.

What are the tax implications for PFML benefits?

On January 15, 2025, the IRS issued Revenue Ruling 2025-4, which explains the federal income tax implications of benefits received from a state administered paid family and medical leave program that mirrors the PFML program. The federal guidance is effective for payments made on or after January 1, 2025.

Because the Massachusetts personal income tax relies on federal law to determine whether income is included or excluded from a taxpayer’s gross income, Massachusetts will generally conform to the conclusions reached by the IRS in Revenue Ruling 2025-4 that concern federal gross income. The Department is currently working on guidance that further explains Revenue Ruling 2025-4’s impact on Massachusetts tax law.

Reporting and Overpayment FAQs

What if I already remitted PFML contributions based on payments made on or after January 1, 2020 that will be reported on IRS Form 1099-NEC? Is there a process by which these contributions can be refunded?

Yes. The business should file an amendment to original PFML returns filed on or after January 1, 2020 that included contributions calculated on payments reported on IRS Form 1099-NEC. The amended return should exclude any IRS Form 1099-NEC contributions that were remitted. The filing of such an amended return will trigger an “overpayment” and a refund will be issued to the filer. The refund will cover both the worker’s contributions as well as any required “employer” contributions, if applicable. It is the employer’s responsibility to return any previously withheld contributions based on IRS Form 1099-NEC payments to the payee.

What if I had two or more employers during the year and my PFML contributions exceeded that required by the Social Security Administration’s Annual Wage Limit?

If you worked for more than one employer during the year and when combined your PFML contributions exceed that required for the calendar year, then you may qualify for a corresponding tax credit in the amount of the overpayment on your personal income tax return. To determine if you qualify for such a credit for tax year 2021, you should follow the instructions that correspond to completing Line 48 of your 2021 Massachusetts FORM 1 Personal Income Tax Return filing.

What if the only employer I worked for withheld more than was required for my PFML contribution?

A single employer may not withhold more than the maximum PFML contribution amount on your behalf in a calendar year. If you had a single employer that exceeded the maximum amount, please contact your employer.

What is the filing frequency for PFML contributions?

Employers, other businesses entities and self-employed individuals electing PFML coverage are required to file Quarterly Returns through MassTaxConnect.

The first required Quarterly Return will cover the period from October 1, 2019 to December 31, 2019 and must be filed on or before January 31, 2020. All subsequent return filings will be due on or before the last day of the month following a calendar quarter’s close.

How should businesses report year-end PFML contributions on IRS Forms W-2 and 1099-MISC?

Businesses will report contributions in Box 14 (Other) for Form W-2.and in Box 16 (State tax withheld) for Form 1099-MISC. The contribution line on both forms will read “MAPFML.”

How do I file if my company has both W-2 employees and 1099-MISC workers and my company outsources only its W-2 payroll services to a third party?

If your company outsources only W-2 payroll services to a third party, and handles reporting for your 1099-MISC workers internally, there are some rules to follow when filing returns. It’s very important that the reporting be done in a specific sequence for it to be processed correctly.

First, the payroll service, filing on behalf of your salaried employees (W-2s), must file before you file on behalf of your “covered contract workers” (1099-MISC workers covered under the PFML Statute). Next, when you file on behalf of your covered contract workers, you must identify your filing as an amendment to the return already filed by your payroll service (see screenshot below). Please follow this sequence to be certain the information is properly recorded.

Are rounding rules applied when filing Paid Family and Medical Leave returns on MassTaxConnect?

Yes. When an employer calculates the amount to be deducted from an employee for a given pay period, the amount is calculated based on the wages for that pay period. As a result of rounding rules applied, the total deducted from the employee during the quarter may differ from the amount calculated on the Paid Family and Medical Leave Return. This is a result of rounding rules being applied to both multiple pay checks for an employee during the quarter and the quarterly total reported by the employer on the Paid Family and Medical Leave return. For some employees, the total deducted during the quarter may be slightly higher or lower than the amount calculated on the Paid Family and Medical Leave return. The differences are generally limited to a few cents. The amount calculated through MassTaxConnect is the amount required to be paid with the return.

