Industry Letter

This letter is meant to clarify Massachusetts Division of Banks’ (Division) methodology as it pertains to Massachusetts General Laws chapter 167J, section 17 (G.L. c.167J, s.17). It aims to provide some illustrative scenarios reflecting when a dividend threshold is triggered and when a written request for approval is required to the Commissioner of Banks.

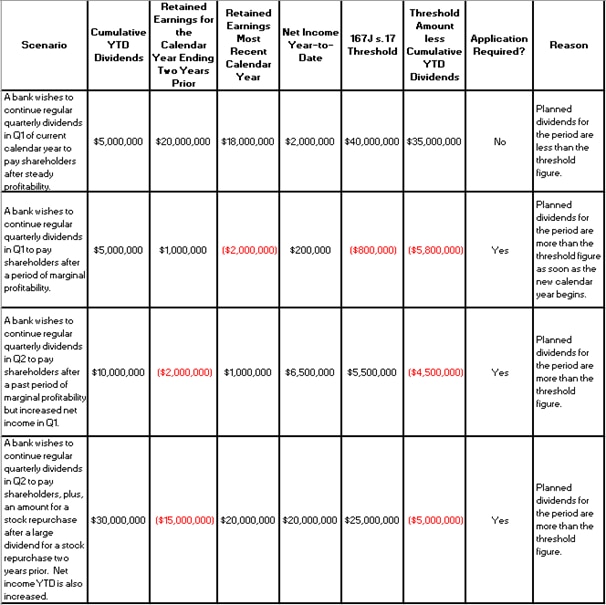

The prior approval requirements apply to savings banks and cooperative banks in stock form, subsidiary banks of mutual holding companies, and trust companies. The trigger threshold can be found in paragraph two of G.L. c. 167J, s.17, which states, in part, “The approval of the commissioner shall be required if the total of all dividends declared by a stock corporation in any calendar year shall exceed the total of its net profits for that year combined with its retained net profits of the preceding two years, less any required transfer to surplus or a fund for the retirement of any preferred stock.” The threshold necessitating a Division approval of the proposed dividend is triggered any time, year-to-date (YTD) in a calendar year, the dividends from a stock corporation exceed the prior two years’ calendar year-end retained earnings PLUS net profit in the current period at the bank level, LESS transfers to surplus or retirement of preferred stock. The Division has generally looked to quarterly net income figures for YTD net income in the current calendar year, but monthly financials statements could also be used. To reiterate, current period net income refers to profit and loss incurred YTD, and not financial projections through year-end of the current period.

An application is required whenever the difference of the G.L. c. 167J, s.17 threshold amount LESS cumulative YTD dividends is less than zero.

The following items should be included for the Division’s consideration when an application is triggered:

1) A letter stating the reason for the application, an overview of financial performance for the bank YTD and for the prior two calendar years, and a description of the reason(s) for the dividend.

2) A copy of the bank’s Board Resolution authorizing the dividend.

3) Capital planning that includes the pro forma effect of the dividend on the bank for the following three years, and any stress testing conducted that includes dividends.

4) A pro-forma balance sheet and income statement for the bank that accounts for dividends.

5) When the dividend is executed to fund in whole or in part a stock repurchase program at the holding company level, a copy of the Common Stock Repurchase Agreement is requested.

Please refer to the below chart for various sample scenarios and triggering thresholds which would, or would not, require Division approval for further dividends:

The purpose of this letter is to provide some insight into when this statute applies and what is required in the application to the Division when the statute threshold amount is triggered. Please do not hesitate to reach out to Chief Director, Michael T. Hensler at (857)529-0581 or michael.hensler@mass.gov with any questions you may have.

Sincerely,

Mary L. Gallagher

Massachusetts Commissioner of Banks