Do you have a question? Ask Max!

When using MassTaxConnect, you can use Max to help find answers to your questions. Max, however, can’t answer questions that are specific to your tax account.

How do you ask Max a question?

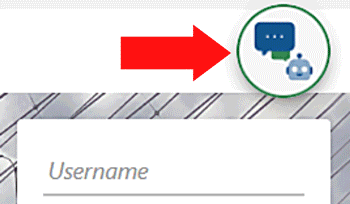

Click on Max’s icon. You can find the icon on the top right-hand side of all MassTaxConnect pages.

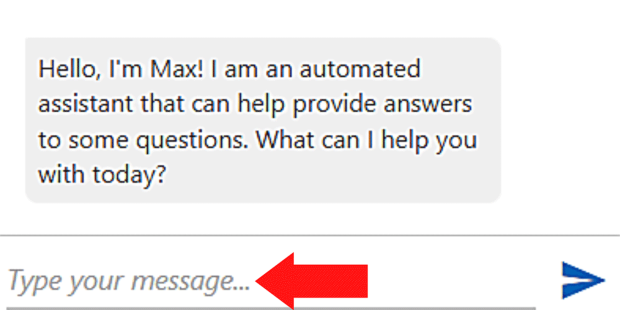

In the Type your message... section:

- Type in your general question and

- Click on the blue arrow to send to Max.

To ask a question about your account, log in to MassTaxConnect and send DOR a secure e-message.

For more resources and help, visit Contact DOR.

New Users (login, username, password & more)

Are you new to MassTaxConnect?

To get started, visit:

Filing Returns & Making Payments

For guidance and FAQs, visit:

You can also learn more with these MassTaxConnect Video Tutorials:

Individuals/Personal Income

Full-year residents who have filed a Massachusetts return in the past can file on MassTaxConnect.

Visit the E-file and Pay page for more information.

Use MassTaxConnect to Check the status of your tax refund after you file.

Need to register with MassTaxConnect?

To get started, visit MassTaxConnect registration for individual filers.

Estimated Tax

Individuals and fiduciaries can make estimated tax payments with MassTaxConnect.

Visit DOR Personal Income and Fiduciary estimated tax payments, for more information.

Do more with MassTaxConnect

With MassTaxConnect you can:

Business

| MassTaxConnect business resources and FAQs: | |

|---|---|

Visit MassTaxConnect Video Tutorials for more information.

Estate

If you're responsible for the estate of someone who died, you may need to file an estate tax return.

For more information, visit:

Third Party Access

A Power of Attorney, Form M-2848, does not give access to a taxpayer’s accounts on MassTaxConnect.

Third party access is your best option.

For more information, visit:

Appeal/Abatement & Amended Requests

You can file an appeal or abatement if you disagree with DOR about the amount of tax or penalties you owe.

Go to File an Appeal or Abatement FAQs for more information.

You can file an amended return if you have already filed a return and need to report:

- An error

- Information left out or

- Update.

An amended return may increase or decrease the amount of tax that you owe.

Go to Amend a MA Individual or Business Tax Return for more information.

Payment Agreement

There are 2 ways you can set up a payment agreement.

If you owe $10,000 or less

Online with MassTaxConnect

- When registered on MassTaxConnect select More, and

- Choose Request a Payment Plan in the Collection Notices section.

Do you need to register with MassTaxConnect?

- Go to the MassTaxConnect homepage

- On the upper right-hand side, click on Sign Up or

- Under Quick Links, choose Register a New Taxpayer.

Phone

- Call the DOR Contact Center at (617) 887-6367.

If you owe more than $10,000

Phone

- Call DOR Collections at (617) 887-6400.

You may need to submit a financial application package (Form 433I) if you owe more than $5,000.

For more information, visit:

Health Insurance Responsibility Disclosure (HIRD)

Employers need to report HIRD every year. The HIRD reporting period:

- Begins on November 15 of the filing year and

- Ends on December 15 of the filing year.

Visit the HIRD FAQs page for more information.

Paid Family & Medical Leave (PFML)

DOR collects PFML contributions.

These PFML actions must be done on MassTaxConnect:

- Account registrations

- Exemption requests

- Payments.

Visit DOR's PFML page for more information.

MassTaxConnect Tax Listing

| You can use MassTaxConnect to file and pay: | |

|---|---|

|

|

Contact

Phone

9 a.m.–4 p.m., Monday through Friday