When completing Forms W-2, employers will reflect the total annual amount actually withheld from the employees.

What should I do if a submission is rejected for missing registration information?

Registration information is not necessary for existing accounts but it is required if there is no account. If you do receive a rejection for missing registration information, complete the registration information and resubmit. Note that the account ID field should not contain dashes or delimiters, and should always be in the PFM########### format. Refer to Bulk XML file specification for instructions (pdf).

How do I correct a return if I’m an employer with both MA and non-MA employees and I inaccurately calculated my workforce at the >25 employee rate instead of the <25 employee rate?

When calculating your workforce for PFML, only include Massachusetts-based employees. For example, if your company has a workforce of 300 in the U.S. but only 10 are Massachusetts-based, you will use the under 25 employee rate for 2021 of .344%. If you instead used the over 25 employee rate of .68% in your calculation, you will need to adjust your system to deduct and report only the employee portion of .344% to correct your account.

Professional Employment Organization FAQs

If a business enters into a Professional Employment Agreement (PEA) with a Professional Employment Organization (PEO) is the PEO or the business considered the employer of the employees covered under the PEA?

PFML follows the Massachusetts Unemployment Insurance Statute (MGL 151A) in this area and considers employees covered under PEAs to be employees of the business and not the PEO. As the employer of record, the business should include these employees in their PFML workforce calculations.

Professional Employment Organizations (PEOs) typically file a single consolidated return when reporting Massachusetts withholding taxes on behalf of their clients. Is consolidated filing also an option for PEOs when filing PFML returns?

Since the business is considered the employer for PFML purposes the business must file a return that includes its entire covered workforce which would include the employees paid by the PEO. If the PEO filed a single consolidated return for all of its clients then all the employees of the various clients would be grouped together. By lumping all of these employees together the workforce count would always be greater than 25. The workforce count and the employer contribution rate should be determined on a client by client basis. Therefore, a PEO should never submit a consolidated return on behalf of their clients. Instead, PEOs should submit individual filings for each client. PEOs should use DOR's bulk filing method so all of their clients’ returns are transmitted in a single transmission.

MassTaxConnect’s bulk filing specifications can be found here.

Step-by-step MassTaxConnect Instructions and Videos

Instructions for amending previously filed return(s) on MassTaxConnect are provided below.

Amend your return by importing an Excel file:

- Log in to your MassTaxConnect account.

- Navigate to your Paid Family Medical Leave account.

- Choose Returns and the period to be amended.

- Choose File or Amend Return.

- Choose Import from Excel.

- Choose Import.

- Choose File from the Select a file to import window and choose the file to import.

- Once the file is has downloaded, choose Ok and provide a reason for amending the return.

- Choose Next then Submit on the bottom right of the page where you will receive a Return Confirmation Number for your submission.

- At the bottom of the confirmation page, you will have an option to make a payment if necessary or to print the confirmation page.

Manually entering data (No Excel file):

- Log in to your MassTaxConnect account.

- Find your Paid Family Medical Leave Account.

- Choose Returns and the period to be amended.

- Choose File or Amend Return.

- Enter the information to be corrected then choose Next and provide a reason for amending the return on the following page.

- Choose Next.

- Confirm that the information is correct from the Return Summary page then choose Submit on the bottom right of the page where you will receive a Return Confirmation Number for your submission.

- At the bottom of the confirmation page, you will have an option to make a payment, if necessary, or to print the confirmation page.

Videos with step-by-step instructions

- Register for Paid Family and Medical Leave Contributions

- File a Return and Remit a Contribution for Paid Family and Medical Leave

- Opt in and contribute to Paid Family and Medical Leave as a Self-Employed Individual

- Upload an Excel Spreadsheet When Filing a Tax Return on MassTaxConnect

- Request a Paid Family and Medical Leave Exemption

Contact Information

For all further questions regarding applying for a Private Plan Exemption or registering your account on MassTaxConnect, please contact DOR at (617) 466-3950 to speak to a PFML representative.