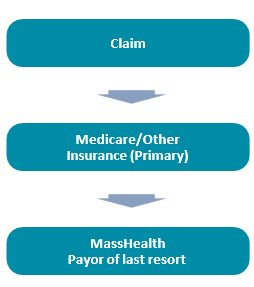

Coordination of Benefits (COB) — Member has Other Insurance

If the member has other insurance (Medicare and/ or commercial), submit the claim to the other insurance carrier, following the other insurer’s billing instructions. If the claim is denied for reasons other than a correctable error, or is partially paid by the other insurance carrier, the claim may be submitted to MassHealth. The claim should not be submitted to MassHealth if denied for noncompliance with any one of the insurer’s billing and authorization requirements.

Medicare Crossover Claims

After Medicare has made a payment or applied the charge to the deductible, the Benefits Coordination and Recovery Center (BCRC) will automatically transmit claims for dual-eligible members (Medicare and MassHealth) to MassHealth for adjudication. A claim must contain at least one Medicare-approved service line in order for the entire claim to be crossed over automatically to MassHealth. For Medicare crossover payment methodology, please refer to 130 CMR 450.318. Providers may directly submit electronic claims for dual-eligible members to MassHealth using the 837 Transaction or POSC if one of the following statements is true:

- The member has other insurance in addition to Medicare and MassHealth;

- The member’s Medicare claim has not appeared on a MassHealth crossover remittance advice and/or the claim cannot be located in POSC during a claim status inquiry; or

- Medicare has denied all services.

Providers must follow instructions described in the HIPAA 837 implementation guides and MassHealth companion guides when submitting COB claims for dual eligible members for the reasons listed above. Providers must include all the COB information on their claim submission to MassHealth as it is reported on the other payer’s Explanation of Benefits (EOB).

Enhanced COB Claim Editing

When submitting a Coordination of Benefits claim, providers must report all valid Claim Adjustment Group Codes (CAGCs) and Claim Adjustment Reason Codes (CARCs) as they appear on the other payer’s Explanation of Benefits (EOB) or 835 to MassHealth when the other payer has denied the claim/claim detail line. Both pieces of information are critical for MassHealth to determine its financial responsibility for the claim/claim detail line and must be reported accurately on the MassHealth claim.

Enhanced COB claims editing (implemented in December 2017) enforces MassHealth TPL regulations to ensure that MassHealth pays for claim/claim detail lines only when there is a member liability and does not pay when the provider is financially obligated for the claim/claim detail line.

Learn more about COB.

Learn more more about Third Party Liability.

| Date published: | July 29, 2022 |

|---|